Initial Reminder Letter Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Reminder - Outstanding Invoice #[Invoice Number]

Dear [Customer's Name],

We hope this letter finds you well. We would like to bring to your attention that an invoice (#[Invoice Number]) for [Amount] remains unpaid, with a due date of [Due Date]. We kindly request that you settle this invoice at your earliest convenience.

Your prompt attention to this matter is greatly appreciated. Please make the necessary payment through the methods specified on the invoice or contact our accounts department at [Accounts Department Phone Number] if you have any questions or concerns.

Thank you for your prompt action.

Sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

First Follow-up Letter Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Second Reminder - Outstanding Invoice #[Invoice Number]

Dear [Customer's Name],

I hope this letter finds you well. We regret to inform you that your invoice (#[Invoice Number]) for [Amount] is still outstanding, even after our previous reminder. The due date was [Due Date].

We understand that oversights can occur, and we kindly urge you to settle this invoice immediately to avoid any further inconvenience. Please refer to the invoice for payment options, or get in touch with our accounts department at [Accounts Department Phone Number] if you require assistance.

We appreciate your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

Final Notice Letter Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Final Notice - Urgent Payment Required for Invoice #[Invoice Number]

Dear [Customer's Name],

I trust this letter reaches you. We have made multiple attempts to communicate regarding the unpaid invoice (#[Invoice Number]) for [Amount] with a due date of [Due Date]. Unfortunately, we have not received any response or payment.

This is our final notice before we initiate further action. We implore you to take immediate action and settle this outstanding balance. Failure to do so may result in escalated measures to recover the debt.

To resolve this matter promptly, please make the necessary payment using the details provided on the invoice or contact our accounts department at [Accounts Department Phone Number].

We sincerely hope to resolve this issue amicably.

Best regards,

[Your Name]

[Your Title]

[Your Contact Information]

Friendly Payment Reminder Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Gentle Reminder - Outstanding Balance #[Invoice Number]

Dear [Customer's Name],

I hope this message finds you well. We wanted to remind you of the unpaid invoice (#[Invoice Number]) for [Amount] that was due on [Due Date]. We understand that oversights can happen, and we kindly ask that you address this matter at your earliest convenience.

Please refer to the invoice for payment options or reach out to our friendly accounts team at [Accounts Department Phone Number] if you have any questions or concerns.

Thank you for your prompt attention to this matter.

Warm regards,

[Your Name]

[Your Title]

[Your Contact Information]

Second Reminder with Late Fee Notice Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Important Notice - Unpaid Invoice #[Invoice Number]

Dear [Customer's Name],

We hope this message finds you well. We wish to inform you that your invoice (#[Invoice Number]) for [Amount] remains unpaid, despite our previous reminders. The due date was [Due Date], and unfortunately, late payment charges are now applicable.

We strongly urge you to settle this invoice immediately to avoid further escalation. Please refer to the invoice for updated payment details, including the late fee, or contact our accounts department at [Accounts Department Phone Number] for assistance.

Your prompt action is greatly appreciated.

Sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

Final Demand for Payment Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Final Demand - Immediate Action Required for Invoice #[Invoice Number]

Dear [Customer's Name],

This letter serves as a final demand for the immediate settlement of your outstanding invoice (#[Invoice Number]) for [Amount], which was due on [Due Date]. Despite our previous attempts to communicate, we have not received any response or payment.

Please be advised that if we do not receive payment or a valid explanation for the delay within [Grace Period], we will have no choice but to pursue further actions to recover the debt, which may include legal proceedings.

To avoid such actions, please make the necessary payment using the information provided on the invoice or contact our accounts department immediately at [Accounts Department Phone Number].

We strongly advise you to treat this matter with utmost urgency.

Yours sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

Legal Action Warning Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Urgent - Pending Legal Action for Invoice #[Invoice Number]

Dear [Customer's Name],

We write to inform you that despite our previous attempts to resolve the matter of your unpaid invoice (#[Invoice Number]) for [Amount], we have not received any response or payment from your end. The due date was [Due Date], and the payment is now significantly overdue.

This letter is a final warning before we initiate legal proceedings to recover the debt. Legal action can lead to additional costs and consequences that we believe can be avoided through amicable resolution.

To prevent further escalation, please remit the outstanding amount promptly using the details provided on the invoice or contact our legal department at [Legal Department Phone Number] to discuss a resolution.

Immediate action is imperative to avoid legal repercussions.

