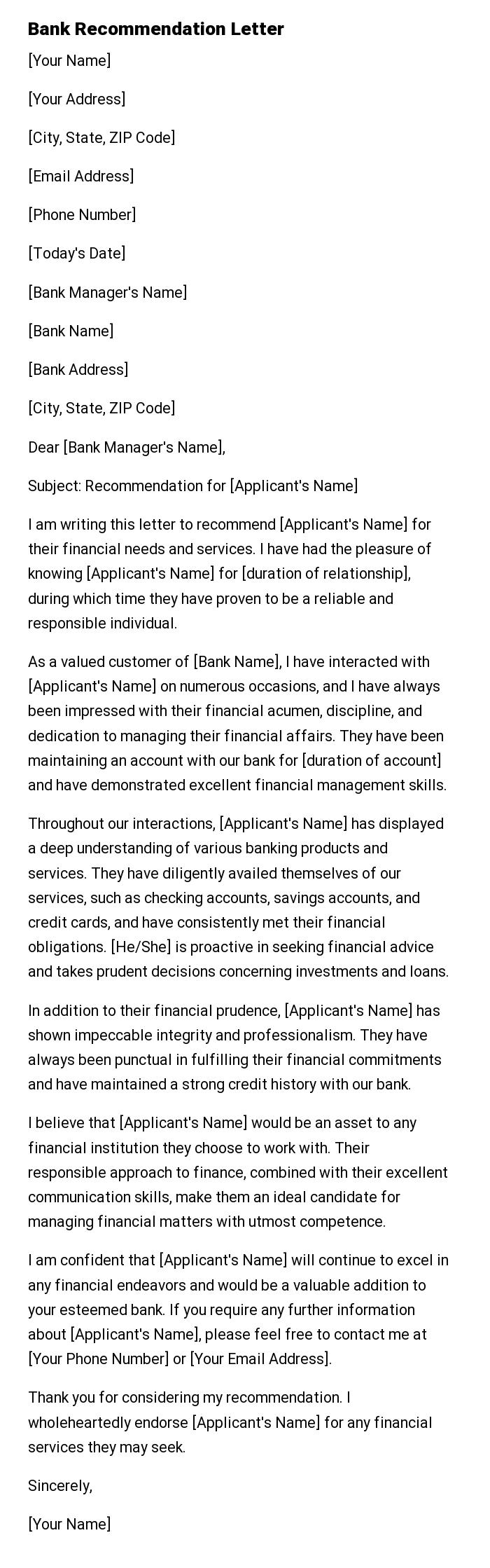

Bank Recommendation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Today's Date]

[Bank Manager's Name]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Dear [Bank Manager's Name],

Subject: Recommendation for [Applicant's Name]

I am writing this letter to recommend [Applicant's Name] for their financial needs and services. I have had the pleasure of knowing [Applicant's Name] for [duration of relationship], during which time they have proven to be a reliable and responsible individual.

As a valued customer of [Bank Name], I have interacted with [Applicant's Name] on numerous occasions, and I have always been impressed with their financial acumen, discipline, and dedication to managing their financial affairs. They have been maintaining an account with our bank for [duration of account] and have demonstrated excellent financial management skills.

Throughout our interactions, [Applicant's Name] has displayed a deep understanding of various banking products and services. They have diligently availed themselves of our services, such as checking accounts, savings accounts, and credit cards, and have consistently met their financial obligations. [He/She] is proactive in seeking financial advice and takes prudent decisions concerning investments and loans.

In addition to their financial prudence, [Applicant's Name] has shown impeccable integrity and professionalism. They have always been punctual in fulfilling their financial commitments and have maintained a strong credit history with our bank.

I believe that [Applicant's Name] would be an asset to any financial institution they choose to work with. Their responsible approach to finance, combined with their excellent communication skills, make them an ideal candidate for managing financial matters with utmost competence.

I am confident that [Applicant's Name] will continue to excel in any financial endeavors and would be a valuable addition to your esteemed bank. If you require any further information about [Applicant's Name], please feel free to contact me at [Your Phone Number] or [Your Email Address].

Thank you for considering my recommendation. I wholeheartedly endorse [Applicant's Name] for any financial services they may seek.

