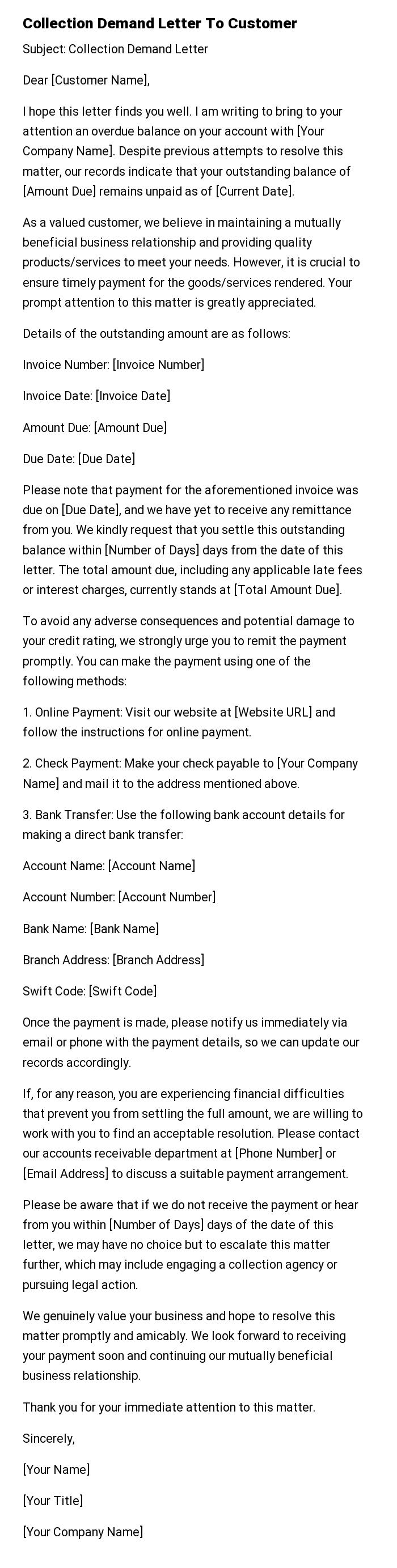

Collection Demand Letter To Customer

Subject: Collection Demand Letter

Dear [Customer Name],

I hope this letter finds you well. I am writing to bring to your attention an overdue balance on your account with [Your Company Name]. Despite previous attempts to resolve this matter, our records indicate that your outstanding balance of [Amount Due] remains unpaid as of [Current Date].

As a valued customer, we believe in maintaining a mutually beneficial business relationship and providing quality products/services to meet your needs. However, it is crucial to ensure timely payment for the goods/services rendered. Your prompt attention to this matter is greatly appreciated.

Details of the outstanding amount are as follows:

Invoice Number: [Invoice Number]

Invoice Date: [Invoice Date]

Amount Due: [Amount Due]

Due Date: [Due Date]

Please note that payment for the aforementioned invoice was due on [Due Date], and we have yet to receive any remittance from you. We kindly request that you settle this outstanding balance within [Number of Days] days from the date of this letter. The total amount due, including any applicable late fees or interest charges, currently stands at [Total Amount Due].

To avoid any adverse consequences and potential damage to your credit rating, we strongly urge you to remit the payment promptly. You can make the payment using one of the following methods:

1. Online Payment: Visit our website at [Website URL] and follow the instructions for online payment.

2. Check Payment: Make your check payable to [Your Company Name] and mail it to the address mentioned above.

3. Bank Transfer: Use the following bank account details for making a direct bank transfer:

Account Name: [Account Name]

Account Number: [Account Number]

Bank Name: [Bank Name]

Branch Address: [Branch Address]

Swift Code: [Swift Code]

Once the payment is made, please notify us immediately via email or phone with the payment details, so we can update our records accordingly.

If, for any reason, you are experiencing financial difficulties that prevent you from settling the full amount, we are willing to work with you to find an acceptable resolution. Please contact our accounts receivable department at [Phone Number] or [Email Address] to discuss a suitable payment arrangement.

Please be aware that if we do not receive the payment or hear from you within [Number of Days] days of the date of this letter, we may have no choice but to escalate this matter further, which may include engaging a collection agency or pursuing legal action.