Yours faithfully,

[Your Name]

[Your Title]

[Your Contact Information]

Post-Legal Action Notification Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Legal Action Initiated - Invoice #[Invoice Number]

Dear [Customer's Name],

We regret to inform you that, despite our previous communications and warnings, we have been compelled to initiate legal action to recover the outstanding debt related to your invoice (#[Invoice Number]) for [Amount].

Our efforts to amicably resolve this matter have been exhausted, and this course of action was taken as a last resort. Legal proceedings are now underway, and this may result in additional costs, legal fees, and potential damage to your credit rating.

If you wish to halt the legal proceedings and avoid further consequences, please contact our legal department immediately at [Legal Department Phone Number] to discuss a settlement arrangement.

Time is of the essence, and we urge you to take swift action.

Yours sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

Settlement Offer Letter Template

[Your Company Name]

[Your Address]

[City, State, ZIP]

[Date]

[Customer's Name]

[Customer's Address]

[City, State, ZIP]

Subject: Settlement Offer for Outstanding Debt

Dear [Customer's Name],

We write to offer a potential resolution to the matter of your unpaid invoice (#[Invoice Number]) for [Amount], which has been outstanding for some time. We understand that financial difficulties can arise, and we wish to work with you to find a suitable solution.

In an effort to expedite the resolution, we propose a settlement arrangement. If you are able to make a one-time payment of [Settlement Amount] by [Settlement Expiry Date], we are willing to consider the debt settled in full.

To confirm your agreement to this offer and to discuss the necessary steps to proceed, please contact our accounts department at [Accounts Department Phone Number] as soon as possible.

We look forward to your prompt response and the opportunity to bring this matter to a close.

Sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

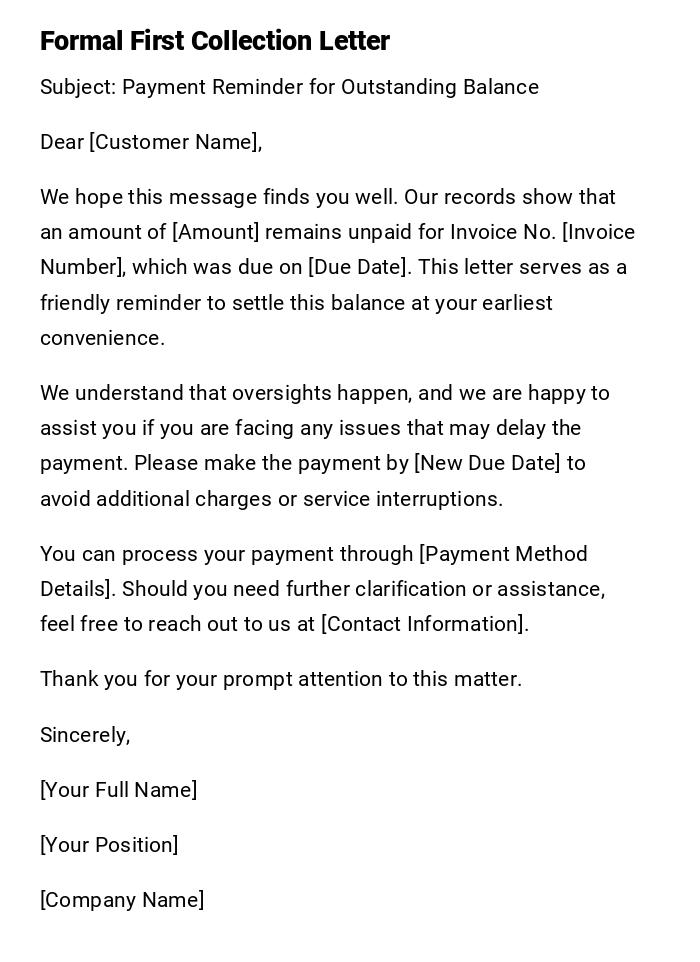

Formal First Collection Letter

Subject: Payment Reminder for Outstanding Balance

Dear [Customer Name],

We hope this message finds you well. Our records show that an amount of [Amount] remains unpaid for Invoice No. [Invoice Number], which was due on [Due Date]. This letter serves as a friendly reminder to settle this balance at your earliest convenience.

We understand that oversights happen, and we are happy to assist you if you are facing any issues that may delay the payment. Please make the payment by [New Due Date] to avoid additional charges or service interruptions.