Sincerely,

[Your Name]

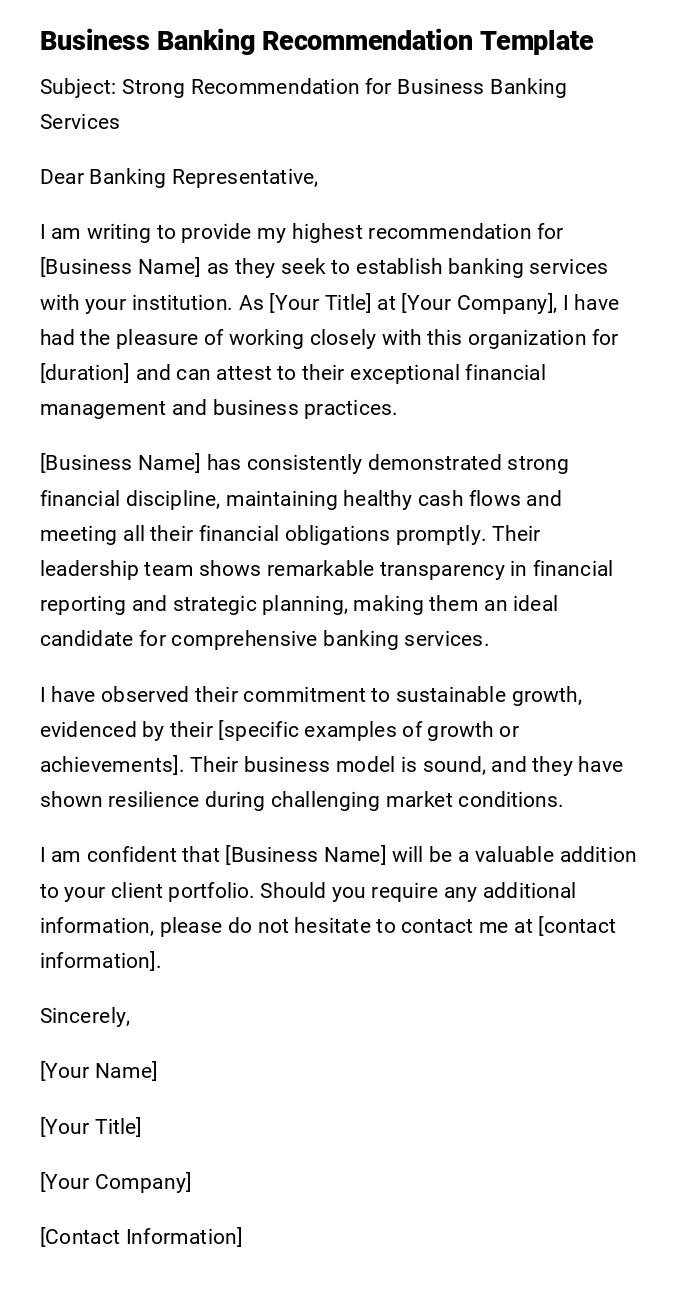

Professional Business Account Recommendation Letter

Subject: Strong Recommendation for Business Banking Services

Dear Banking Representative,

I am writing to provide my highest recommendation for [Business Name] as they seek to establish banking services with your institution. As [Your Title] at [Your Company], I have had the pleasure of working closely with this organization for [duration] and can attest to their exceptional financial management and business practices.

[Business Name] has consistently demonstrated strong financial discipline, maintaining healthy cash flows and meeting all their financial obligations promptly. Their leadership team shows remarkable transparency in financial reporting and strategic planning, making them an ideal candidate for comprehensive banking services.

I have observed their commitment to sustainable growth, evidenced by their [specific examples of growth or achievements]. Their business model is sound, and they have shown resilience during challenging market conditions.

I am confident that [Business Name] will be a valuable addition to your client portfolio. Should you require any additional information, please do not hesitate to contact me at [contact information].

