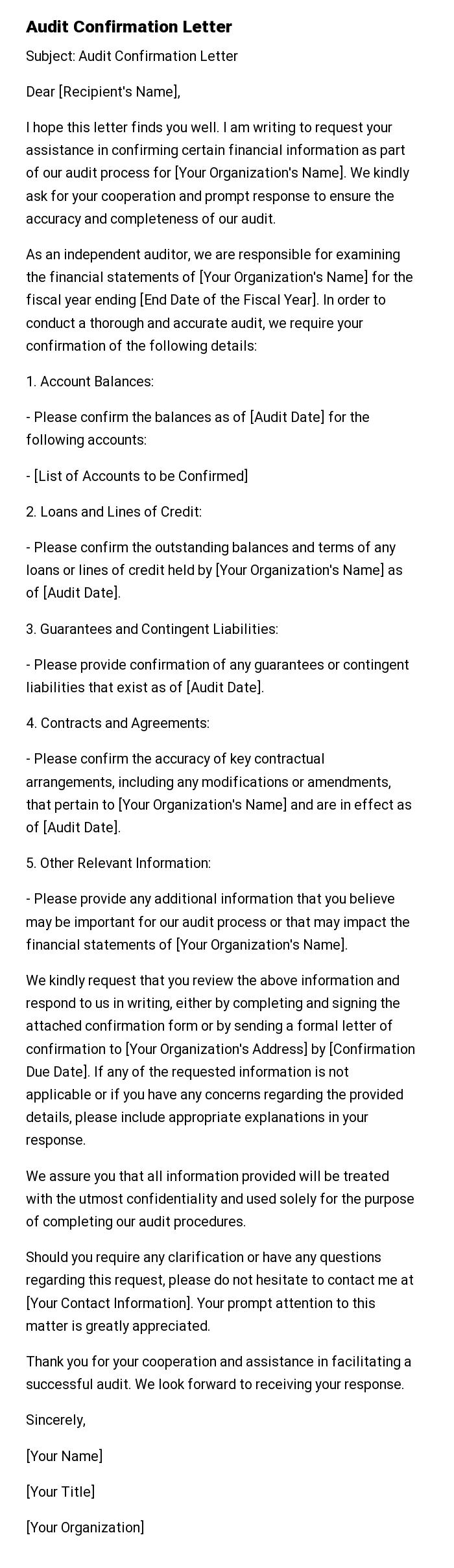

Audit Confirmation Letter

Subject: Audit Confirmation Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to request your assistance in confirming certain financial information as part of our audit process for [Your Organization's Name]. We kindly ask for your cooperation and prompt response to ensure the accuracy and completeness of our audit.

As an independent auditor, we are responsible for examining the financial statements of [Your Organization's Name] for the fiscal year ending [End Date of the Fiscal Year]. In order to conduct a thorough and accurate audit, we require your confirmation of the following details:

1. Account Balances:

- Please confirm the balances as of [Audit Date] for the following accounts:

- [List of Accounts to be Confirmed]

2. Loans and Lines of Credit:

- Please confirm the outstanding balances and terms of any loans or lines of credit held by [Your Organization's Name] as of [Audit Date].

3. Guarantees and Contingent Liabilities:

- Please provide confirmation of any guarantees or contingent liabilities that exist as of [Audit Date].

4. Contracts and Agreements:

- Please confirm the accuracy of key contractual arrangements, including any modifications or amendments, that pertain to [Your Organization's Name] and are in effect as of [Audit Date].

5. Other Relevant Information:

- Please provide any additional information that you believe may be important for our audit process or that may impact the financial statements of [Your Organization's Name].

We kindly request that you review the above information and respond to us in writing, either by completing and signing the attached confirmation form or by sending a formal letter of confirmation to [Your Organization's Address] by [Confirmation Due Date]. If any of the requested information is not applicable or if you have any concerns regarding the provided details, please include appropriate explanations in your response.

We assure you that all information provided will be treated with the utmost confidentiality and used solely for the purpose of completing our audit procedures.

Should you require any clarification or have any questions regarding this request, please do not hesitate to contact me at [Your Contact Information]. Your prompt attention to this matter is greatly appreciated.

Thank you for your cooperation and assistance in facilitating a successful audit. We look forward to receiving your response.