You can process your payment through [Payment Method Details]. Should you need further clarification or assistance, feel free to reach out to us at [Contact Information].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Position]

[Company Name]

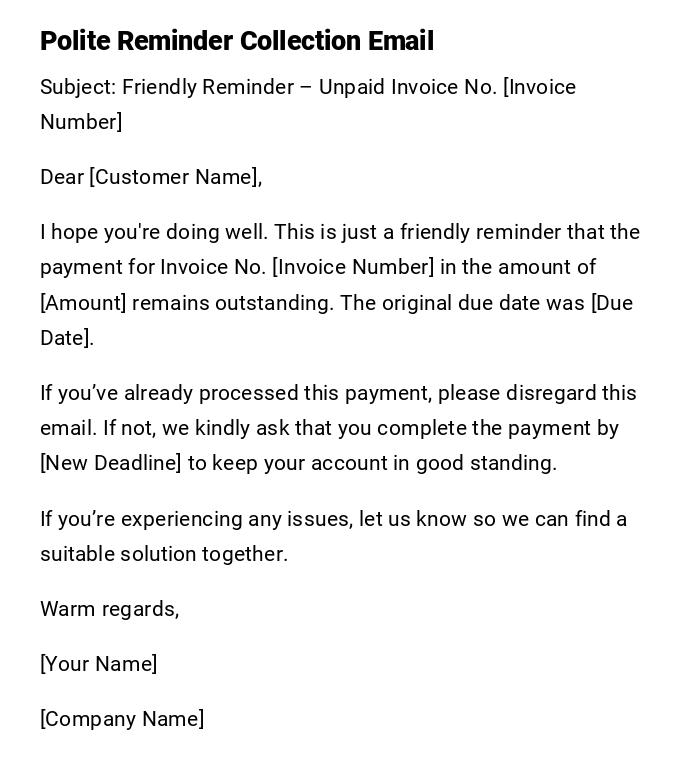

Polite Reminder Collection Email

Subject: Friendly Reminder – Unpaid Invoice No. [Invoice Number]

Dear [Customer Name],

I hope you're doing well. This is just a friendly reminder that the payment for Invoice No. [Invoice Number] in the amount of [Amount] remains outstanding. The original due date was [Due Date].

If you’ve already processed this payment, please disregard this email. If not, we kindly ask that you complete the payment by [New Deadline] to keep your account in good standing.

If you’re experiencing any issues, let us know so we can find a suitable solution together.

Warm regards,

[Your Name]

[Company Name]

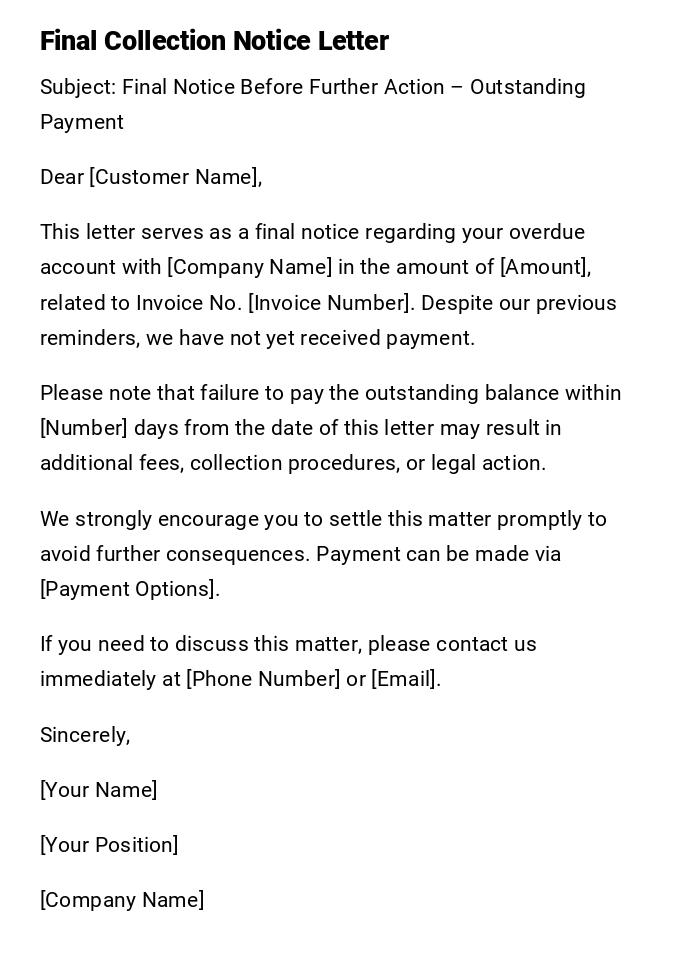

Final Collection Notice Letter

Subject: Final Notice Before Further Action – Outstanding Payment

Dear [Customer Name],

This letter serves as a final notice regarding your overdue account with [Company Name] in the amount of [Amount], related to Invoice No. [Invoice Number]. Despite our previous reminders, we have not yet received payment.

