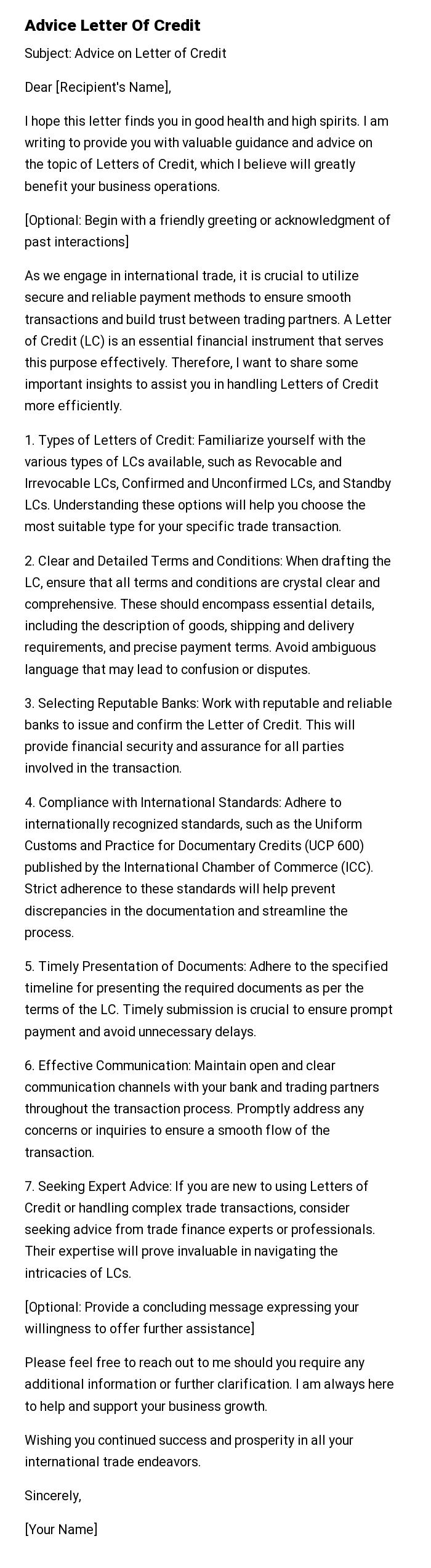

Advice Letter Of Credit

Subject: Advice on Letter of Credit

Dear [Recipient's Name],

I hope this letter finds you in good health and high spirits. I am writing to provide you with valuable guidance and advice on the topic of Letters of Credit, which I believe will greatly benefit your business operations.

[Optional: Begin with a friendly greeting or acknowledgment of past interactions]

As we engage in international trade, it is crucial to utilize secure and reliable payment methods to ensure smooth transactions and build trust between trading partners. A Letter of Credit (LC) is an essential financial instrument that serves this purpose effectively. Therefore, I want to share some important insights to assist you in handling Letters of Credit more efficiently.

1. Types of Letters of Credit: Familiarize yourself with the various types of LCs available, such as Revocable and Irrevocable LCs, Confirmed and Unconfirmed LCs, and Standby LCs. Understanding these options will help you choose the most suitable type for your specific trade transaction.

2. Clear and Detailed Terms and Conditions: When drafting the LC, ensure that all terms and conditions are crystal clear and comprehensive. These should encompass essential details, including the description of goods, shipping and delivery requirements, and precise payment terms. Avoid ambiguous language that may lead to confusion or disputes.

3. Selecting Reputable Banks: Work with reputable and reliable banks to issue and confirm the Letter of Credit. This will provide financial security and assurance for all parties involved in the transaction.

4. Compliance with International Standards: Adhere to internationally recognized standards, such as the Uniform Customs and Practice for Documentary Credits (UCP 600) published by the International Chamber of Commerce (ICC). Strict adherence to these standards will help prevent discrepancies in the documentation and streamline the process.

5. Timely Presentation of Documents: Adhere to the specified timeline for presenting the required documents as per the terms of the LC. Timely submission is crucial to ensure prompt payment and avoid unnecessary delays.

6. Effective Communication: Maintain open and clear communication channels with your bank and trading partners throughout the transaction process. Promptly address any concerns or inquiries to ensure a smooth flow of the transaction.

7. Seeking Expert Advice: If you are new to using Letters of Credit or handling complex trade transactions, consider seeking advice from trade finance experts or professionals. Their expertise will prove invaluable in navigating the intricacies of LCs.

