Credit Repair Letters

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Address]

[City, State, ZIP Code]

Subject: Dispute of Inaccurate Information on Credit Report

To Whom It May Concern,

I am writing to dispute the accuracy of the information contained in my credit report. I recently obtained a copy of my credit report, and after careful review, I have identified several items that I believe to be inaccurate and not reflective of my true credit history.

I request your assistance in investigating and correcting the following disputed items:

1. [Account Name]: [Account Number (if applicable)]

Disputed Information: [Inaccurate or outdated information regarding the account]

Explanation: [Explain the reason you believe the information is inaccurate]

2. [Account Name]: [Account Number (if applicable)]

Disputed Information: [Inaccurate or outdated information regarding the account]

Explanation: [Explain the reason you believe the information is inaccurate]

3. [Account Name]: [Account Number (if applicable)]

Disputed Information: [Inaccurate or outdated information regarding the account]

Explanation: [Explain the reason you believe the information is inaccurate]

I understand my rights under the Fair Credit Reporting Act (FCRA), which entitle me to dispute any inaccurate or incomplete information in my credit report. I kindly request that you conduct a thorough investigation into the disputed items and verify the accuracy of the reported information.

According to the FCRA, you are required to respond to my dispute within 30 days of receipt of this letter. If you find that any of the disputed items are indeed inaccurate, please promptly correct or remove them from my credit report.

Enclosed with this letter are copies of supporting documents that validate my claim. These documents include [list any documents you are providing, such as payment receipts or correspondence with creditors].

I would appreciate your prompt attention to this matter. Please send me a written confirmation once the investigation is complete and the necessary corrections have been made to my credit report.

Thank you for your assistance in resolving this matter. Your cooperation is crucial to ensuring the accuracy of my credit report and maintaining the integrity of the credit reporting system.

Sincerely,

[Your Name]

[Your Signature (if sending by mail)]

Enclosures: [List any enclosed documents, if applicable]

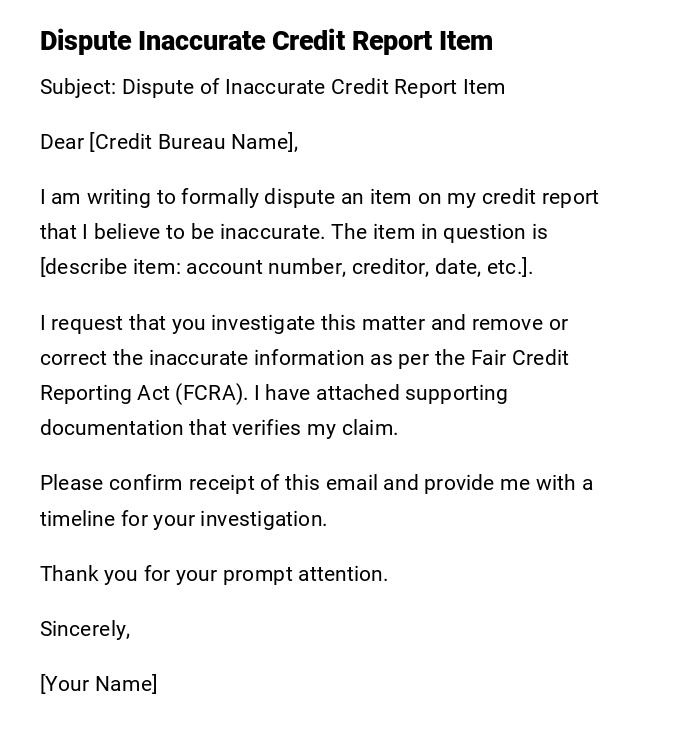

Dispute Inaccurate Item Email

Subject: Dispute of Inaccurate Credit Report Item

Dear [Credit Bureau Name],

I am writing to formally dispute an item on my credit report that I believe to be inaccurate. The item in question is [describe item: account number, creditor, date, etc.].

