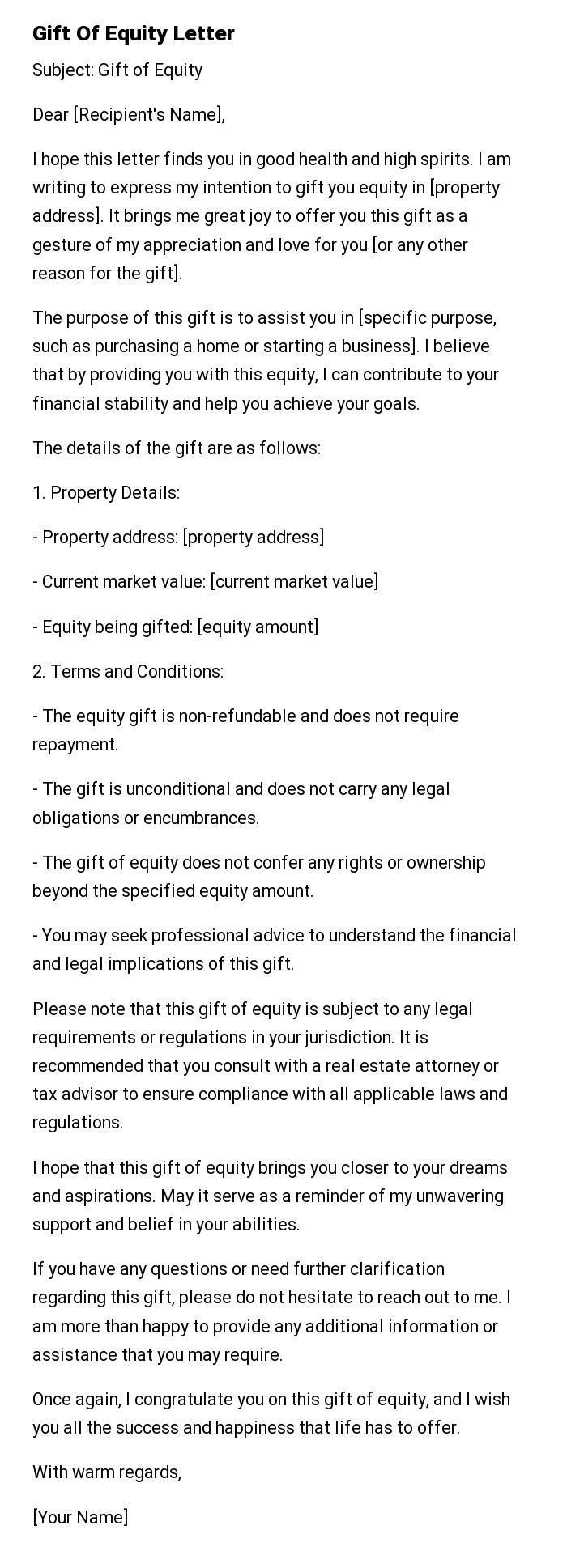

Gift Of Equity Letter

Subject: Gift of Equity

Dear [Recipient's Name],

I hope this letter finds you in good health and high spirits. I am writing to express my intention to gift you equity in [property address]. It brings me great joy to offer you this gift as a gesture of my appreciation and love for you [or any other reason for the gift].

The purpose of this gift is to assist you in [specific purpose, such as purchasing a home or starting a business]. I believe that by providing you with this equity, I can contribute to your financial stability and help you achieve your goals.

The details of the gift are as follows:

1. Property Details:

- Property address: [property address]

- Current market value: [current market value]

- Equity being gifted: [equity amount]

2. Terms and Conditions:

- The equity gift is non-refundable and does not require repayment.

- The gift is unconditional and does not carry any legal obligations or encumbrances.

- The gift of equity does not confer any rights or ownership beyond the specified equity amount.

- You may seek professional advice to understand the financial and legal implications of this gift.

Please note that this gift of equity is subject to any legal requirements or regulations in your jurisdiction. It is recommended that you consult with a real estate attorney or tax advisor to ensure compliance with all applicable laws and regulations.

I hope that this gift of equity brings you closer to your dreams and aspirations. May it serve as a reminder of my unwavering support and belief in your abilities.

If you have any questions or need further clarification regarding this gift, please do not hesitate to reach out to me. I am more than happy to provide any additional information or assistance that you may require.

Once again, I congratulate you on this gift of equity, and I wish you all the success and happiness that life has to offer.