Sincerely,

[Your Name]

[Your Title]

[Your Organization]

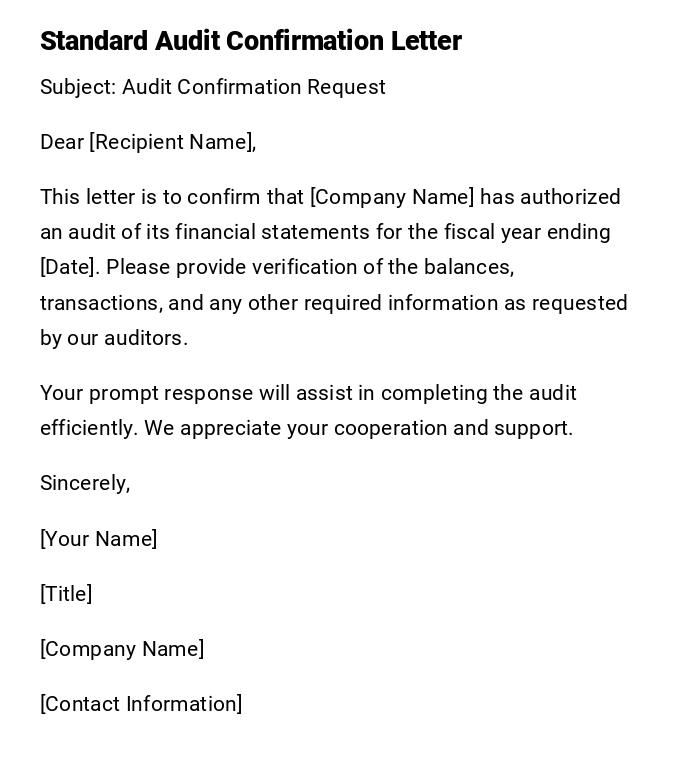

Standard Audit Confirmation Letter

Subject: Audit Confirmation Request

Dear [Recipient Name],

This letter is to confirm that [Company Name] has authorized an audit of its financial statements for the fiscal year ending [Date]. Please provide verification of the balances, transactions, and any other required information as requested by our auditors.

Your prompt response will assist in completing the audit efficiently. We appreciate your cooperation and support.

Sincerely,

[Your Name]

[Title]

[Company Name]

[Contact Information]

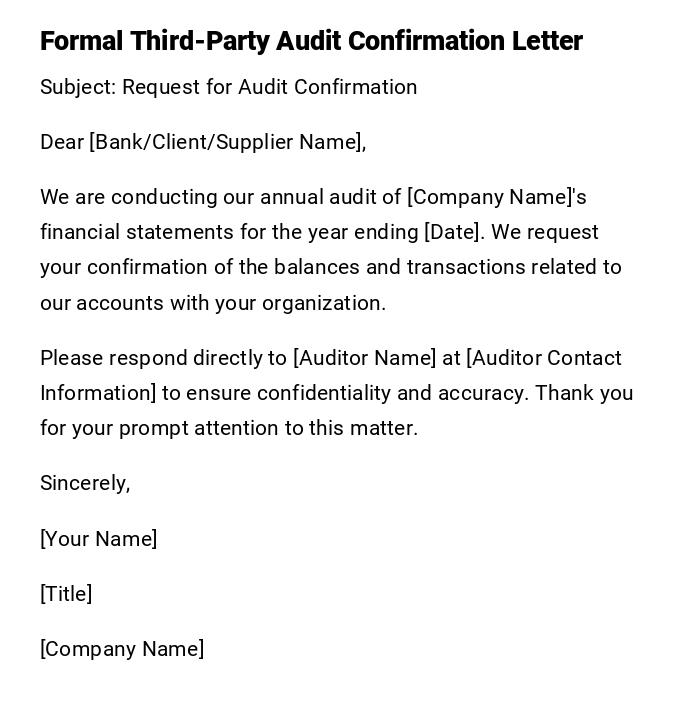

Formal Third-Party Audit Confirmation Letter

Subject: Request for Audit Confirmation

Dear [Bank/Client/Supplier Name],

We are conducting our annual audit of [Company Name]'s financial statements for the year ending [Date]. We request your confirmation of the balances and transactions related to our accounts with your organization.