We genuinely value your business and hope to resolve this matter promptly and amicably. We look forward to receiving your payment soon and continuing our mutually beneficial business relationship.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

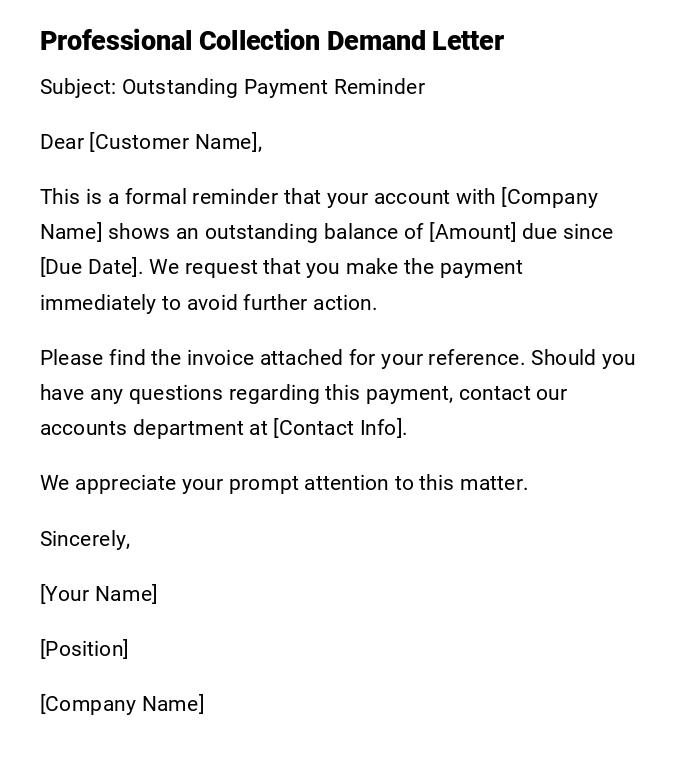

Professional Collection Demand Letter

Subject: Outstanding Payment Reminder

Dear [Customer Name],

This is a formal reminder that your account with [Company Name] shows an outstanding balance of [Amount] due since [Due Date]. We request that you make the payment immediately to avoid further action.

Please find the invoice attached for your reference. Should you have any questions regarding this payment, contact our accounts department at [Contact Info].

We appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Position]

[Company Name]

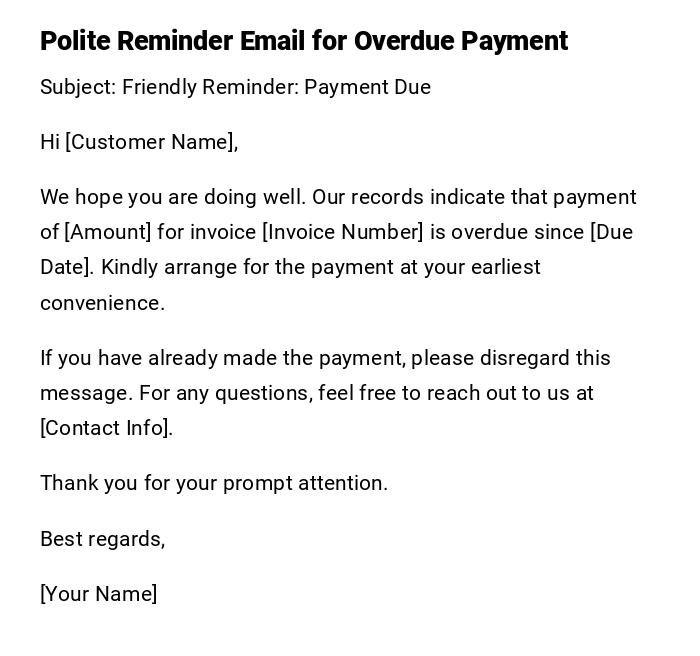

Polite Reminder Email for Overdue Payment

Subject: Friendly Reminder: Payment Due

Hi [Customer Name],

We hope you are doing well. Our records indicate that payment of [Amount] for invoice [Invoice Number] is overdue since [Due Date]. Kindly arrange for the payment at your earliest convenience.

If you have already made the payment, please disregard this message. For any questions, feel free to reach out to us at [Contact Info].

Thank you for your prompt attention.