Sincerely,

[Your Name]

[Your Title]

[Your Company]

[Contact Information]

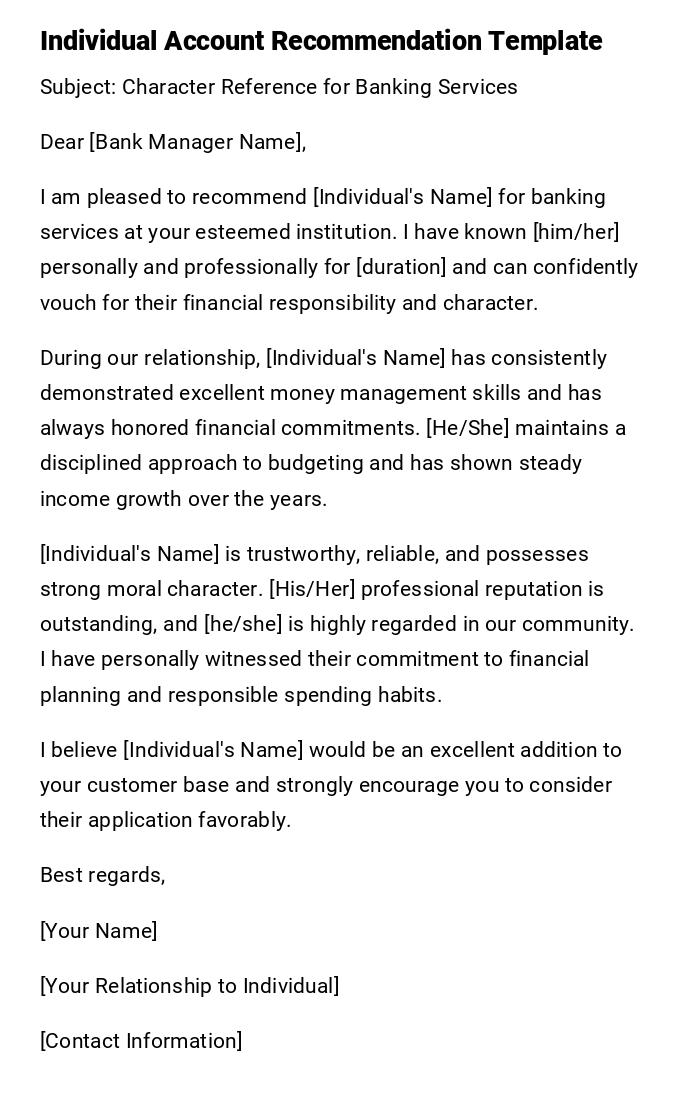

Personal Banking Recommendation Letter

Subject: Character Reference for Banking Services

Dear [Bank Manager Name],

I am pleased to recommend [Individual's Name] for banking services at your esteemed institution. I have known [him/her] personally and professionally for [duration] and can confidently vouch for their financial responsibility and character.

During our relationship, [Individual's Name] has consistently demonstrated excellent money management skills and has always honored financial commitments. [He/She] maintains a disciplined approach to budgeting and has shown steady income growth over the years.

[Individual's Name] is trustworthy, reliable, and possesses strong moral character. [His/Her] professional reputation is outstanding, and [he/she] is highly regarded in our community. I have personally witnessed their commitment to financial planning and responsible spending habits.

I believe [Individual's Name] would be an excellent addition to your customer base and strongly encourage you to consider their application favorably.

Best regards,

[Your Name]

[Your Relationship to Individual]

[Contact Information]