I request that you investigate this matter and remove or correct the inaccurate information as per the Fair Credit Reporting Act (FCRA). I have attached supporting documentation that verifies my claim.

Please confirm receipt of this email and provide me with a timeline for your investigation.

Thank you for your prompt attention.

Sincerely,

[Your Name]

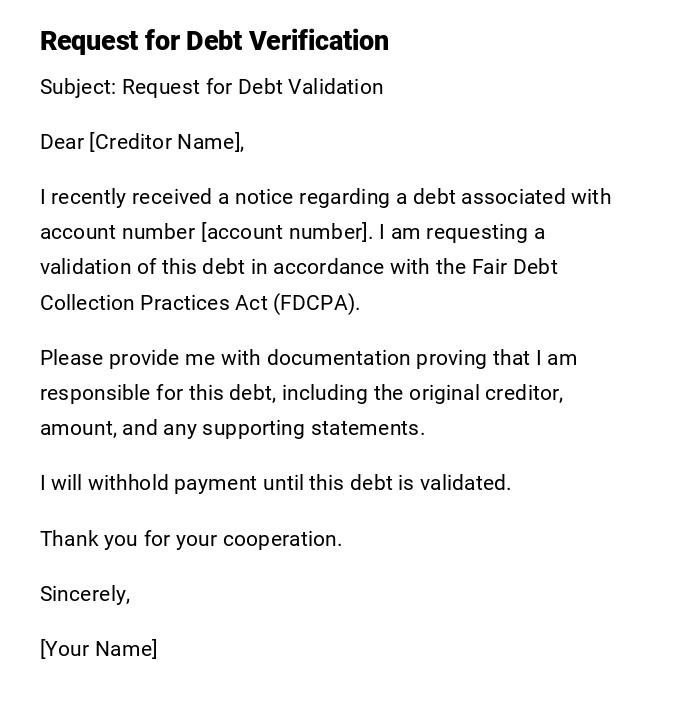

Request for Debt Validation Letter

Subject: Request for Debt Validation

Dear [Creditor Name],

I recently received a notice regarding a debt associated with account number [account number]. I am requesting a validation of this debt in accordance with the Fair Debt Collection Practices Act (FDCPA).

Please provide me with documentation proving that I am responsible for this debt, including the original creditor, amount, and any supporting statements.

I will withhold payment until this debt is validated.

Thank you for your cooperation.

Sincerely,

[Your Name]

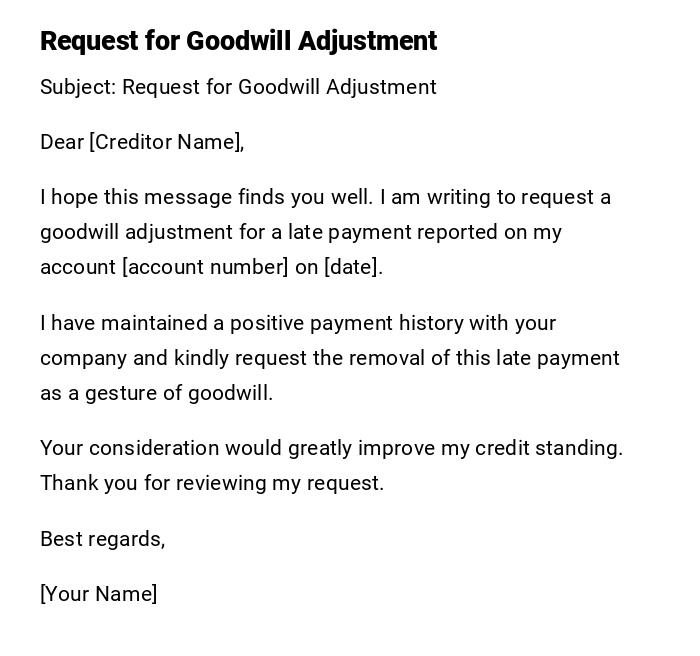

Goodwill Adjustment Request Letter

Subject: Request for Goodwill Adjustment

Dear [Creditor Name],

I hope this message finds you well. I am writing to request a goodwill adjustment for a late payment reported on my account [account number] on [date].