Best regards,

[Your Name]

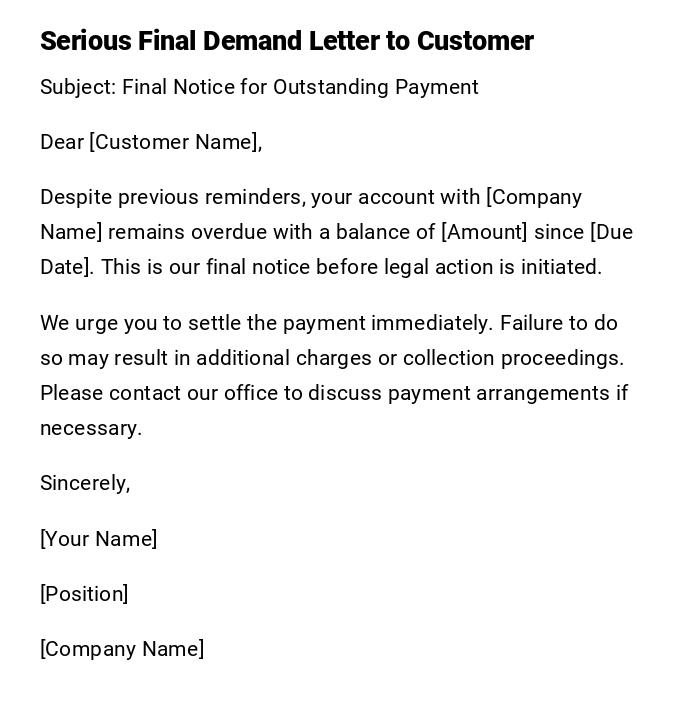

Serious Final Demand Letter to Customer

Subject: Final Notice for Outstanding Payment

Dear [Customer Name],

Despite previous reminders, your account with [Company Name] remains overdue with a balance of [Amount] since [Due Date]. This is our final notice before legal action is initiated.

We urge you to settle the payment immediately. Failure to do so may result in additional charges or collection proceedings. Please contact our office to discuss payment arrangements if necessary.

Sincerely,

[Your Name]

[Position]

[Company Name]

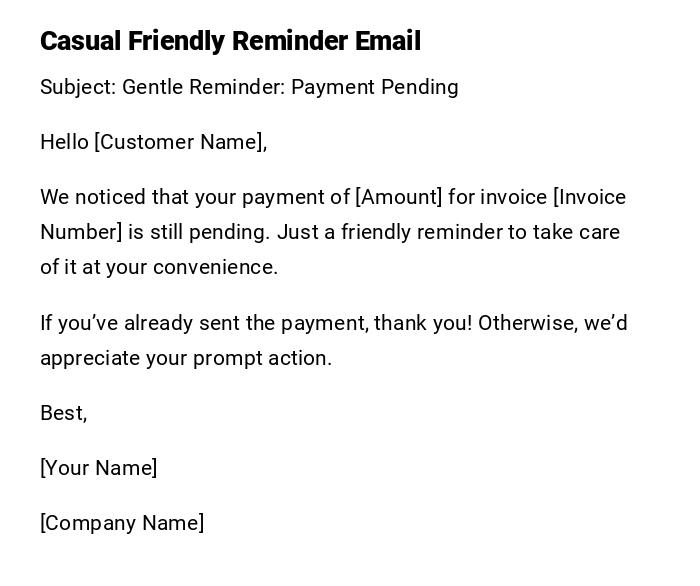

Casual Friendly Reminder Email

Subject: Gentle Reminder: Payment Pending

Hello [Customer Name],

We noticed that your payment of [Amount] for invoice [Invoice Number] is still pending. Just a friendly reminder to take care of it at your convenience.

If you’ve already sent the payment, thank you! Otherwise, we’d appreciate your prompt action.

Best,

[Your Name]

[Company Name]