With warm regards,

[Your Name]

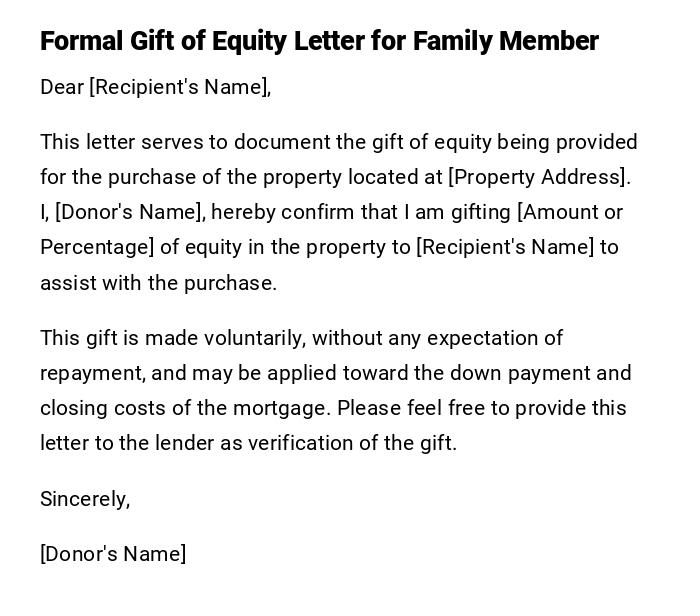

Formal Gift of Equity Letter for Family Member

Dear [Recipient's Name],

This letter serves to document the gift of equity being provided for the purchase of the property located at [Property Address]. I, [Donor's Name], hereby confirm that I am gifting [Amount or Percentage] of equity in the property to [Recipient's Name] to assist with the purchase.

This gift is made voluntarily, without any expectation of repayment, and may be applied toward the down payment and closing costs of the mortgage. Please feel free to provide this letter to the lender as verification of the gift.

Sincerely,

[Donor's Name]

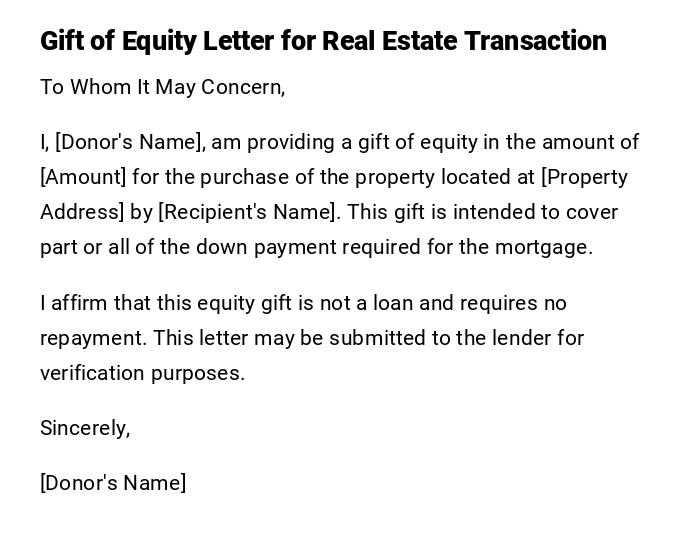

Gift of Equity Letter for Real Estate Transaction

To Whom It May Concern,

I, [Donor's Name], am providing a gift of equity in the amount of [Amount] for the purchase of the property located at [Property Address] by [Recipient's Name]. This gift is intended to cover part or all of the down payment required for the mortgage.

I affirm that this equity gift is not a loan and requires no repayment. This letter may be submitted to the lender for verification purposes.

Sincerely,

[Donor's Name]

Informal Gift of Equity Letter for a Friend

Hi [Friend's Name],

I am excited to help you with the purchase of [Property Address]. I am giving you [Amount or Percentage] of equity from the property as a gift to help with your mortgage and closing costs.

This is a gift, so no repayment is expected. I hope this helps make your dream home a reality!

Best,

[Donor's Name]

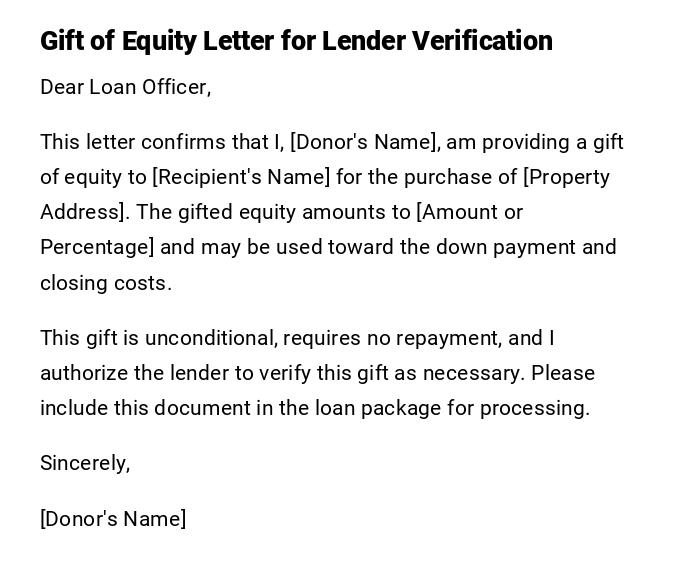

Gift of Equity Letter for Lender Verification

Dear Loan Officer,

This letter confirms that I, [Donor's Name], am providing a gift of equity to [Recipient's Name] for the purchase of [Property Address]. The gifted equity amounts to [Amount or Percentage] and may be used toward the down payment and closing costs.