[Optional: Provide a concluding message expressing your willingness to offer further assistance]

Please feel free to reach out to me should you require any additional information or further clarification. I am always here to help and support your business growth.

Wishing you continued success and prosperity in all your international trade endeavors.

Sincerely,

[Your Name]

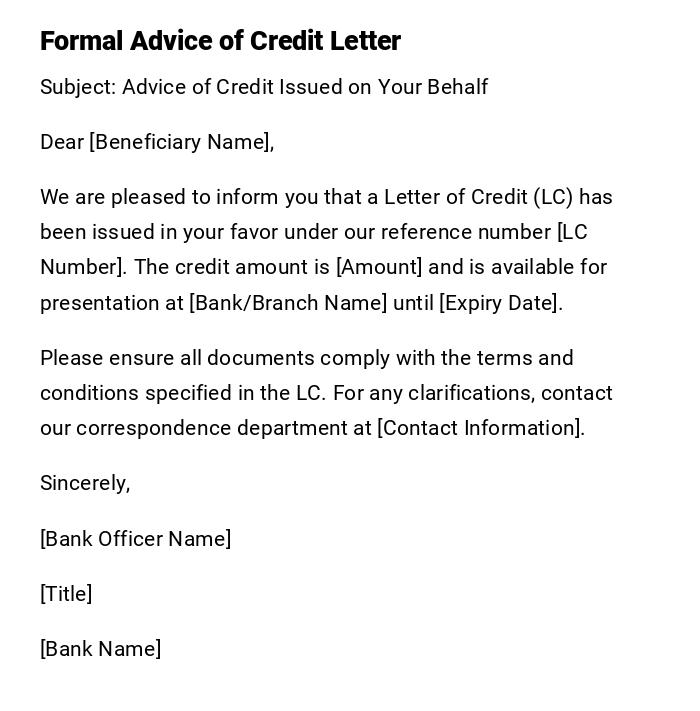

Formal Advice of Credit Letter

Subject: Advice of Credit Issued on Your Behalf

Dear [Beneficiary Name],

We are pleased to inform you that a Letter of Credit (LC) has been issued in your favor under our reference number [LC Number]. The credit amount is [Amount] and is available for presentation at [Bank/Branch Name] until [Expiry Date].

Please ensure all documents comply with the terms and conditions specified in the LC. For any clarifications, contact our correspondence department at [Contact Information].

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

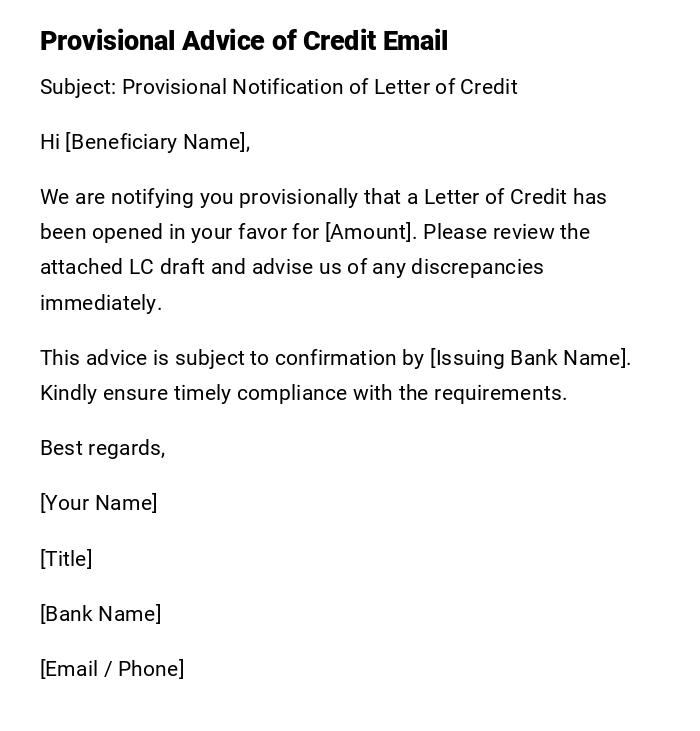

Provisional Advice of Credit Email

Subject: Provisional Notification of Letter of Credit

Hi [Beneficiary Name],

We are notifying you provisionally that a Letter of Credit has been opened in your favor for [Amount]. Please review the attached LC draft and advise us of any discrepancies immediately.