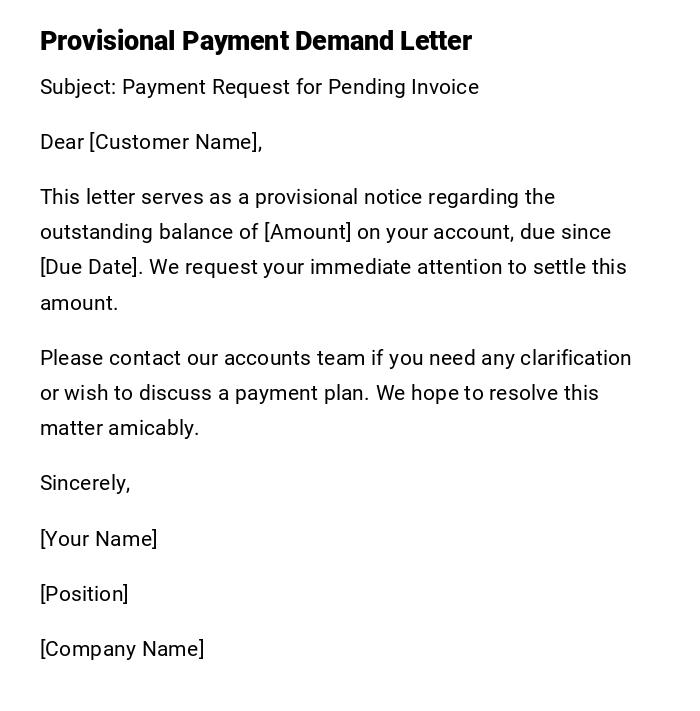

Provisional Payment Demand Letter

Subject: Payment Request for Pending Invoice

Dear [Customer Name],

This letter serves as a provisional notice regarding the outstanding balance of [Amount] on your account, due since [Due Date]. We request your immediate attention to settle this amount.

Please contact our accounts team if you need any clarification or wish to discuss a payment plan. We hope to resolve this matter amicably.

Sincerely,

[Your Name]

[Position]

[Company Name]

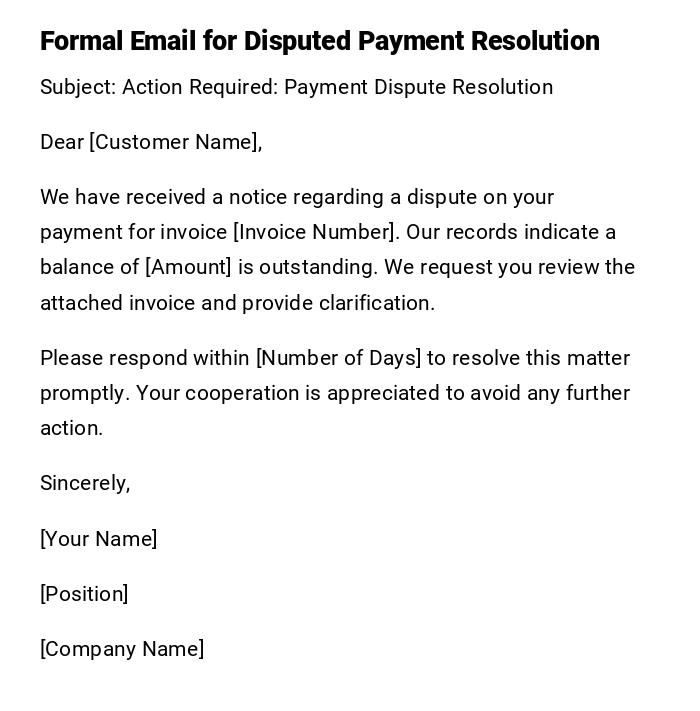

Formal Email for Disputed Payment Resolution

Subject: Action Required: Payment Dispute Resolution

Dear [Customer Name],

We have received a notice regarding a dispute on your payment for invoice [Invoice Number]. Our records indicate a balance of [Amount] is outstanding. We request you review the attached invoice and provide clarification.

Please respond within [Number of Days] to resolve this matter promptly. Your cooperation is appreciated to avoid any further action.

Sincerely,

[Your Name]

[Position]

[Company Name]

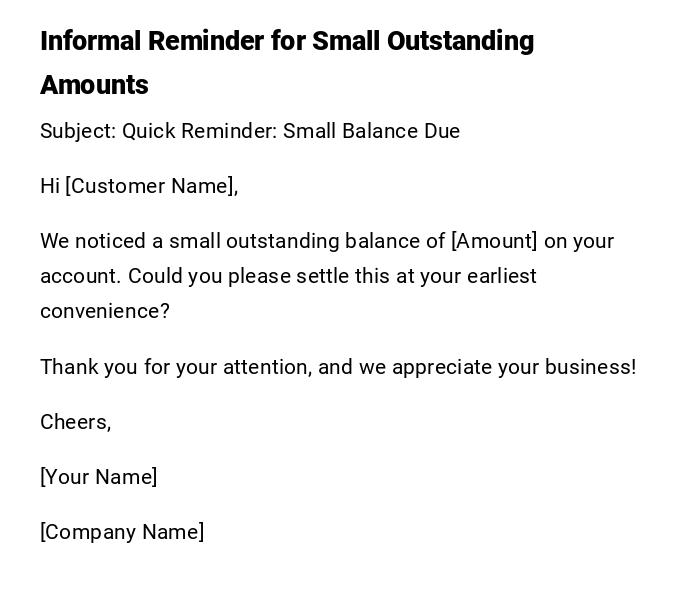

Informal Reminder for Small Outstanding Amounts

Subject: Quick Reminder: Small Balance Due

Hi [Customer Name],

We noticed a small outstanding balance of [Amount] on your account. Could you please settle this at your earliest convenience?