This gift is unconditional, requires no repayment, and I authorize the lender to verify this gift as necessary. Please include this document in the loan package for processing.

Sincerely,

[Donor's Name]

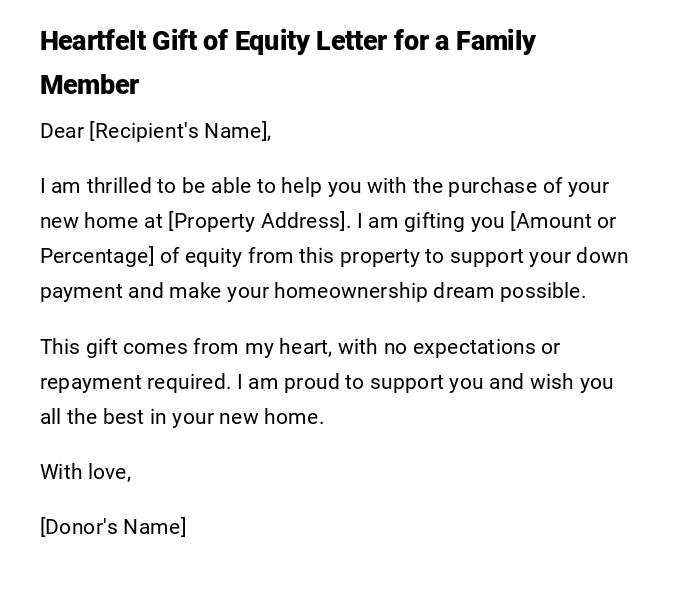

Heartfelt Gift of Equity Letter for a Family Member

Dear [Recipient's Name],

I am thrilled to be able to help you with the purchase of your new home at [Property Address]. I am gifting you [Amount or Percentage] of equity from this property to support your down payment and make your homeownership dream possible.

This gift comes from my heart, with no expectations or repayment required. I am proud to support you and wish you all the best in your new home.

With love,

[Donor's Name]

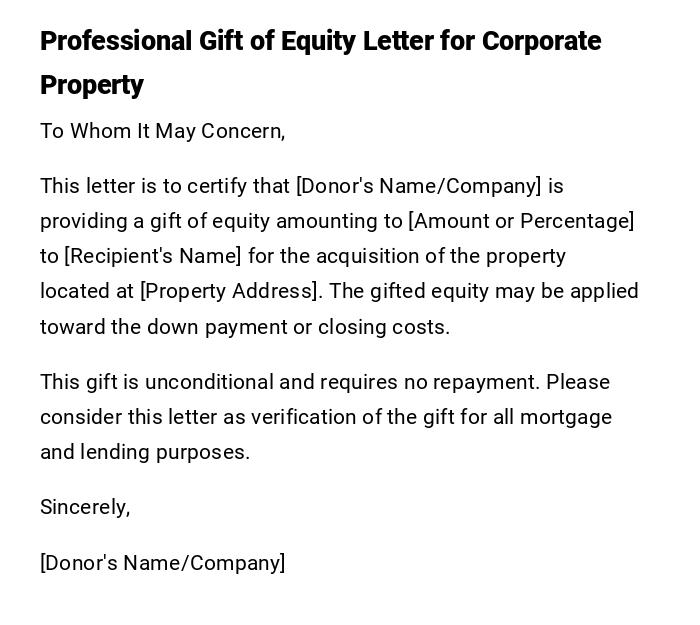

Professional Gift of Equity Letter for Corporate Property

To Whom It May Concern,

This letter is to certify that [Donor's Name/Company] is providing a gift of equity amounting to [Amount or Percentage] to [Recipient's Name] for the acquisition of the property located at [Property Address]. The gifted equity may be applied toward the down payment or closing costs.

This gift is unconditional and requires no repayment. Please consider this letter as verification of the gift for all mortgage and lending purposes.