Please respond directly to [Auditor Name] at [Auditor Contact Information] to ensure confidentiality and accuracy. Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Title]

[Company Name]

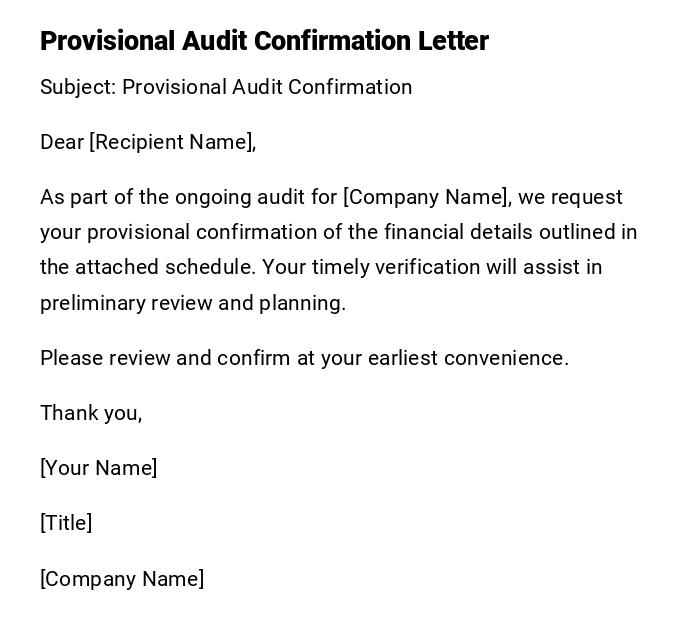

Provisional Audit Confirmation Letter

Subject: Provisional Audit Confirmation

Dear [Recipient Name],

As part of the ongoing audit for [Company Name], we request your provisional confirmation of the financial details outlined in the attached schedule. Your timely verification will assist in preliminary review and planning.

Please review and confirm at your earliest convenience.

Thank you,

[Your Name]

[Title]

[Company Name]

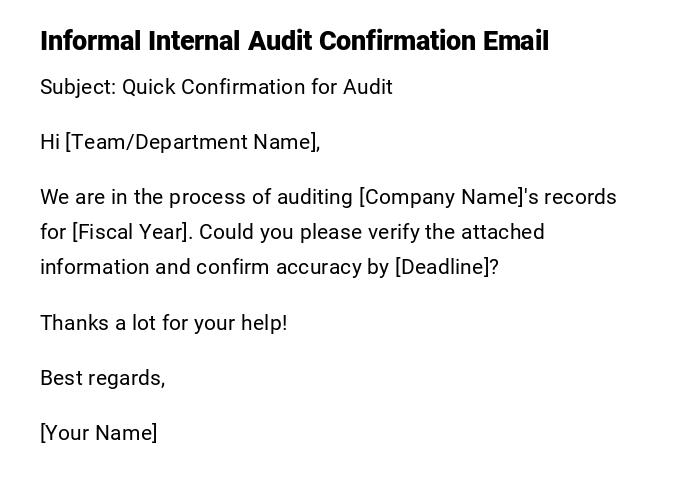

Informal Internal Audit Confirmation Email

Subject: Quick Confirmation for Audit

Hi [Team/Department Name],

We are in the process of auditing [Company Name]'s records for [Fiscal Year]. Could you please verify the attached information and confirm accuracy by [Deadline]?

Thanks a lot for your help!

Best regards,

[Your Name]