Thank you for your attention, and we appreciate your business!

Cheers,

[Your Name]

[Company Name]

Urgent Collection Notice

Subject: Urgent: Immediate Payment Required

Dear [Customer Name],

Your account with [Company Name] has an overdue balance of [Amount] since [Due Date]. Immediate payment is required to prevent account suspension or further action.

Please contact our office to confirm payment arrangements. We hope to resolve this matter quickly and avoid escalation.

Sincerely,

[Your Name]

[Position]

[Company Name]

What / Why you need a Collection Demand Letter to Customer

A Collection Demand Letter is used to formally notify customers about overdue payments.

Its purposes include:

- Reminding customers of unpaid invoices.

- Establishing a formal record of communication.

- Initiating potential recovery actions if payment is delayed.

Who should send a Collection Demand Letter

- Accounts receivable personnel.

- Company managers or supervisors.

- Collection agencies authorized to act on behalf of the business.

- Legal department representatives for serious cases.

Whom the Collection Demand Letter should be addressed to

- Individual customers with overdue payments.

- Corporate clients who have unpaid invoices.

- Authorized representatives managing customer accounts.

- Customers with a history of delayed payments.

When to send a Collection Demand Letter

- Immediately after the payment due date is missed.

- After sending initial reminders without response.

- Before initiating legal or collection agency proceedings.

- When multiple invoices remain unpaid over a set period.

How to write and send a Collection Demand Letter

- Clearly state the outstanding amount and due date.

- Mention prior reminders or communications.

- Use a professional tone for serious matters; friendly tone for minor overdue amounts.

- Include contact details for payment and inquiries.

- Decide between sending via email or printed letter depending on urgency and formality.

How much or How many amounts to specify

- Clearly specify the exact overdue amount.

- Mention each invoice separately if multiple are outstanding.

- Include late fees or interest, if applicable.

- Indicate total amount due to avoid confusion.

FAQ about Collection Demand Letters

Q: Can I send a casual email for overdue payments?

A: Yes, for small amounts or friendly customers.

Q: When should a serious tone be used?

A: When payments remain overdue despite reminders.

Q: Is it necessary to attach invoices?

A: Yes, always attach supporting documents for clarity.

Requirements and Prerequisites before sending

- Verify the overdue amount and invoice details.

- Ensure previous reminders were sent.

- Confirm contact information is correct.

- Decide the appropriate tone based on customer relationship and amount due.

Formatting Guidelines

- Length: concise, 1 page maximum.

- Tone: polite for first reminders, firm for final notices.

- Include invoice numbers, due dates, and total amounts.

- Signature by authorized personnel.

- Email or printed letter depending on urgency.

After Sending / Follow-up

- Track if the customer responds or makes payment.

- Send a second or final notice if necessary.

- Escalate to collection agencies or legal action for unresolved cases.

- Maintain records of all communication for future reference.

Pros and Cons of Sending a Collection Demand Letter

Pros:

- Provides formal documentation.

- Increases likelihood of payment.

- Can serve as evidence for legal actions.

Cons:

- May affect customer relationship if overly harsh.

- Repeated letters may be ignored without escalation.

- Requires careful tone management.

Compare and Contrast with Other Collection Methods

- Versus Phone Calls: Letters are formal and documented, calls are immediate but not always recorded.

- Versus Legal Notices: Letters are initial steps before legal action.

- Versus Automated Emails: Personalized letters can be more effective in serious cases.

Tricks and Tips for Effective Collection Demand Letters

- Personalize letters with customer name and invoice numbers.

- Maintain polite but firm tone.

- Provide clear instructions for payment methods.

- Set deadlines for payment response.

- Attach supporting documents to reduce disputes.

Common Mistakes to Avoid

- Sending letters without verifying amounts.

- Using overly aggressive language initially.

- Failing to include contact details.

- Not keeping a copy for records.

- Ignoring minor disputes or errors that could delay payment.

Elements and Structure of a Collection Demand Letter

- Subject line indicating overdue payment.

- Greeting and customer identification.

- Details of overdue amount, invoices, and due dates.

- Reference to previous reminders.

- Clear payment instructions and deadlines.

- Contact information for queries.

- Closing with signature of authorized personnel.

Does it require attestation or authorization

- Signature from authorized personnel is recommended.

- Company letterhead adds credibility.

- For legal escalation, formal attestation may be required.

Download Word Doc

Download Word Doc

Download PDF

Download PDF