I have maintained a positive payment history with your company and kindly request the removal of this late payment as a gesture of goodwill.

Your consideration would greatly improve my credit standing. Thank you for reviewing my request.

Best regards,

[Your Name]

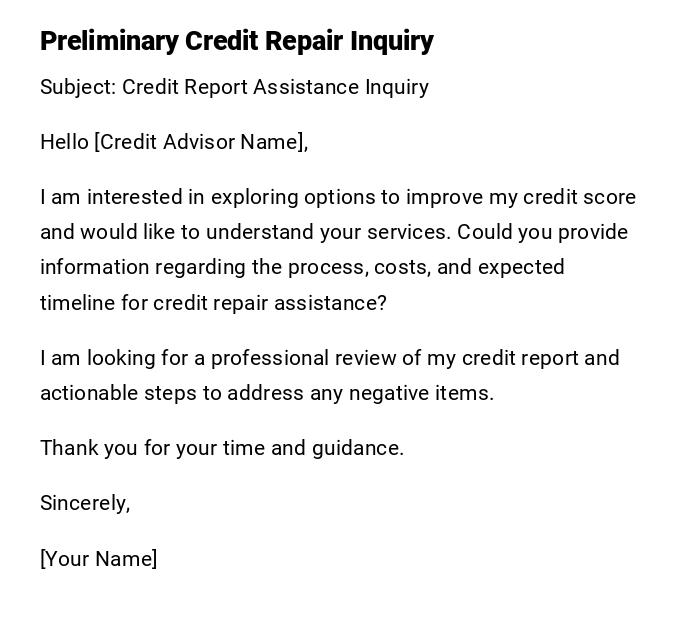

Preliminary Credit Repair Inquiry Email

Subject: Credit Report Assistance Inquiry

Hello [Credit Advisor Name],

I am interested in exploring options to improve my credit score and would like to understand your services. Could you provide information regarding the process, costs, and expected timeline for credit repair assistance?

I am looking for a professional review of my credit report and actionable steps to address any negative items.

Thank you for your time and guidance.

Sincerely,

[Your Name]

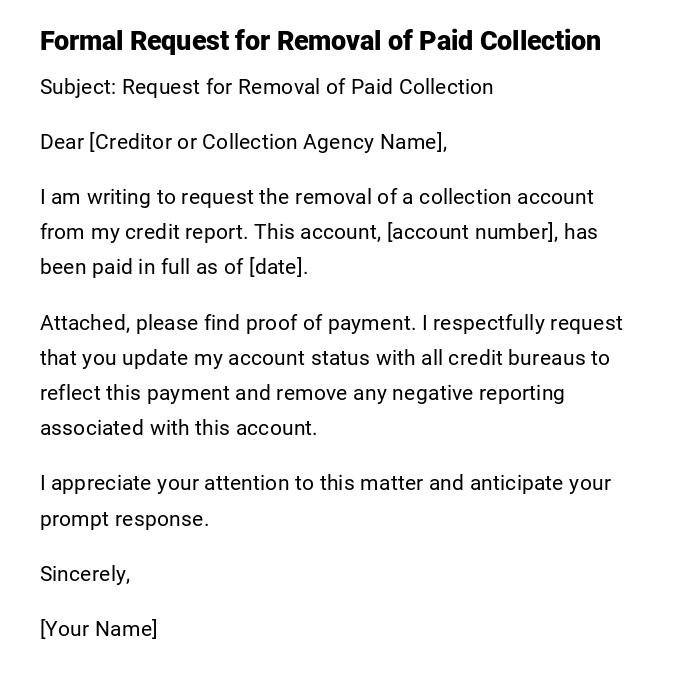

Formal Removal of Paid Collection Letter

Subject: Request for Removal of Paid Collection

Dear [Creditor or Collection Agency Name],

I am writing to request the removal of a collection account from my credit report. This account, [account number], has been paid in full as of [date].