This advice is subject to confirmation by [Issuing Bank Name]. Kindly ensure timely compliance with the requirements.

Best regards,

[Your Name]

[Title]

[Bank Name]

[Email / Phone]

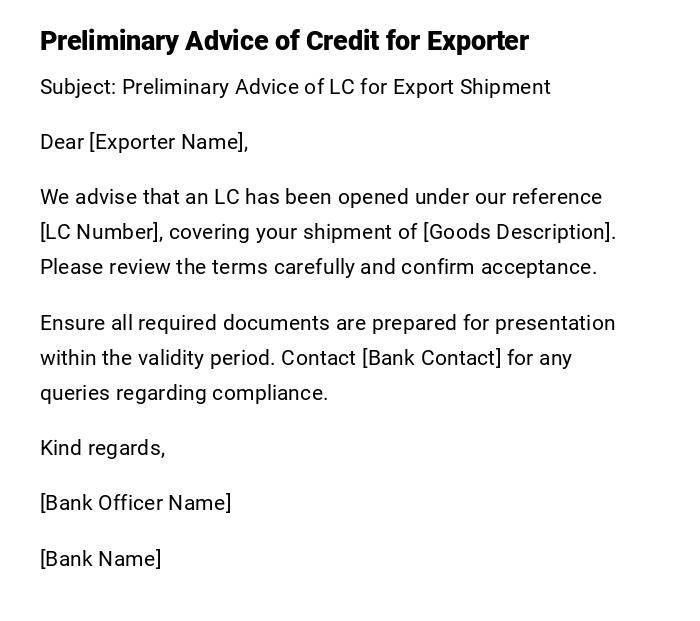

Preliminary Advice of Credit for Exporter

Subject: Preliminary Advice of LC for Export Shipment

Dear [Exporter Name],

We advise that an LC has been opened under our reference [LC Number], covering your shipment of [Goods Description]. Please review the terms carefully and confirm acceptance.

Ensure all required documents are prepared for presentation within the validity period. Contact [Bank Contact] for any queries regarding compliance.

Kind regards,

[Bank Officer Name]

[Bank Name]

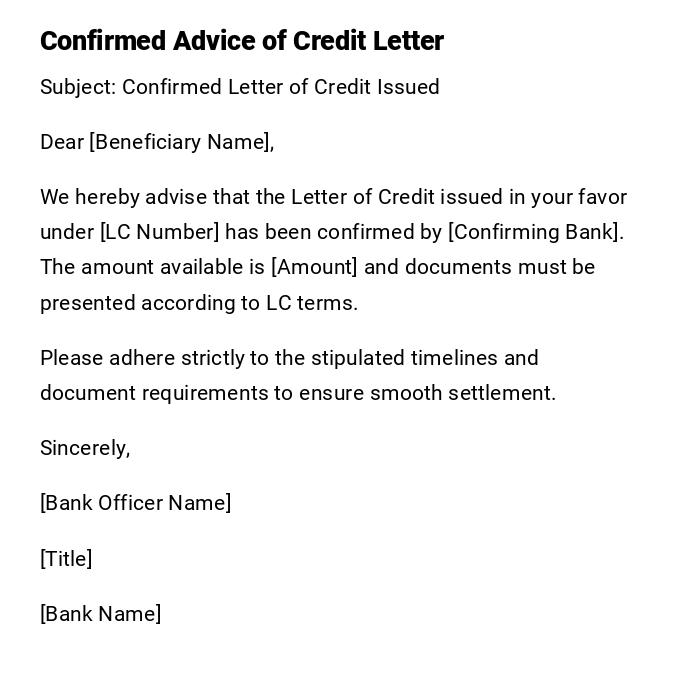

Confirmed Advice of Credit Letter

Subject: Confirmed Letter of Credit Issued

Dear [Beneficiary Name],

We hereby advise that the Letter of Credit issued in your favor under [LC Number] has been confirmed by [Confirming Bank]. The amount available is [Amount] and documents must be presented according to LC terms.

Please adhere strictly to the stipulated timelines and document requirements to ensure smooth settlement.

