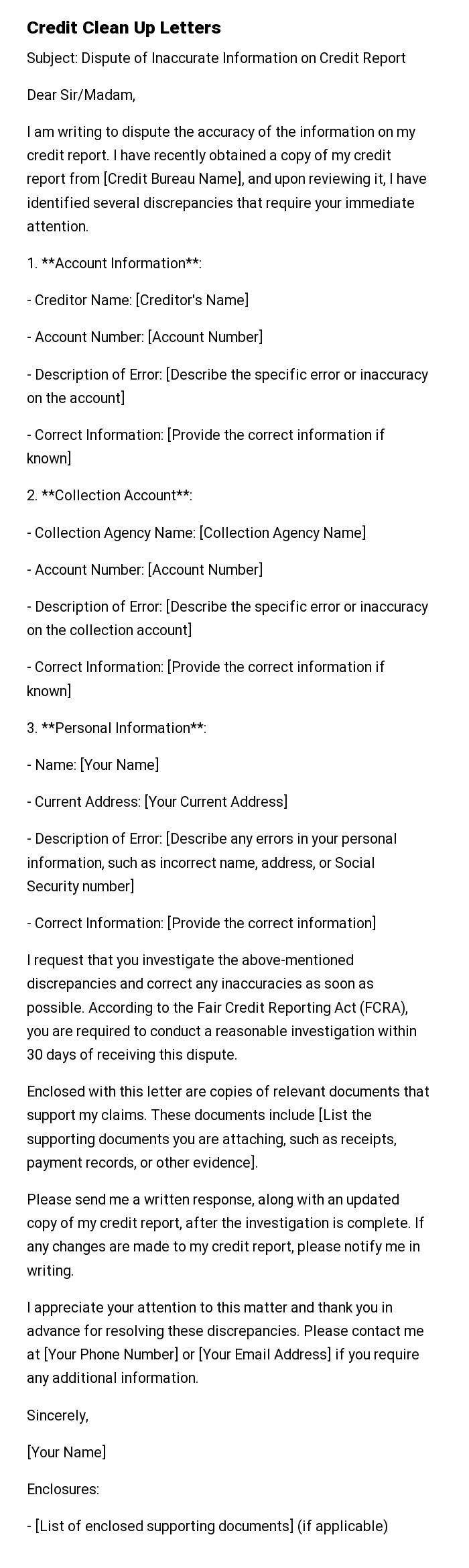

Credit Clean Up Letters

Subject: Dispute of Inaccurate Information on Credit Report

Dear Sir/Madam,

I am writing to dispute the accuracy of the information on my credit report. I have recently obtained a copy of my credit report from [Credit Bureau Name], and upon reviewing it, I have identified several discrepancies that require your immediate attention.

1. **Account Information**:

- Creditor Name: [Creditor's Name]

- Account Number: [Account Number]

- Description of Error: [Describe the specific error or inaccuracy on the account]

- Correct Information: [Provide the correct information if known]

2. **Collection Account**:

- Collection Agency Name: [Collection Agency Name]

- Account Number: [Account Number]

- Description of Error: [Describe the specific error or inaccuracy on the collection account]

- Correct Information: [Provide the correct information if known]

3. **Personal Information**:

- Name: [Your Name]

- Current Address: [Your Current Address]

- Description of Error: [Describe any errors in your personal information, such as incorrect name, address, or Social Security number]

- Correct Information: [Provide the correct information]

I request that you investigate the above-mentioned discrepancies and correct any inaccuracies as soon as possible. According to the Fair Credit Reporting Act (FCRA), you are required to conduct a reasonable investigation within 30 days of receiving this dispute.

Enclosed with this letter are copies of relevant documents that support my claims. These documents include [List the supporting documents you are attaching, such as receipts, payment records, or other evidence].

Please send me a written response, along with an updated copy of my credit report, after the investigation is complete. If any changes are made to my credit report, please notify me in writing.

I appreciate your attention to this matter and thank you in advance for resolving these discrepancies. Please contact me at [Your Phone Number] or [Your Email Address] if you require any additional information.