Please note that failure to pay the outstanding balance within [Number] days from the date of this letter may result in additional fees, collection procedures, or legal action.

We strongly encourage you to settle this matter promptly to avoid further consequences. Payment can be made via [Payment Options].

If you need to discuss this matter, please contact us immediately at [Phone Number] or [Email].

Sincerely,

[Your Name]

[Your Position]

[Company Name]

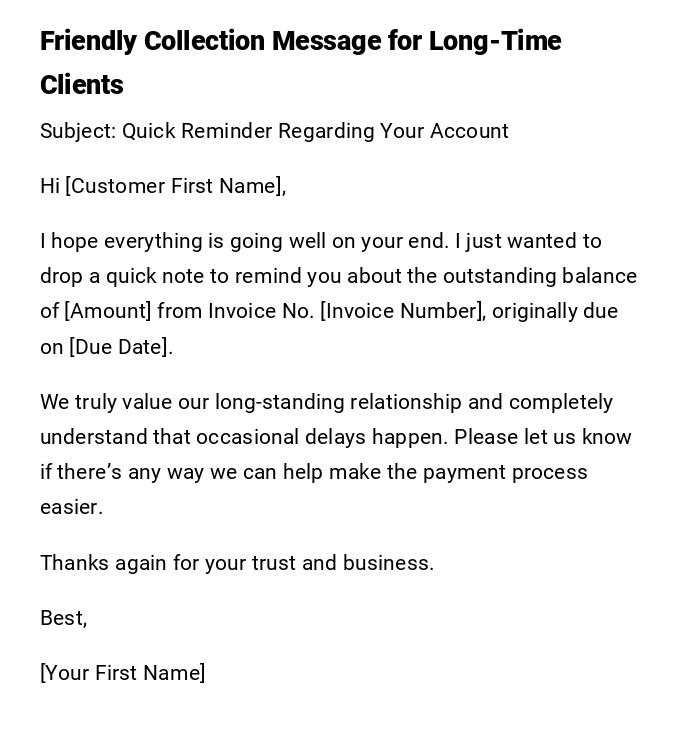

Friendly Collection Message for Long-Time Clients

Subject: Quick Reminder Regarding Your Account

Hi [Customer First Name],

I hope everything is going well on your end. I just wanted to drop a quick note to remind you about the outstanding balance of [Amount] from Invoice No. [Invoice Number], originally due on [Due Date].

We truly value our long-standing relationship and completely understand that occasional delays happen. Please let us know if there’s any way we can help make the payment process easier.

Thanks again for your trust and business.

Best,

[Your First Name]

Collection Letter with Payment Plan Option

Subject: Payment Plan Option for Outstanding Balance

Dear [Customer Name],

We are writing to remind you of the outstanding amount of [Amount] for Invoice No. [Invoice Number], which was due on [Due Date]. We understand that financial situations can be challenging, and we want to offer a flexible solution.

If you’re unable to pay the full amount immediately, we can arrange a payment plan that suits your situation. This will allow you to clear the balance over an agreed period, avoiding further penalties.

Please contact us at [Contact Information] to discuss the details of the payment plan. We appreciate your cooperation and timely response.

Kind regards,

[Your Name]

[Your Position]

[Company Name]

Collection Letter for Overdue Service Fees

Subject: Overdue Service Fees – Immediate Action Required

Dear [Customer Name],

Our records show that payment for your service account is overdue in the amount of [Amount], which was due on [Due Date]. We kindly request that the payment be made immediately to avoid service suspension.

Continued non-payment may result in additional charges or termination of services. To prevent this, please make the payment using [Payment Method] or contact our office to resolve any issues.

We appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

Debt Collection Letter on Behalf of Client

Subject: Debt Recovery Notice

Dear [Debtor’s Name],

We are writing on behalf of [Client Company Name] regarding an outstanding debt of [Amount] related to Invoice No. [Invoice Number]. Despite previous notifications, the balance remains unpaid.