Sincerely,

[Donor's Name/Company]

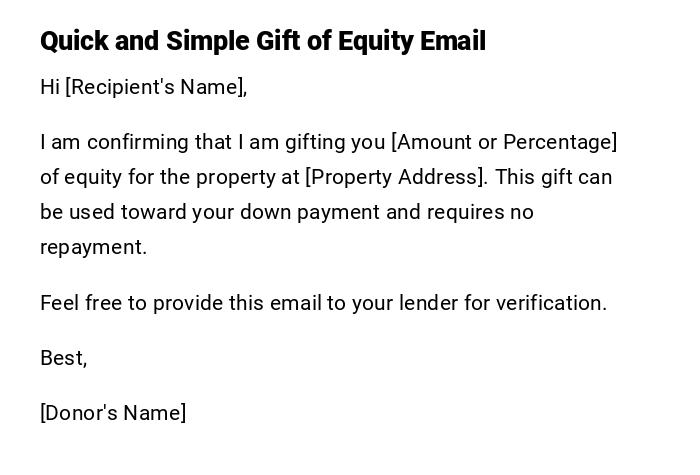

Quick and Simple Gift of Equity Email

Hi [Recipient's Name],

I am confirming that I am gifting you [Amount or Percentage] of equity for the property at [Property Address]. This gift can be used toward your down payment and requires no repayment.

Feel free to provide this email to your lender for verification.

Best,

[Donor's Name]

What / Why: Purpose of a Gift of Equity Letter

A Gift of Equity Letter is a formal or informal document confirming that a property owner is transferring a portion of the home's equity to a buyer, typically a family member or close acquaintance.

The purpose is to:

- Document the transfer for lenders and mortgage purposes

- Confirm that the gift is unconditional and requires no repayment

- Facilitate the home purchase process by assisting with the down payment

- Provide legal and financial transparency

Who Should Send a Gift of Equity Letter

- Homeowners transferring equity to family members

- Property owners assisting friends or acquaintances

- Companies transferring equity in corporate property transactions

- Trustees or legal guardians managing equity gifts on behalf of beneficiaries

Whom to Address in a Gift of Equity Letter

- Primary recipient or buyer of the property

- Mortgage lender or financial institution requiring verification

- Real estate agents or closing officers involved in the transaction

- Legal representatives handling the property transfer

When to Use a Gift of Equity Letter

- During property sales between family members

- When a portion of the home’s equity is applied toward a mortgage down payment

- At the time of mortgage application for lender verification

- Before the closing of property transactions to document the gift

How to Write and Send a Gift of Equity Letter

- Clearly state the property address and parties involved

- Specify the amount or percentage of equity being gifted

- Confirm that the gift is unconditional and requires no repayment

- Include a statement allowing lender verification if necessary

- Choose appropriate delivery: email for quick processing, printed letter for formal submissions

Formatting and Style Recommendations

- Length: 1–2 pages maximum

- Tone: Professional, formal, or heartfelt depending on relationship

- Wording: Clear, concise, and legally understandable

- Mode: Printed letter preferred for closing documentation; email can be used for lender pre-verification

- Etiquette: Ensure accuracy and legal compliance, avoid ambiguous language

Requirements and Prerequisites

- Confirm ownership and legal right to gift equity

- Determine the exact equity value and applicable amount

- Check lender requirements for documentation

- Decide whether additional supporting documents are needed, such as property appraisal or mortgage statements

Tricks and Tips for an Effective Gift of Equity Letter

- Include property address, donor, and recipient names clearly

- Specify amount or percentage of equity being gifted

- Explicitly state that repayment is not required

- Use formal language for lender submission

- Keep a copy for personal and legal records

Common Mistakes to Avoid

- Failing to specify that the gift is unconditional

- Omitting property address or participant details

- Using ambiguous language that may confuse lenders

- Not following lender-specific guidelines for documentation

- Forgetting to sign the letter or keep a copy for records

After Sending / Follow-up Actions

- Provide copies to the lender, closing agent, and recipient

- Ensure lender verifies the gift as required for mortgage approval

- Maintain records of the letter and supporting documentation

- Be available to clarify any questions from lenders or legal representatives

Elements and Structure of a Gift of Equity Letter

- Opening greeting

- Identification of property and parties involved

- Statement of gifted equity and amount/percentage

- Confirmation that the gift is unconditional and requires no repayment

- Authorization for lender verification (if applicable)

- Closing signature and date

Pros and Cons of Using a Gift of Equity Letter

Pros:

- Simplifies mortgage approval process

- Provides legal documentation of equity transfer

- Facilitates family or friendly property transactions

Cons:

- Must meet lender verification requirements

- Requires precise language to avoid misinterpretation

- May involve tax implications if not properly documented

Compare and Contrast: Gift of Equity vs Other Financial Assistance

- Gift of Equity vs Cash Gift: Equity reduces mortgage needs directly; cash gift can be used for broader expenses

- Gift of Equity vs Loan: Equity gift requires no repayment; loans create debt obligations

- Formal Letter vs Informal Email: Letters are preferred for legal and mortgage purposes; emails may expedite lender verification

Download Word Doc

Download Word Doc

Download PDF

Download PDF