Sincerely,

[Your Name]

Enclosures:

- [List of enclosed supporting documents] (if applicable)

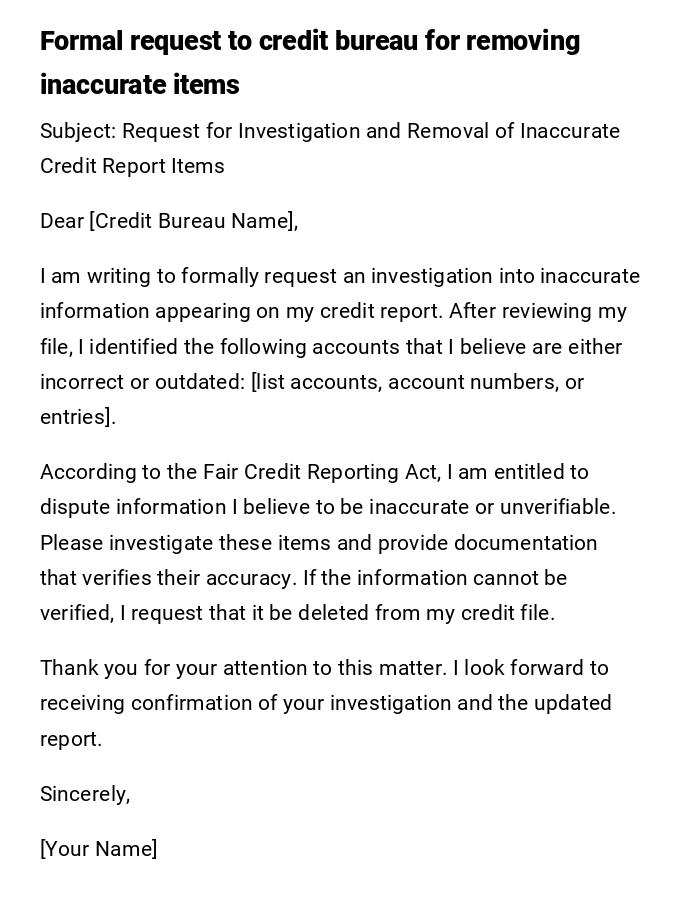

Formal Credit Clean Up Letter to Credit Bureau

Subject: Request for Investigation and Removal of Inaccurate Credit Report Items

Dear [Credit Bureau Name],

I am writing to formally request an investigation into inaccurate information appearing on my credit report. After reviewing my file, I identified the following accounts that I believe are either incorrect or outdated: [list accounts, account numbers, or entries].

According to the Fair Credit Reporting Act, I am entitled to dispute information I believe to be inaccurate or unverifiable. Please investigate these items and provide documentation that verifies their accuracy. If the information cannot be verified, I request that it be deleted from my credit file.

Thank you for your attention to this matter. I look forward to receiving confirmation of your investigation and the updated report.

Sincerely,

[Your Name]