Please consider this letter a formal demand for payment. Failure to settle this debt within [Number] days may result in legal proceedings or referral to a collection agency.

If you have already paid, kindly provide proof of payment. Otherwise, remit the balance to [Payment Information] immediately.

Respectfully,

[Collection Agency Name]

[Representative Name]

Urgent Overdue Account Collection Email

Subject: Urgent – Immediate Payment Required

Dear [Customer Name],

This is to inform you that your account with [Company Name] is now [Number] days overdue, with an outstanding balance of [Amount]. We’ve attempted to reach you multiple times without success.

To avoid legal escalation and additional fees, we require payment no later than [Deadline Date]. If payment has already been made, please disregard this notice.

Kindly make your payment immediately through [Payment Instructions] or contact us to discuss the situation.

Regards,

[Your Name]

[Company Name]

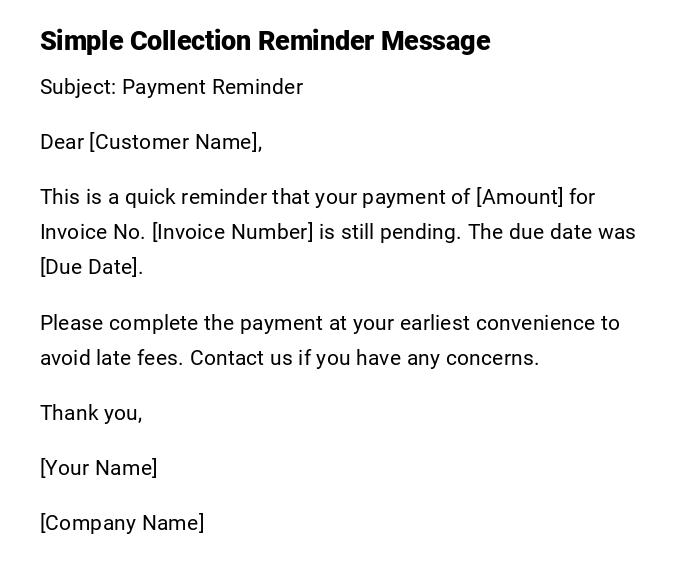

Simple Collection Reminder Message

Subject: Payment Reminder

Dear [Customer Name],

This is a quick reminder that your payment of [Amount] for Invoice No. [Invoice Number] is still pending. The due date was [Due Date].

Please complete the payment at your earliest convenience to avoid late fees. Contact us if you have any concerns.

Thank you,

[Your Name]

[Company Name]

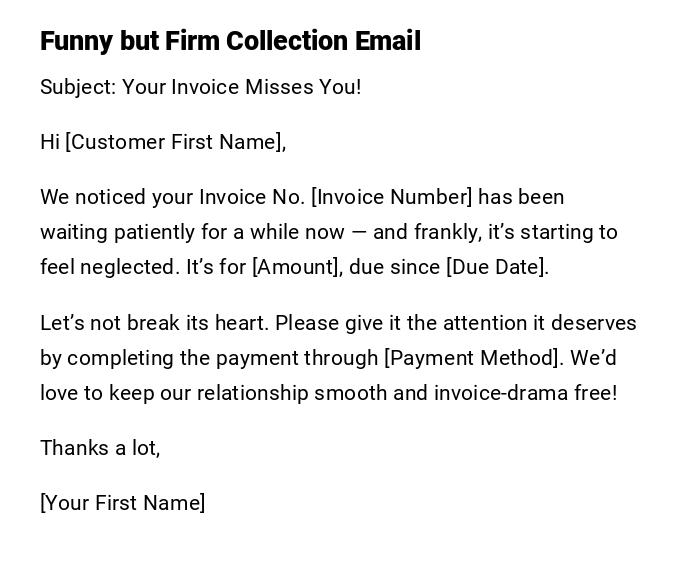

Funny but Firm Collection Email

Subject: Your Invoice Misses You!

Hi [Customer First Name],

We noticed your Invoice No. [Invoice Number] has been waiting patiently for a while now — and frankly, it’s starting to feel neglected. It’s for [Amount], due since [Due Date].

Let’s not break its heart. Please give it the attention it deserves by completing the payment through [Payment Method]. We’d love to keep our relationship smooth and invoice-drama free!