Attached, please find proof of payment. I respectfully request that you update my account status with all credit bureaus to reflect this payment and remove any negative reporting associated with this account.

I appreciate your attention to this matter and anticipate your prompt response.

Sincerely,

[Your Name]

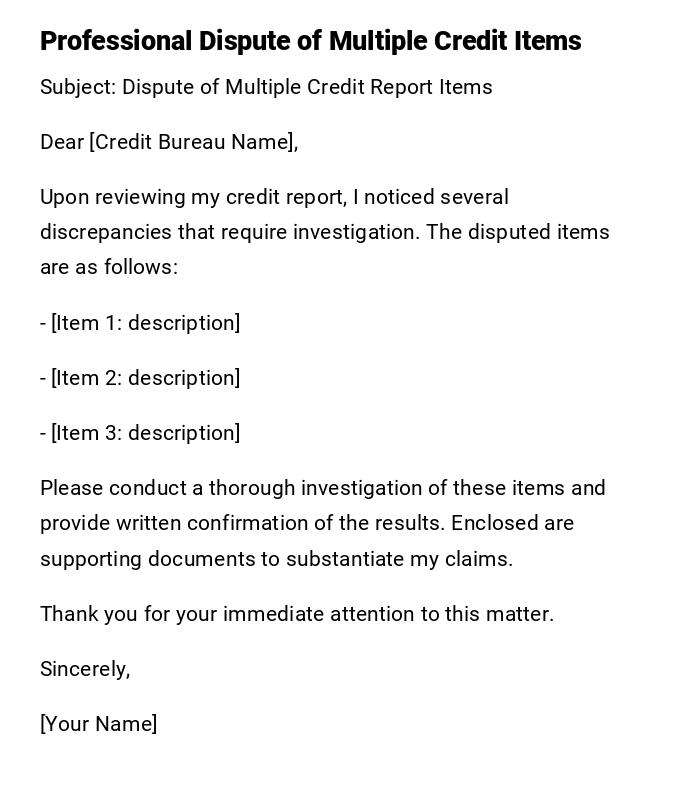

Professional Credit Report Dispute Letter

Subject: Dispute of Multiple Credit Report Items

Dear [Credit Bureau Name],

Upon reviewing my credit report, I noticed several discrepancies that require investigation. The disputed items are as follows:

- [Item 1: description]

- [Item 2: description]

- [Item 3: description]

Please conduct a thorough investigation of these items and provide written confirmation of the results. Enclosed are supporting documents to substantiate my claims.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

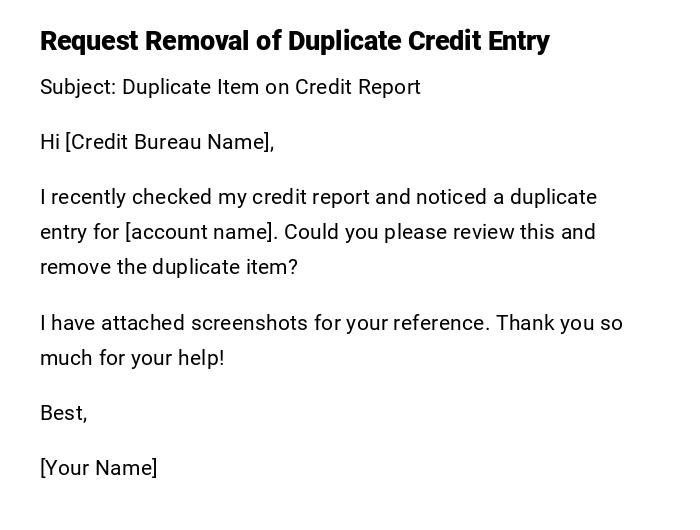

Friendly Reminder to Remove Duplicate Item Email

Subject: Duplicate Item on Credit Report

Hi [Credit Bureau Name],

I recently checked my credit report and noticed a duplicate entry for [account name]. Could you please review this and remove the duplicate item?