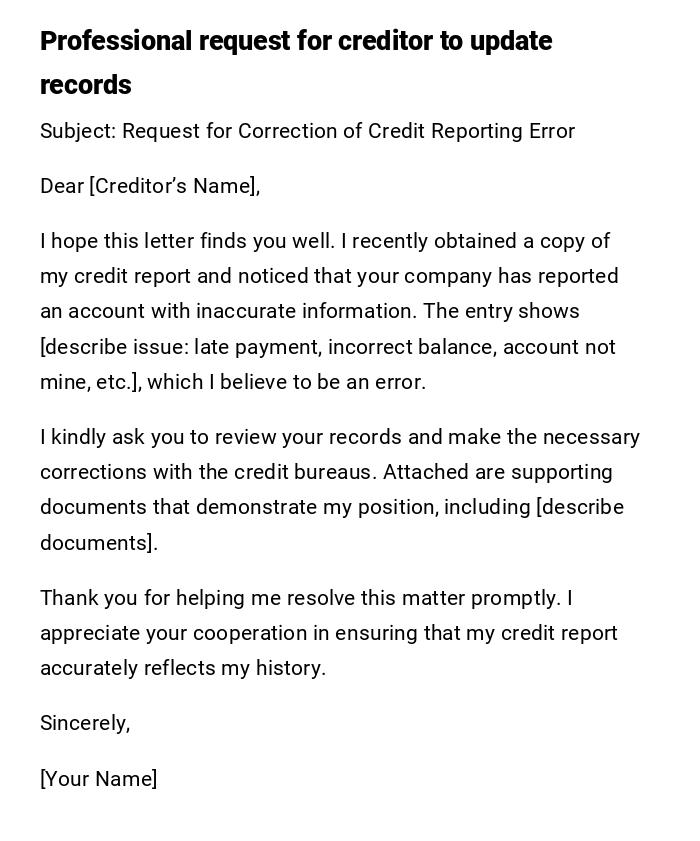

Polite Credit Clean Up Letter to a Creditor

Subject: Request for Correction of Credit Reporting Error

Dear [Creditor’s Name],

I hope this letter finds you well. I recently obtained a copy of my credit report and noticed that your company has reported an account with inaccurate information. The entry shows [describe issue: late payment, incorrect balance, account not mine, etc.], which I believe to be an error.

I kindly ask you to review your records and make the necessary corrections with the credit bureaus. Attached are supporting documents that demonstrate my position, including [describe documents].

Thank you for helping me resolve this matter promptly. I appreciate your cooperation in ensuring that my credit report accurately reflects my history.

Sincerely,

[Your Name]

Goodwill Credit Clean Up Letter

Subject: Request for Goodwill Adjustment on Credit Report

Dear [Creditor’s Name],

I am reaching out to request a goodwill adjustment regarding the reporting of late payments on my account. I understand that the payments were late during [specific period], but since then I have maintained consistent on-time payments and worked diligently to improve my credit standing.

As a loyal customer who values our relationship, I kindly ask that you consider removing the negative marks from my report as a gesture of goodwill. This adjustment would greatly assist me as I work toward achieving financial stability.

Thank you for your understanding and consideration.

Warm regards,

[Your Name]

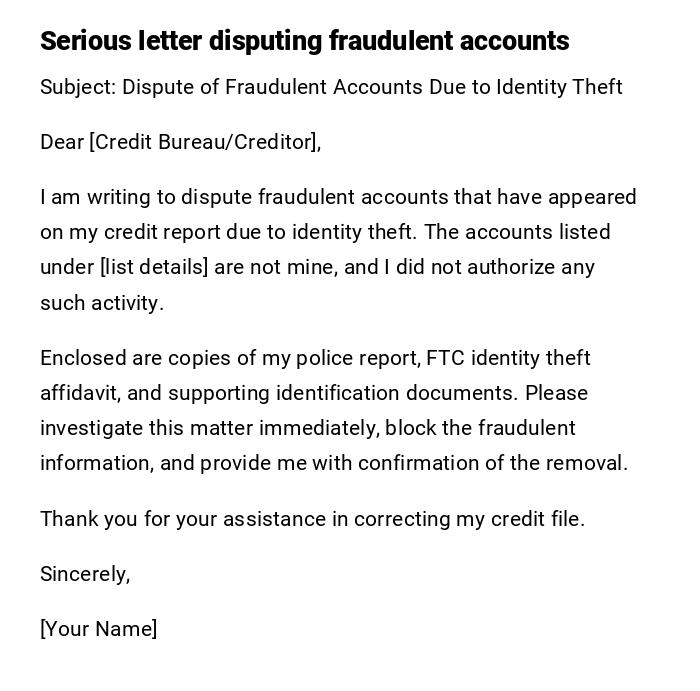

Dispute Credit Clean Up Letter for Identity Theft

Subject: Dispute of Fraudulent Accounts Due to Identity Theft

Dear [Credit Bureau/Creditor],

I am writing to dispute fraudulent accounts that have appeared on my credit report due to identity theft. The accounts listed under [list details] are not mine, and I did not authorize any such activity.

Enclosed are copies of my police report, FTC identity theft affidavit, and supporting identification documents. Please investigate this matter immediately, block the fraudulent information, and provide me with confirmation of the removal.