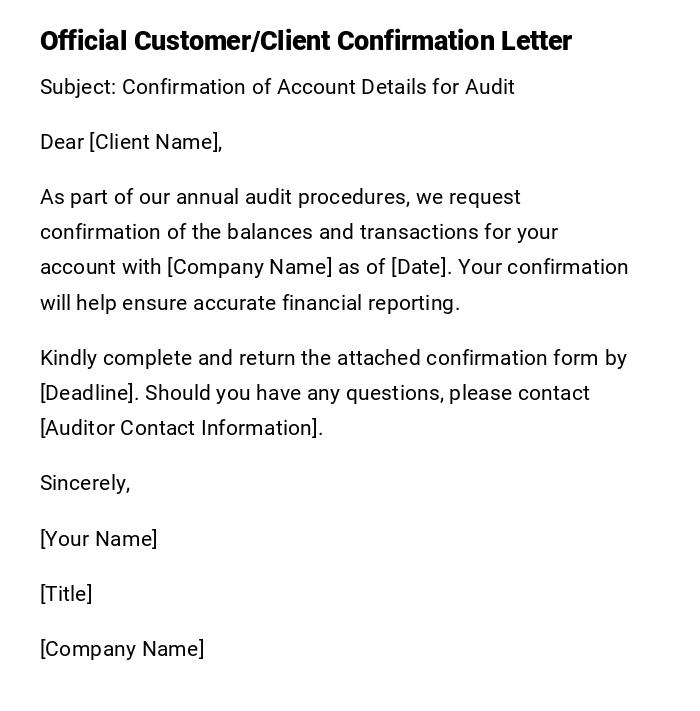

Official Customer/Client Confirmation Letter

Subject: Confirmation of Account Details for Audit

Dear [Client Name],

As part of our annual audit procedures, we request confirmation of the balances and transactions for your account with [Company Name] as of [Date]. Your confirmation will help ensure accurate financial reporting.

Kindly complete and return the attached confirmation form by [Deadline]. Should you have any questions, please contact [Auditor Contact Information].

Sincerely,

[Your Name]

[Title]

[Company Name]

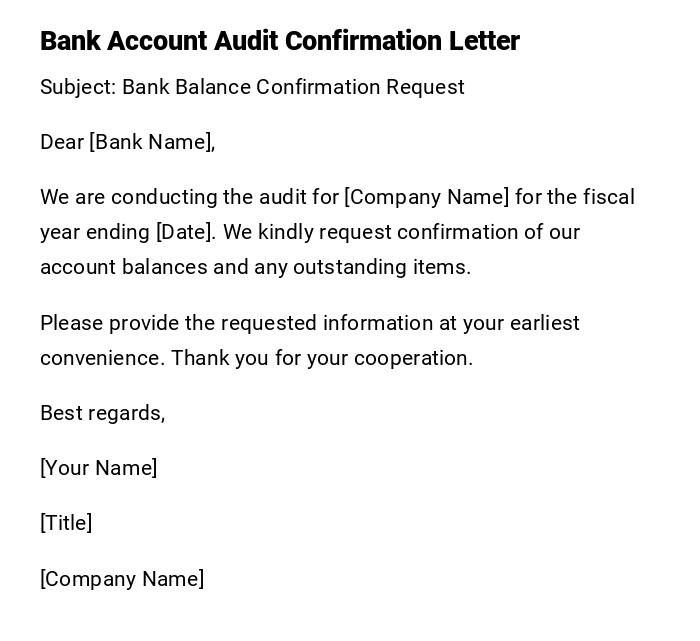

Bank Account Audit Confirmation Letter

Subject: Bank Balance Confirmation Request

Dear [Bank Name],

We are conducting the audit for [Company Name] for the fiscal year ending [Date]. We kindly request confirmation of our account balances and any outstanding items.

Please provide the requested information at your earliest convenience. Thank you for your cooperation.

Best regards,

[Your Name]

[Title]

[Company Name]

