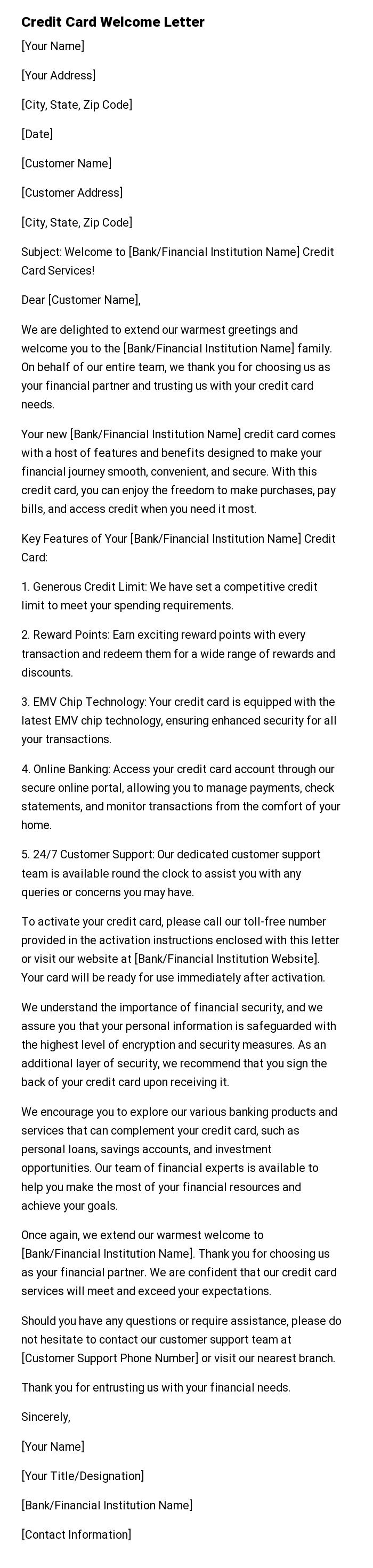

Credit Card Welcome Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Customer Name]

[Customer Address]

[City, State, Zip Code]

Subject: Welcome to [Bank/Financial Institution Name] Credit Card Services!

Dear [Customer Name],

We are delighted to extend our warmest greetings and welcome you to the [Bank/Financial Institution Name] family. On behalf of our entire team, we thank you for choosing us as your financial partner and trusting us with your credit card needs.

Your new [Bank/Financial Institution Name] credit card comes with a host of features and benefits designed to make your financial journey smooth, convenient, and secure. With this credit card, you can enjoy the freedom to make purchases, pay bills, and access credit when you need it most.

Key Features of Your [Bank/Financial Institution Name] Credit Card:

1. Generous Credit Limit: We have set a competitive credit limit to meet your spending requirements.

2. Reward Points: Earn exciting reward points with every transaction and redeem them for a wide range of rewards and discounts.

3. EMV Chip Technology: Your credit card is equipped with the latest EMV chip technology, ensuring enhanced security for all your transactions.

4. Online Banking: Access your credit card account through our secure online portal, allowing you to manage payments, check statements, and monitor transactions from the comfort of your home.

5. 24/7 Customer Support: Our dedicated customer support team is available round the clock to assist you with any queries or concerns you may have.

To activate your credit card, please call our toll-free number provided in the activation instructions enclosed with this letter or visit our website at [Bank/Financial Institution Website]. Your card will be ready for use immediately after activation.

We understand the importance of financial security, and we assure you that your personal information is safeguarded with the highest level of encryption and security measures. As an additional layer of security, we recommend that you sign the back of your credit card upon receiving it.

We encourage you to explore our various banking products and services that can complement your credit card, such as personal loans, savings accounts, and investment opportunities. Our team of financial experts is available to help you make the most of your financial resources and achieve your goals.

Once again, we extend our warmest welcome to [Bank/Financial Institution Name]. Thank you for choosing us as your financial partner. We are confident that our credit card services will meet and exceed your expectations.

Should you have any questions or require assistance, please do not hesitate to contact our customer support team at [Customer Support Phone Number] or visit our nearest branch.

Thank you for entrusting us with your financial needs.