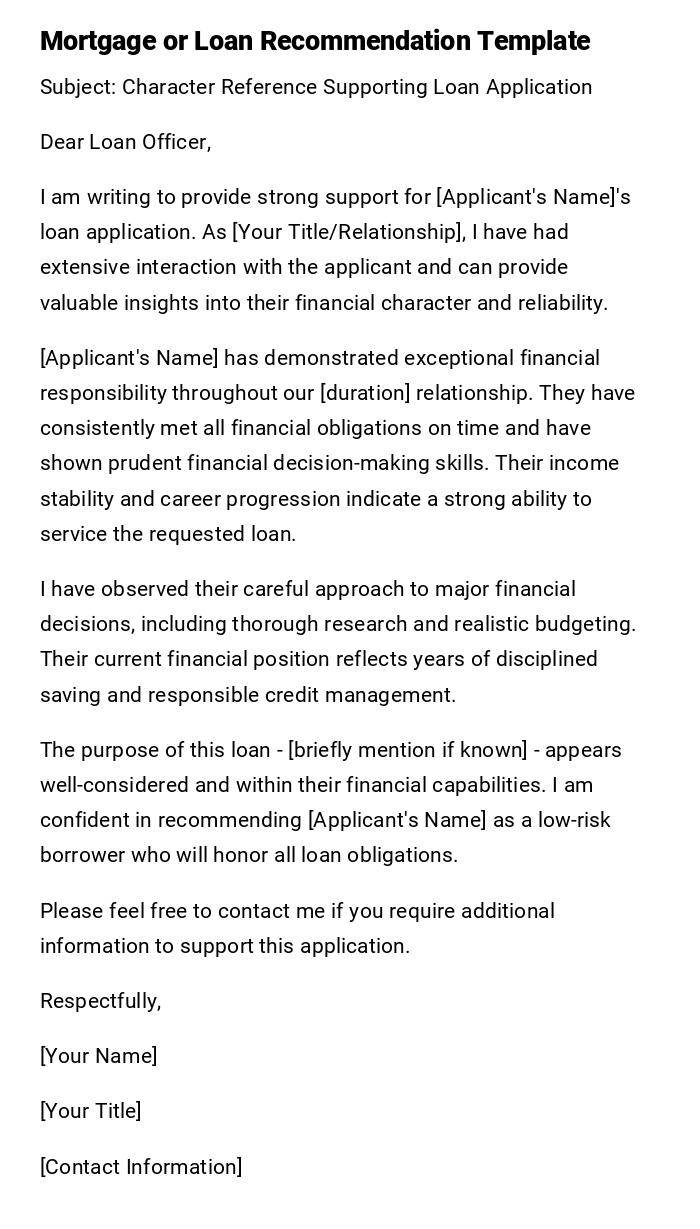

Loan Application Support Letter

Subject: Character Reference Supporting Loan Application

Dear Loan Officer,

I am writing to provide strong support for [Applicant's Name]'s loan application. As [Your Title/Relationship], I have had extensive interaction with the applicant and can provide valuable insights into their financial character and reliability.

[Applicant's Name] has demonstrated exceptional financial responsibility throughout our [duration] relationship. They have consistently met all financial obligations on time and have shown prudent financial decision-making skills. Their income stability and career progression indicate a strong ability to service the requested loan.

I have observed their careful approach to major financial decisions, including thorough research and realistic budgeting. Their current financial position reflects years of disciplined saving and responsible credit management.

The purpose of this loan - [briefly mention if known] - appears well-considered and within their financial capabilities. I am confident in recommending [Applicant's Name] as a low-risk borrower who will honor all loan obligations.

Please feel free to contact me if you require additional information to support this application.

Respectfully,

[Your Name]

[Your Title]

[Contact Information]

Credit Enhancement Recommendation Message

Subject: Professional Reference for Credit Application

Hello [Bank Representative],

I'm reaching out to support [Individual/Business Name]'s application for enhanced credit facilities. Having worked with them in my capacity as [Your Role], I can provide valuable perspective on their creditworthiness and financial habits.

Over the past [timeframe], I've witnessed their commitment to improving their financial standing. They've taken proactive steps to address previous credit challenges and have shown remarkable discipline in rebuilding their financial reputation.

Key observations include consistent payment history, reduced debt-to-income ratio, and improved financial planning. Their current financial trajectory suggests continued improvement and stability.

I believe extending credit facilities would be mutually beneficial - they need the opportunity to further establish credit history, and your institution would gain a motivated customer committed to financial success.

Happy to discuss this recommendation further if needed.

Best,

[Your Name]

[Position/Title]

[Contact Details]

Investment Services Recommendation Letter

Subject: Recommendation for Investment Banking Services

Dear Investment Services Team,

I am writing to recommend [Client Name] for your premium investment and wealth management services. As [Your Professional Role], I have had the opportunity to observe their financial acumen and investment philosophy over [duration].

[Client Name] demonstrates sophisticated understanding of financial markets and maintains a well-diversified investment approach. Their risk tolerance is appropriately calibrated to their financial goals, and they show excellent judgment in financial planning decisions.

Their current portfolio performance reflects careful research and strategic thinking. They have successfully navigated various market conditions while maintaining focus on long-term wealth building objectives. Their financial resources and investment timeline make them an ideal candidate for comprehensive wealth management services.

I am particularly impressed by their commitment to regular portfolio review and their openness to professional investment advice. They understand the value of expert guidance while maintaining informed oversight of their investments.