Thanks a lot,

[Your First Name]

What is a Collection Letter and Why It’s Important

A collection letter is a formal or informal written notice sent to remind or demand payment for an outstanding debt. Its purpose is to:

- Encourage the debtor to pay promptly.

- Maintain professional and legal records of communication.

- Avoid unnecessary escalation to legal or collection agencies.

- Preserve the business relationship through structured reminders.

Who Should Send a Collection Letter

Collection letters are typically sent by:

- Businesses or service providers owed money.

- Accounts receivable departments or finance teams.

- Third-party collection agencies (if the debt is outsourced).

- Landlords or property managers in the case of unpaid rent.

Whom to Address a Collection Letter To

This letter is generally sent to:

- Customers with unpaid invoices.

- Tenants who owe rent.

- Clients or vendors with overdue balances.

- Debtors in legal or business transactions. Ensure it is addressed to the correct legal or financial contact person.

When to Send a Collection Letter

Collection letters should be sent when:

- The due date of payment has passed.

- Previous reminders have not been successful.

- You want to create a formal record of the outstanding amount.

- Legal or recovery procedures might follow. Many businesses follow a structured reminder timeline — 1st notice, 2nd reminder, and final notice.

How to Write a Professional Collection Letter

The writing process typically involves:

- Clearly stating the amount due and original due date.

- Mentioning previous reminders (if any).

- Offering a chance to settle or communicate before escalation.

- Keeping the tone polite but firm.

- Including payment methods and contact details.

- Setting a clear deadline for response or action.

Formatting Tips for a Collection Letter

- Keep it brief, clear, and structured (150–300 words).

- Use a formal and respectful tone, especially for initial reminders.

- Gradually increase firmness in follow-up notices.

- Include payment details, deadlines, and invoice references.

- Choose the appropriate medium (email, letter, or message).

Requirements and Prerequisites Before Sending a Collection Letter

- Verify the outstanding amount and invoice details.

- Ensure previous communication attempts are documented.

- Check payment records to avoid errors.

- Have payment options clearly set.

- Decide escalation steps if the debtor does not respond.

Common Mistakes to Avoid in Collection Letters

- Using aggressive or threatening language too early.

- Failing to include payment details or deadlines.

- Sending reminders to the wrong contact.

- Not maintaining a professional tone.

- Forgetting to follow up systematically.

What to Do After Sending a Collection Letter

- Allow reasonable time for a response or payment.

- Follow up with a phone call if needed.

- Send additional reminders if required.

- Document all communications for legal and financial records.

- Escalate to legal action or collection agencies if necessary.

Pros and Cons of Using Collection Letters

Pros:

- Creates formal documentation.

- Encourages quick payments.

- Maintains professional tone.

- Reduces the need for immediate legal action.

Cons:

- Some debtors may ignore letters.

- May strain relationships if not worded carefully.

- May require follow-up and escalation.

Tips and Best Practices for Effective Collection Letters

- Send the first reminder politely and escalate tone gradually.

- Offer flexible payment plans when possible.

- Keep messages personalized but professional.

- Automate reminders through accounting systems.

- Always include clear payment instructions.

Elements and Structure of a Good Collection Letter

- Subject or heading stating the purpose.

- Salutation with correct name.

- Description of the debt (amount, invoice number, due date).

- Reminder of previous notices (if applicable).

- Payment options and deadline.

- Contact information for assistance.

- Professional closing.

Does a Collection Letter Require Attestation or Authorization

In most cases, collection letters do not require legal attestation. However:

- If sent by a collection agency, an authorization from the creditor is required.

- Legal notices or final demands may need to be signed by an authorized representative.

- For large debts, legal counsel may review the wording before sending.

Bank Collection Letter

Bill Collection Letter

Cease And Desist Collection Letter

Collection Demand Letter To Customer

Collection Dispute Letter

Collection Letter For Past Due Account

Collection Letter For Past Due Invoices

Collection Letter From Attorney

Collection Letter Reminder

Collection Letter Response

Collection Letter Template Final Notice

Collection Letters To Patients

Collection Removal Letter

Credit And Collection Letter

Debt Collection Letter

Friendly Collection Letter Template

Loan Collection Letter

Medical Collection Letter

Payment Collection Letter

Rent Collection Letter

Sample Dispute Letter To Collection Agency

Download Word Doc

Download Word Doc

Download PDF

Download PDF