Thank you for your assistance in correcting my credit file.

Sincerely,

[Your Name]

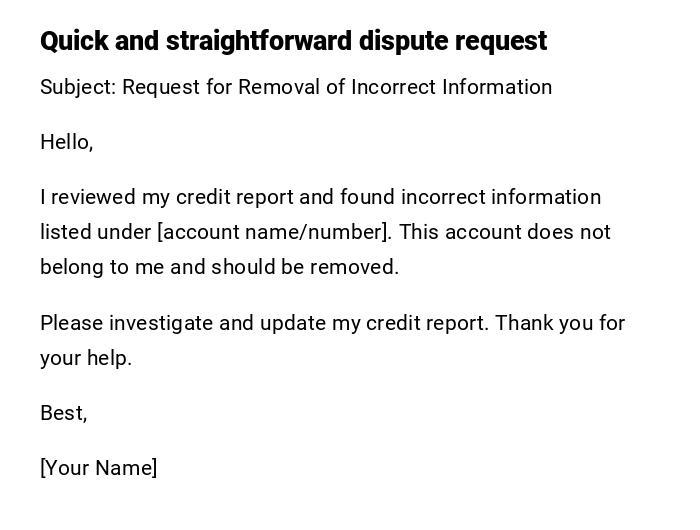

Simple Credit Clean Up Message to Credit Bureau

Subject: Request for Removal of Incorrect Information

Hello,

I reviewed my credit report and found incorrect information listed under [account name/number]. This account does not belong to me and should be removed.

Please investigate and update my credit report. Thank you for your help.

Best,

[Your Name]

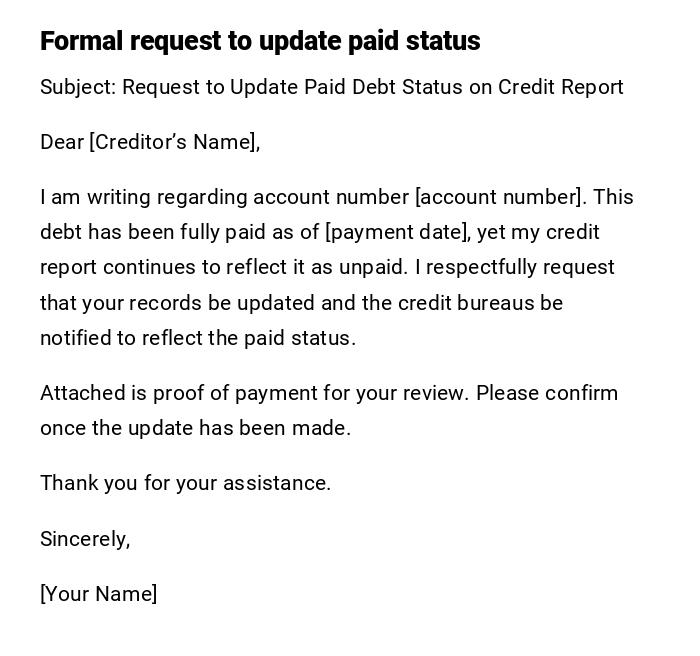

Official Credit Clean Up Letter for Paid Debt

Subject: Request to Update Paid Debt Status on Credit Report

Dear [Creditor’s Name],

I am writing regarding account number [account number]. This debt has been fully paid as of [payment date], yet my credit report continues to reflect it as unpaid. I respectfully request that your records be updated and the credit bureaus be notified to reflect the paid status.

Attached is proof of payment for your review. Please confirm once the update has been made.

Thank you for your assistance.