Sincerely,

[Your Name]

[Your Title/Designation]

[Bank/Financial Institution Name]

[Contact Information]

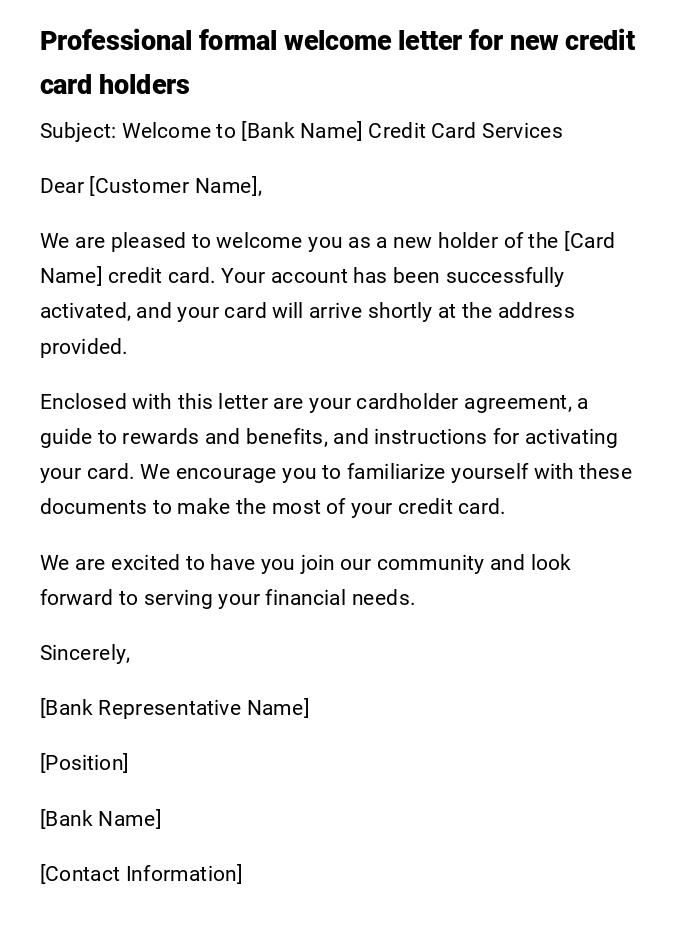

Formal Credit Card Welcome Letter

Subject: Welcome to [Bank Name] Credit Card Services

Dear [Customer Name],

We are pleased to welcome you as a new holder of the [Card Name] credit card. Your account has been successfully activated, and your card will arrive shortly at the address provided.

Enclosed with this letter are your cardholder agreement, a guide to rewards and benefits, and instructions for activating your card. We encourage you to familiarize yourself with these documents to make the most of your credit card.

We are excited to have you join our community and look forward to serving your financial needs.

Sincerely,

[Bank Representative Name]

[Position]

[Bank Name]

[Contact Information]

Friendly Welcome Email for New Credit Card Users

Subject: Welcome to Your New [Card Name]!

Hi [Customer Name],

Welcome aboard! Your [Card Name] credit card is ready for you to use. We’ve packed it with rewards, benefits, and features to make your experience enjoyable and convenient.

You’ll find a quick start guide attached to help you activate your card and start using it right away. If you have any questions, our team is here to assist you anytime.

Cheers,

[Bank Representative Name]

[Bank Name] Customer Support

VIP Credit Card Welcome Letter

Subject: Welcome to [Bank Name] Premium Credit Card Program

Dear [Customer Name],

Congratulations and welcome to our exclusive [Card Name] program. As a valued member, you now have access to premium benefits, including concierge services, travel rewards, and elite customer support.

Enclosed you will find your card, activation instructions, and a comprehensive guide to maximize your benefits. We encourage you to explore these features to enjoy your premium experience fully.

Thank you for choosing [Bank Name]. We look forward to serving you with exceptional care.

Warm regards,

[Bank Representative Name]

[Position]

[Bank Name]

Provisional Credit Card Welcome Letter

Subject: Your [Card Name] is Almost Ready

Dear [Customer Name],

Thank you for applying for the [Card Name] credit card. Your application has been approved, and your card is currently being processed.

You will receive your physical card within the next 7–10 business days. In the meantime, you can access your provisional account number online to start enjoying select services immediately.

We are excited to have you on board and are committed to providing a seamless experience.

Best regards,

[Bank Representative Name]

[Position]

[Bank Name]

Quick Activation Welcome Email

Subject: Activate Your New [Card Name] Today

Hello [Customer Name],

Your new [Card Name] credit card has arrived! Activate your card now using the instructions included with your package.

Once activated, you can start enjoying your rewards, benefits, and special offers. Welcome to a smarter way to manage your spending.

Thank you,

[Bank Name] Customer Service

What and Why of a Credit Card Welcome Letter

What and Why of a Credit Card Welcome Letter

- A credit card welcome letter formally greets new cardholders.

- Purpose: Introduces the cardholder to account features, benefits, and services.