I have attached screenshots for your reference. Thank you so much for your help!

Best,

[Your Name]

What is a Credit Repair Letter and Why It’s Used

Credit repair letters are formal communications sent to credit bureaus, creditors, or debt collectors to dispute inaccuracies, request corrections, or negotiate removals of negative items from a credit report.

- Purpose:

- Correct inaccurate or outdated information

- Improve credit score

- Ensure compliance with credit reporting laws

- They serve as an official record of disputes and requests

Who Should Send Credit Repair Letters

- Individuals seeking to correct errors on their personal credit reports

- Consumers disputing fraudulent charges or identity theft

- Professionals managing credit repair on behalf of clients

- People negotiating goodwill adjustments with creditors

Whom to Address Credit Repair Letters To

- Credit bureaus (Equifax, Experian, TransUnion)

- Original creditors reporting negative items

- Collection agencies reporting debts

- Debt settlement or credit repair services (for inquiries or coordination)

When to Send a Credit Repair Letter

- After discovering an error on your credit report

- Following a payment in full of a previously delinquent account

- When requesting goodwill adjustments for past late payments

- Upon receiving notices of disputed debt from collection agencies

- Before applying for a major loan or mortgage to ensure report accuracy

How to Write and Send a Credit Repair Letter

- Identify the inaccurate item(s) and gather supporting documentation

- Use a clear, polite, and professional tone (formal or friendly depending on context)

- Include all relevant details: account numbers, dates, and supporting proof

- Specify your requested action: correction, removal, or verification

- Send via certified mail or secure email to track delivery

- Keep copies for your records

Requirements and Prerequisites Before Sending

- Obtain a current copy of your credit report from all major bureaus

- Collect documentation: payment receipts, account statements, identity verification

- Confirm deadlines under FCRA or FDCPA for disputing items

- Be ready to provide identification if required by the recipient

Formatting Guidelines for Credit Repair Letters

- Length: 1–2 pages for detailed disputes, shorter for simple requests

- Tone: professional, polite, and assertive; avoid aggressive language

- Style: plain text with clear headings for each disputed item

- Mode: email for quick inquiries, certified letter for formal disputes

- Etiquette: always thank the recipient and request confirmation of receipt

Common Mistakes to Avoid

- Failing to provide sufficient documentation

- Sending vague or incomplete information

- Using aggressive or accusatory language

- Forgetting to include account numbers or relevant dates

- Not keeping copies of correspondence

Elements and Structure of a Credit Repair Letter

- Subject line or purpose statement

- Greeting

- Clear description of the issue(s)

- Supporting details and attached documentation

- Specific request or action desired

- Closing and signature

- Optional: request for confirmation of receipt and timeline

After Sending a Credit Repair Letter

- Monitor credit reports to ensure changes are implemented

- Follow up if no response is received within 30–45 days

- Keep a record of all responses and confirmations

- Be prepared to escalate disputes to regulatory agencies if necessary

Tips and Best Practices

- Maintain a polite, professional tone even when frustrated

- Use bullet points to clearly outline disputed items

- Attach copies, not originals, of supporting documentation

- Send disputes to all credit bureaus that report the item

- Keep a timeline of all correspondence for reference

Compare and Contrast with Other Approaches

- Direct negotiation with creditors vs. formal dispute letters:

- Letters create a formal, documented trail

- Negotiation may be faster but less formal

- Credit repair services vs. DIY letters:

- Services can save time but may incur fees

- DIY allows full control and is often free

- Informal email inquiries vs. certified mail disputes:

- Email is fast for information requests

- Certified letters ensure legal proof and tracking

Download Word Doc

Download Word Doc

Download PDF

Download PDF