Sincerely,

[Your Name]

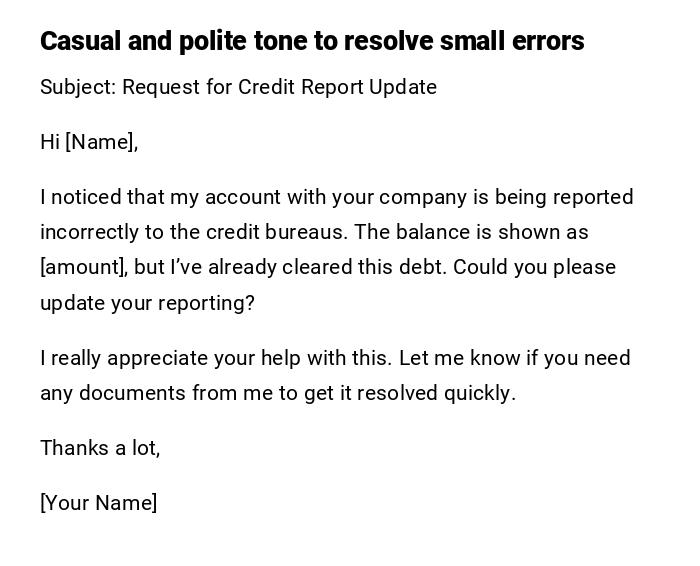

Friendly Credit Clean Up Email to a Small Creditor

Subject: Request for Credit Report Update

Hi [Name],

I noticed that my account with your company is being reported incorrectly to the credit bureaus. The balance is shown as [amount], but I’ve already cleared this debt. Could you please update your reporting?

I really appreciate your help with this. Let me know if you need any documents from me to get it resolved quickly.

Thanks a lot,

[Your Name]

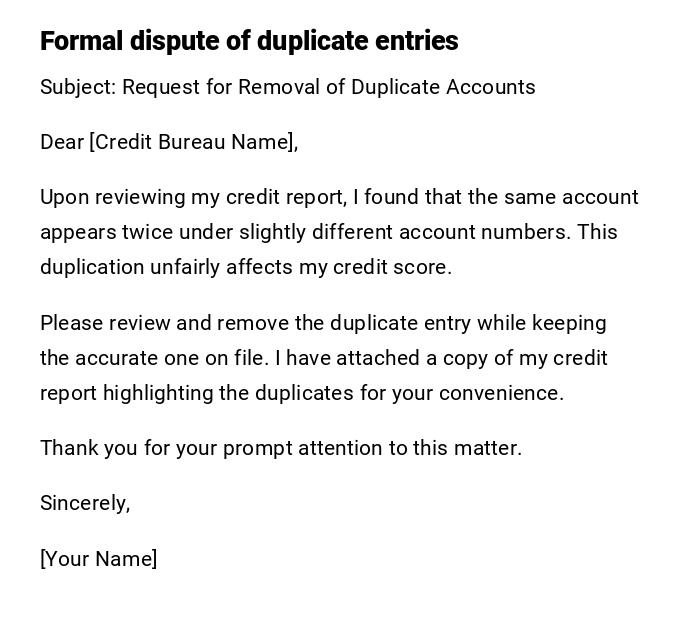

Credit Clean Up Letter for Duplicate Accounts

Subject: Request for Removal of Duplicate Accounts

Dear [Credit Bureau Name],

Upon reviewing my credit report, I found that the same account appears twice under slightly different account numbers. This duplication unfairly affects my credit score.

Please review and remove the duplicate entry while keeping the accurate one on file. I have attached a copy of my credit report highlighting the duplicates for your convenience.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Serious Credit Clean Up Letter for Outdated Information

Subject: Request for Removal of Outdated Negative Information

Dear [Credit Bureau Name],

According to the Fair Credit Reporting Act, negative information should not remain on a credit report beyond the legal reporting period. My report currently lists [describe account], which is over seven years old.

I respectfully request that this outdated item be removed immediately. Please confirm in writing once the update has been completed.

Thank you for your cooperation.

Sincerely,

[Your Name]

What is a Credit Clean Up Letter and Why Do You Need One?

A credit clean up letter is a written request sent to credit bureaus or creditors to correct, remove, or update inaccurate, outdated, or unfairly reported information on a credit report.

It is needed to protect your credit score, ensure accurate reporting, and prevent financial obstacles when applying for loans, housing, or employment.

Who Should Send a Credit Clean Up Letter?

- Individuals who find errors on their credit report.

- Victims of identity theft disputing fraudulent accounts.