- Provides essential instructions for card activation and use.

- Builds trust and establishes professional communication between the bank and the customer.

- Encourages proper and safe use of the credit card.

Who Should Send a Credit Card Welcome Letter

Who Should Send a Credit Card Welcome Letter

- Bank representatives from the credit card department.

- Customer relationship managers or account officers.

- Automated systems can issue digital emails on behalf of the bank.

- VIP or premium cards may be sent by dedicated concierge teams.

Whom the Welcome Letter Should Be Addressed To

Whom the Welcome Letter Should Be Addressed To

- The primary cardholder as listed in the account application.

- Co-applicants or authorized users if relevant.

- Special recipients for premium or business cards where benefits may differ.

- Ensure personalization by using the cardholder’s name and account type.

When to Send a Credit Card Welcome Letter

When to Send a Credit Card Welcome Letter

- Immediately after card approval and issuance.

- Upon delivery of the physical card to the customer.

- When providing digital card access or online account setup.

- For upgrades to premium or VIP card tiers.

How to Write and Send a Credit Card Welcome Letter

How to Write and Send a Credit Card Welcome Letter

- Begin with a friendly greeting and personalization.

- Include card type, account number (partially masked), and activation instructions.

- Highlight benefits, rewards, and any introductory offers.

- Provide contact details for customer support.

- Choose the delivery mode: printed mail for formality, email for speed and convenience.

- Proofread to ensure accuracy of all information before sending.

Formatting Tips for Credit Card Welcome Letters

Formatting Tips for Credit Card Welcome Letters

- Length: 1 page for printed letters; 300–500 words for emails.

- Tone: Professional, friendly, and reassuring.

- Style: Clear headings, short paragraphs, bulleted benefits.

- Include visual elements if digital: logos, icons, and links.

- Ensure consistent branding with the bank’s communication standards.

Elements and Structure of a Credit Card Welcome Letter

Elements and Structure of a Credit Card Welcome Letter

- Greeting: Personalized with customer’s name.

- Introduction: Welcome message and account confirmation.

- Card Details: Card type, number (masked), activation instructions.

- Benefits Overview: Rewards, cashback, travel points, or exclusive features.

- Terms and Policies: Briefly mention important policies; link to full documents.

- Support Information: Customer service contacts, website, mobile app details.

- Closing: Warm conclusion encouraging card usage.

Pros and Cons of Sending Credit Card Welcome Letters

Pros and Cons of Sending Credit Card Welcome Letters

Pros:

- Establishes professional communication with the customer.

- Provides essential information for safe and effective card use.

- Enhances brand reputation and customer satisfaction.

- Encourages immediate card activation and usage.

Cons:

- Requires accurate, updated information to avoid errors.

- Overloading with terms may overwhelm the recipient.

- Printed letters increase postal costs; emails may be filtered as spam.

After Sending / Follow-Up Recommendations

After Sending / Follow-Up Recommendations

- Confirm the card has been received and activated.

- Send a follow-up email highlighting key benefits or promotions.

- Encourage customers to register for online banking and mobile alerts.

- Provide ongoing customer support for questions and account management.

- Collect feedback to improve welcome communication for future cardholders.

Tricks and Tips for Effective Credit Card Welcome Letters

Tricks and Tips for Effective Credit Card Welcome Letters

- Personalize content to the cardholder’s profile and card type.

- Use concise and simple language to improve readability.

- Include visual cues such as icons for rewards, contact information, or steps.

- Highlight benefits upfront to create excitement.

- Ensure digital emails are mobile-friendly and compatible with various devices.

Common Mistakes in Credit Card Welcome Letters

Common Mistakes in Credit Card Welcome Letters

- Using generic greetings instead of personalized messages.

- Forgetting to include activation instructions or customer support contacts.

- Overloading letters with fine print or excessive technical terms.

- Delayed delivery, causing confusion or missed opportunities.

- Failing to properly differentiate card types or tiered benefits.

FAQ: Credit Card Welcome Letters

FAQ: Credit Card Welcome Letters

- Q: Is a welcome letter mandatory for every new cardholder?

A: While not legally required, it is best practice to enhance customer experience. - Q: Can the welcome letter be emailed instead of mailed?

A: Yes, digital delivery is efficient and allows clickable links and instructions. - Q: Should benefits be detailed in the letter?

A: Yes, briefly highlight key rewards; attach or link to full details for reference. - Q: What if the cardholder doesn’t receive the letter?

A: Customer service should verify the address and resend digitally or via post.

Download Word Doc

Download Word Doc

Download PDF

Download PDF