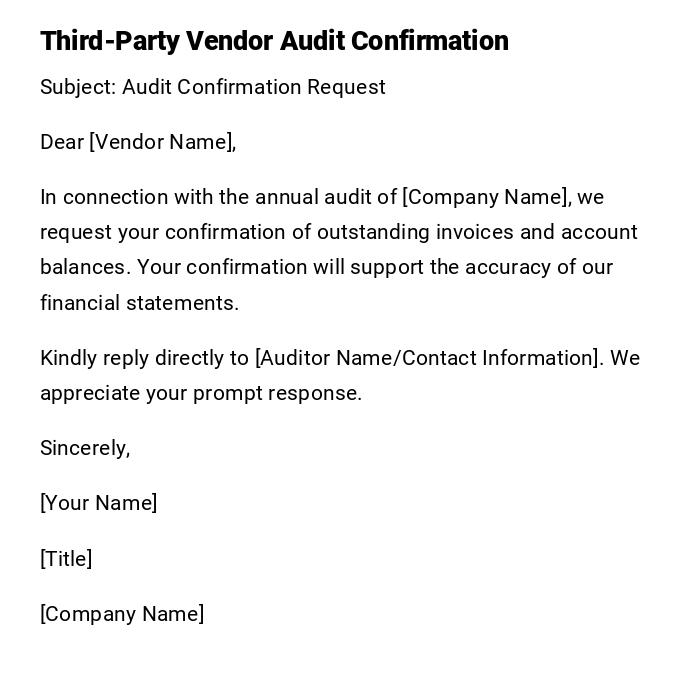

Third-Party Vendor Audit Confirmation

Subject: Audit Confirmation Request

Dear [Vendor Name],

In connection with the annual audit of [Company Name], we request your confirmation of outstanding invoices and account balances. Your confirmation will support the accuracy of our financial statements.

Kindly reply directly to [Auditor Name/Contact Information]. We appreciate your prompt response.

Sincerely,

[Your Name]

[Title]

[Company Name]

What is an Audit Confirmation Letter and Why You Need It

An Audit Confirmation Letter is a formal communication used during financial audits to verify account balances, transactions, and other financial information.

Purposes include:

- Ensuring the accuracy and completeness of financial statements.

- Obtaining independent verification from third parties such as banks, clients, or vendors.

- Reducing the risk of errors or misstatements during audits.

Who Should Send an Audit Confirmation Letter

- Internal accounting departments initiating the audit.

- External auditors on behalf of the company.

- Financial controllers responsible for compliance and reporting.

Whom Should an Audit Confirmation Letter Be Addressed To

- Banks or financial institutions holding company accounts.

- Customers or clients with outstanding balances.

- Vendors or suppliers with pending invoices.

- Any third party whose confirmation is necessary for audit accuracy.

When to Send an Audit Confirmation Letter

- At the beginning or during the audit period when verification is required.

- Prior to finalizing financial statements.

- When auditors identify balances or accounts that require external confirmation.

How to Write and Send an Audit Confirmation Letter

- Identify the accounts and third parties requiring confirmation.

- Prepare a clear and professional letter including details to be confirmed.

- Include deadlines and return instructions for recipients.

- Send via email, mail, or secure online portal to ensure confidentiality.

- Track responses to ensure all confirmations are received.

Requirements and Prerequisites for Sending

- Accurate and up-to-date financial records.

- Contact information for recipients.

- Predefined template or schedule of items to confirm.

- Auditor’s instructions regarding confidentiality and format.

Formatting Guidelines for Audit Confirmation Letters

- Tone: Professional, formal, and concise.

- Length: Typically one page or less.

- Include: Subject, greeting, request for confirmation, deadline, and contact info.

- Attach: Any relevant schedules, forms, or statements for verification.

Tricks and Tips for Effective Audit Confirmation

- Double-check all figures and account details before sending.

- Use clear deadlines and instructions for return.

- Send reminders for non-responses.

- Maintain records of all communications for audit trails.

- Customize letters based on type of recipient (bank, client, vendor).

Common Mistakes to Avoid

- Sending incomplete or incorrect information.

- Using informal or vague language.

- Missing deadlines or failing to follow up.

- Sending letters to incorrect contacts.

- Ignoring confidentiality requirements.

Elements and Structure of an Audit Confirmation Letter

- Subject line indicating purpose.

- Salutation addressing the recipient.

- Clear statement of the audit request.

- Detailed list of balances, transactions, or items to confirm.

- Deadline for response.

- Contact information for questions.

- Professional closing and signature.

After Sending an Audit Confirmation Letter: Follow-Up

- Track responses and follow up with non-responding parties.

- Document received confirmations for audit records.

- Notify auditors if discrepancies are identified.

- Keep copies of all communications for compliance purposes.

Pros and Cons of Sending Audit Confirmation Letters

Pros:

- Provides independent verification of financial information.

- Helps identify discrepancies or errors early.

- Enhances credibility of financial statements.

Cons:

- Can be time-consuming to prepare and track.

- Delays may occur if third parties respond late.

- Requires careful attention to confidentiality and accuracy.

Compare and Contrast with Other Audit Procedures

- Compared to internal checks, audit confirmation involves external validation.

- Unlike informal emails, formal letters provide documented evidence.

- Alternative procedures include analytical reviews and reconciliations, but these may not substitute for third-party confirmation.

Download Word Doc

Download Word Doc

Download PDF

Download PDF