- Borrowers who have repaid debts but are still shown as delinquent.

- Consumers seeking goodwill adjustments from creditors.

- Anyone working to improve their credit history and rating.

To Whom Should Credit Clean Up Letters Be Addressed?

- Major credit bureaus (Experian, Equifax, TransUnion).

- Original creditors who reported the information.

- Collection agencies handling the account.

- Smaller lenders or service providers reporting incorrect data.

- Legal representatives or credit repair specialists, in some cases.

When Should You Send a Credit Clean Up Letter?

- Immediately after spotting errors on your credit report.

- After paying off a debt that still appears as unpaid.

- When fraudulent accounts are opened under your name.

- If outdated items remain past the legal reporting period.

- When duplicate entries appear on your report.

- As part of an overall credit improvement strategy.

How to Write and Send a Credit Clean Up Letter

- Obtain a copy of your credit report from all three major bureaus.

- Identify inaccuracies, outdated accounts, or fraudulent entries.

- Draft a clear and polite letter specifying the disputed items.

- Provide supporting documents (payment proofs, IDs, police reports).

- Send the letter via certified mail for tracking and proof.

- Keep copies of everything you send.

- Follow up if you don’t receive a timely response.

Requirements and Prerequisites Before Writing a Credit Clean Up Letter

- Access to your updated credit report.

- Knowledge of your legal rights under the Fair Credit Reporting Act.

- Documentation to support your claims.

- Clear identification of each disputed item.

- Awareness of reporting timelines (e.g., 7 years for most negatives).

- Willingness to follow up with bureaus or creditors.

Formatting Guidelines for Credit Clean Up Letters

- Be clear, concise, and professional.

- Use a polite but firm tone.

- Include specific details: account numbers, dates, amounts.

- Attach supporting documents when possible.

- Send via mail for formal cases, email for smaller creditors.

- Structure: subject, greeting, explanation, request, closing.

- Avoid emotional or irrelevant details.

Common Mistakes to Avoid in Credit Clean Up Letters

- Failing to provide account numbers or specific details.

- Not including proof or supporting documents.

- Using aggressive or hostile language.

- Sending the letter too late after identifying errors.

- Forgetting to follow up after no response.

- Assuming one letter is enough without persistence.

Pros and Cons of Sending Credit Clean Up Letters

Pros:

- Helps improve credit score.

- Ensures accuracy in financial records.

- Protects against fraud and identity theft.

- Builds stronger credibility for future applications.

Cons:

- May require multiple follow-ups.

- Some creditors may deny goodwill requests.

- Takes time for changes to reflect in credit reports.

- Not all disputes result in removal.

After Sending a Credit Clean Up Letter: What to Do Next

- Wait for the bureau/creditor’s investigation (usually 30 days).

- Review their written response and updated report.

- Follow up if the correction hasn’t been made.

- File a complaint with the CFPB if the issue is unresolved.

- Keep all correspondence for future reference.

- Continue monitoring your credit for new errors.

Tricks and Tips for Effective Credit Clean Up Letters

- Always use certified mail for important letters.

- Dispute only legitimate errors—false claims may backfire.

- Keep your tone respectful, not confrontational.

- Attach proof whenever possible.

- Dispute one or two items per letter for clarity.

- Track all deadlines to ensure timely responses.

Elements and Structure of a Strong Credit Clean Up Letter

- Subject line or header.

- Personalized greeting.

- Statement of purpose.

- Detailed description of the disputed error.

- Supporting evidence.

- Clear request for correction or removal.

- Closing note and signature.

- Attachments list.

Compare and Contrast: Credit Clean Up Letters vs Other Credit Repair Methods

- Credit Clean Up Letters: Directly dispute inaccurate or outdated items.

- Debt Settlement: Negotiates reduced payments with creditors but still shows as settled.

- Credit Counseling: Provides financial advice without removing errors.

- Credit Repair Agencies: Paid services that often use the same letters consumers can send themselves.

Credit clean up letters stand out because they empower individuals to exercise their legal rights directly.

Download Word Doc

Download Word Doc

Download PDF

Download PDF