I strongly recommend [Client Name] for your investment services program.

Sincerely,

[Your Name]

[Your Credentials/Title]

[Professional Contact Information]

International Banking Services Letter

Subject: Reference for International Banking Requirements

Dear International Banking Department,

I am providing this recommendation for [Individual/Business Name] who requires international banking services for their cross-border activities. As someone familiar with their international business operations, I can attest to their need for and ability to effectively utilize global banking services.

[Individual/Business Name] conducts legitimate international business activities requiring multi-currency transactions, foreign exchange services, and international wire transfers. Their business model necessitates reliable international banking partnerships to support their global operations.

I can confirm their compliance with international business regulations and their commitment to transparent financial reporting across jurisdictions. Their international partners and clients regard them highly, reflecting their professional reputation in the global marketplace.

The requested international banking services align perfectly with their business requirements and growth strategy. I am confident they will utilize these services appropriately and maintain compliance with all regulatory requirements.

I recommend approving their application for international banking services without reservation.

Yours truly,

[Your Name]

[Your International Business Role]

[Contact Information]

Banking Relationship Recovery Letter

Subject: Character Reference for Banking Relationship Restoration

Dear Bank Management,

I am writing to support [Individual/Business Name]'s request to restore their banking relationship with your institution. While I understand there may have been previous challenges, I believe current circumstances warrant reconsideration of their application.

Having known [Individual/Business Name] for [duration], I can attest to the significant positive changes in their financial management practices. They have taken responsibility for past issues and implemented comprehensive measures to prevent future problems.

Recent developments in their financial situation include [specific improvements such as steady income, debt reduction, improved credit score, etc.]. These changes reflect genuine commitment to financial responsibility and rebuilding their banking reputation.

I understand the importance of due diligence in such matters, but I believe [Individual/Business Name] has demonstrated the necessary changes to warrant a fresh start. They value the opportunity to rebuild this banking relationship and are committed to maintaining exemplary account management.

I respectfully request your consideration of their application and am available to discuss this recommendation further.

Sincerely,

[Your Name]

[Your Relationship/Title]

[Contact Information]

What Are Bank Recommendation Letters and Why Are They Needed

Bank recommendation letters are formal documents that provide third-party endorsement of an individual's or business's financial character, creditworthiness, and banking suitability. These letters serve as crucial supporting documentation when establishing new banking relationships, applying for loans, or seeking specialized financial services.

- Character verification: Banks use these letters to assess the moral character and reliability of potential clients

- Risk assessment: Recommendations help banks evaluate the likelihood of successful banking relationships

- Credibility enhancement: Third-party endorsements add weight to applications and requests

- Due diligence support: Letters provide additional perspective beyond standard financial documentation

- Relationship building: Recommendations can expedite account opening and service approval processes

Who Should Write Bank Recommendation Letters

The credibility of a recommendation letter heavily depends on who writes it. Different scenarios require different types of recommenders to maximize effectiveness.

- Business leaders: CEOs, managers, and business owners can recommend employees or business partners

- Financial professionals: Accountants, financial advisors, and investment managers provide credible financial assessments

- Long-term clients: Existing bank customers in good standing can recommend individuals or businesses

- Professional colleagues: Industry peers who have financial dealings or professional relationships

- Community leaders: Respected community members who know the applicant's character and reputation

- Legal professionals: Attorneys who have handled financial matters or business transactions

- Educational institutions: For recent graduates, academic administrators or professors with knowledge of financial responsibility

When Bank Recommendation Letters Are Required or Beneficial

Understanding the appropriate timing and circumstances for bank recommendation letters ensures they're used effectively and when most needed.

- New account opening: Especially for high-value accounts or when credit history is limited

- Loan applications: Personal loans, mortgages, business loans, or credit line requests

- International banking: Cross-border transactions, foreign currency accounts, or global business banking

- Investment services: Wealth management, private banking, or investment advisory services

- After financial difficulties: Rebuilding banking relationships following previous issues

- Business banking: Commercial accounts, merchant services, or business credit facilities

- Specialized services: Safe deposit boxes, international wire services, or premium banking packages

- Credit enhancement: Supporting applications for increased credit limits or better terms

How to Write Effective Bank Recommendation Letters

The process of crafting compelling bank recommendation letters requires careful consideration of content, structure, and presentation to maximize impact.