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

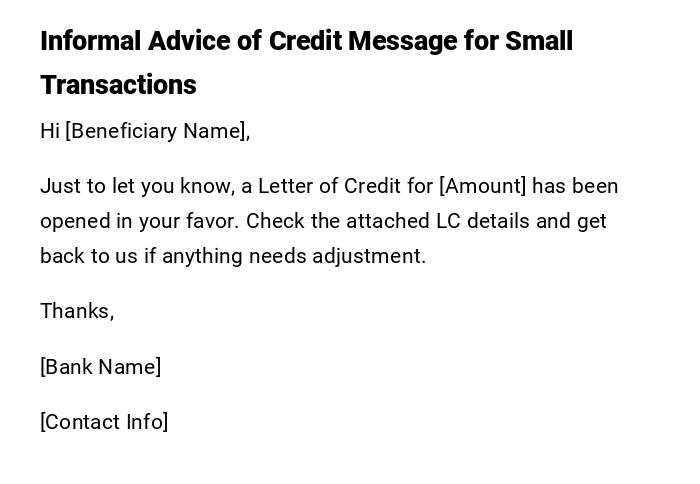

Informal Advice of Credit Message for Small Transactions

Hi [Beneficiary Name],

Just to let you know, a Letter of Credit for [Amount] has been opened in your favor. Check the attached LC details and get back to us if anything needs adjustment.

Thanks,

[Bank Name]

[Contact Info]

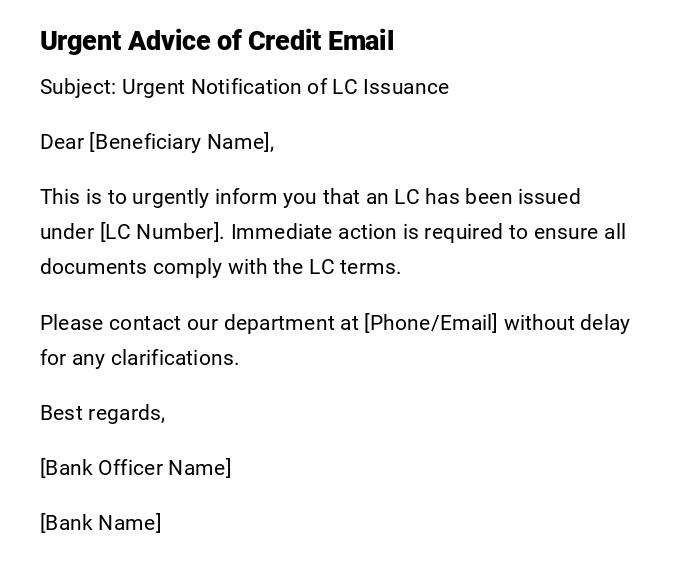

Urgent Advice of Credit Email

Subject: Urgent Notification of LC Issuance

Dear [Beneficiary Name],

This is to urgently inform you that an LC has been issued under [LC Number]. Immediate action is required to ensure all documents comply with the LC terms.

Please contact our department at [Phone/Email] without delay for any clarifications.

Best regards,

[Bank Officer Name]

[Bank Name]

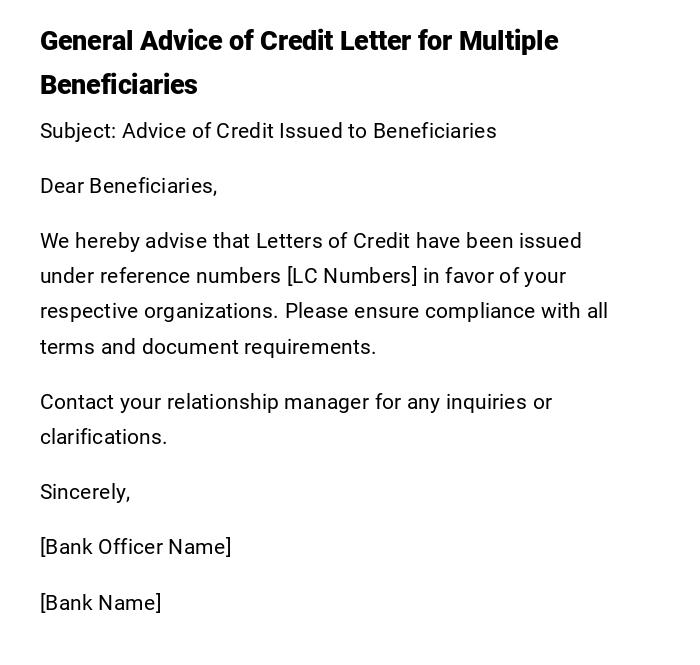

General Advice of Credit Letter for Multiple Beneficiaries

Subject: Advice of Credit Issued to Beneficiaries

Dear Beneficiaries,

We hereby advise that Letters of Credit have been issued under reference numbers [LC Numbers] in favor of your respective organizations. Please ensure compliance with all terms and document requirements.

Contact your relationship manager for any inquiries or clarifications.

Sincerely,

[Bank Officer Name]

[Bank Name]

What is an Advice of Credit and Why It Is Important

- An Advice of Credit is a formal communication from a bank informing the beneficiary that a Letter of Credit has been issued in their favor.

- Purpose:

- Notifies the beneficiary of LC issuance.

- Provides the terms, amount, expiry, and required documents.

- Enables beneficiaries to prepare shipment or services in accordance with LC conditions.

Who Should Send an Advice of Credit

- Issuing banks are the primary senders.

- Advising or confirming banks may also send to beneficiaries.

- Senior bank officers or correspondence departments ensure authenticity and accuracy.

Whom Should an Advice of Credit Be Addressed To

- Directly to the LC beneficiary (exporter or service provider).

- Copy may be sent to intermediaries such as negotiating or confirming banks.

- Ensures the recipient can act promptly to meet LC requirements.

When to Issue an Advice of Credit

- Immediately after the LC is issued by the issuing bank.

- For provisional notices, before confirmation of LC.

- In case of amendments or urgent updates to existing LCs.

How to Write and Send an Advice of Credit

- Confirm all LC details with issuing bank.

- Clearly mention LC number, amount, currency, validity, and advising/confirming bank.

- Include document requirements and deadlines.

- Maintain professional tone and clarity.

- Send via secure channels: SWIFT, email with secure attachment, or official bank letterhead.

Requirements and Prerequisites Before Sending

- Complete and accurate LC details from the issuing bank.

- Beneficiary contact information.

- Confirmation whether the LC is confirmed or unconfirmed.

- Draft reviewed by compliance and legal departments if required.

Formatting Guidelines for Advice of Credit Letters

- Length: concise but complete; 1–2 pages for formal letters.

- Tone: formal and professional.

- Include all LC essential details: number, amount, currency, expiry, and bank references.

- Mode: secure email, SWIFT message, or official bank letter.

Common Mistakes to Avoid

- Providing incorrect LC number or amount.

- Omitting expiry dates or essential terms.

- Sending advice to wrong recipient.

- Using unclear language that may cause beneficiary confusion.

Tricks and Tips for Effective Advice of Credit

- Double-check all LC references and amounts.

- Use clear headings and bullet points for document requirements.

- Highlight any urgent actions or deadlines.

- Ensure consistent terminology matching the LC issued by the bank.

Elements and Structure of an Advice of Credit

- Subject: Clear reference to LC issuance.

- Beneficiary Name: Who the LC is for.

- LC Details: Number, amount, currency, expiry.

- Issuing/Confirming Bank Info: Name and contact.

- Document Requirements: Outline what the beneficiary must present.

- Special Instructions: Any additional notes.

- Closing: Sign-off with officer name and bank details.

After Sending an Advice of Credit

- Confirm receipt by beneficiary.

- Respond to queries or requests for amendments.

- Monitor compliance and document submission deadlines.

Pros and Cons of Sending Advice of Credit

Pros:

- Notifies beneficiary promptly.

- Reduces risk of errors in shipment or documentation.

- Strengthens trust between bank and client.

Cons:

- Requires careful review to avoid mistakes.

- Delays or errors can disrupt transactions.

- Must follow strict compliance and security protocols.

FAQ About Advice of Credit

Q: Can an advice of credit be provisional?

A: Yes, preliminary advice may be sent before LC confirmation.

Q: Is attestation needed for an advice of credit?

A: Usually no, except for legal or high-value transactions.

Q: Can it be sent via email?

A: Yes, provided secure channels are used and bank policy allows.

Q: What details must always be included?

A: LC number, amount, currency, expiry, issuing/advising bank, and document requirements.

Does an Advice of Credit Require Attestation or Authorization

- Typically, an advice of credit does not require attestation.

- High-value or legally sensitive LCs may require senior officer approval.

- Ensure bank compliance procedures are followed.

Download Word Doc

Download Word Doc

Download PDF

Download PDF