- Gather relevant information: Collect details about the applicant's financial history, character, and banking needs

- Choose appropriate tone: Match the letter's formality to the banking service and institutional culture

- Structure logically: Begin with introduction, provide specific examples, and conclude with strong endorsement

- Include specific examples: Use concrete instances of financial responsibility or positive character traits

- Address potential concerns: Acknowledge and contextualize any known financial challenges

- Provide contact information: Make yourself available for follow-up questions or verification

- Review and edit: Ensure accuracy, clarity, and professional presentation before sending

Requirements and Prerequisites for Bank Recommendation Letters

Proper preparation ensures recommendation letters meet banking standards and provide maximum value to the application process.

- Written permission: Obtain explicit consent from the individual or business being recommended

- Sufficient knowledge: Ensure adequate familiarity with the applicant's financial character and history

- Professional relationship: Establish credible connection justifying your ability to provide meaningful recommendation

- Current information: Verify that your knowledge of the applicant's situation is up-to-date

- Supporting documentation: Gather relevant financial records or business documents if appropriate

- Bank-specific requirements: Research any special formats or information requirements of the target bank

- Legal considerations: Understand liability implications and ensure all statements are truthful and verifiable

Formatting Guidelines and Best Practices

Professional presentation significantly impacts the effectiveness of bank recommendation letters and their reception by financial institutions.

- Length: Typically 1-2 pages, providing sufficient detail without excessive length

- Professional letterhead: Use business letterhead when writing in professional capacity

- Formal business format: Include date, recipient address, and professional closing

- Clear subject line: Specifically identify the purpose and applicant name

- Confident tone: Write with authority and conviction while maintaining honesty

- Specific details: Include quantifiable achievements, timeframes, and concrete examples

- Contact information: Provide multiple ways for banks to reach you for verification

- Signature: Include handwritten signature for formal letters or electronic signature for emails

Common Mistakes to Avoid When Writing Bank Recommendations

Avoiding these common pitfalls ensures your recommendation letter achieves its intended purpose and maintains your professional credibility.

- Exaggeration or false claims: Never overstate qualifications or make unverifiable assertions

- Generic language: Avoid template-like content that doesn't reflect specific knowledge of the applicant

- Insufficient detail: Vague statements provide little value and may seem insincere

- Inappropriate recommender: Don't write recommendations if you lack adequate knowledge or credible relationship

- Outdated information: Ensure all details reflect current circumstances and recent knowledge

- Ignoring known issues: Address potential concerns rather than hoping they won't surface

- Poor presentation: Spelling errors, formatting issues, or unprofessional appearance undermine credibility

- Missing contact information: Banks need ways to verify recommendations and ask follow-up questions

Follow-up Actions After Sending Bank Recommendation Letters

Proper follow-up ensures recommendation letters achieve maximum effectiveness and maintains professional relationships throughout the banking application process.

- Confirm receipt: Verify that banks received your recommendation letter as intended

- Remain available: Be prepared to answer follow-up questions or provide additional information

- Update if necessary: Notify banks of any significant changes in the applicant's circumstances

- Support verification: Respond promptly to bank requests for confirmation or clarification

- Maintain confidentiality: Keep all communication regarding the recommendation confidential and professional

- Follow up with applicant: Check on application progress and offer additional support if needed

- Document the process: Keep copies of all recommendation letters and related correspondence for your records

Tips and Best Practices for Maximum Impact

These proven strategies help ensure your bank recommendation letters carry maximum weight and achieve desired outcomes for applicants.

- Research the bank: Understanding institutional culture and requirements helps tailor recommendations effectively

- Use specific metrics: Include quantifiable achievements, dollar amounts, or percentage improvements when possible

- Highlight unique strengths: Focus on qualities that distinguish the applicant from other candidates

- Address banking needs: Connect your recommendation to the specific services or accounts being requested

- Leverage your credibility: Emphasize your own qualifications and expertise to strengthen the recommendation

- Time submissions strategically: Submit recommendations when they will have maximum impact on decision-making

- Coordinate with applicant: Ensure your letter complements rather than contradicts other application materials

- Professional networks: Use industry connections to ensure recommendations reach appropriate decision-makers

Download Word Doc

Download Word Doc

Download PDF

Download PDF