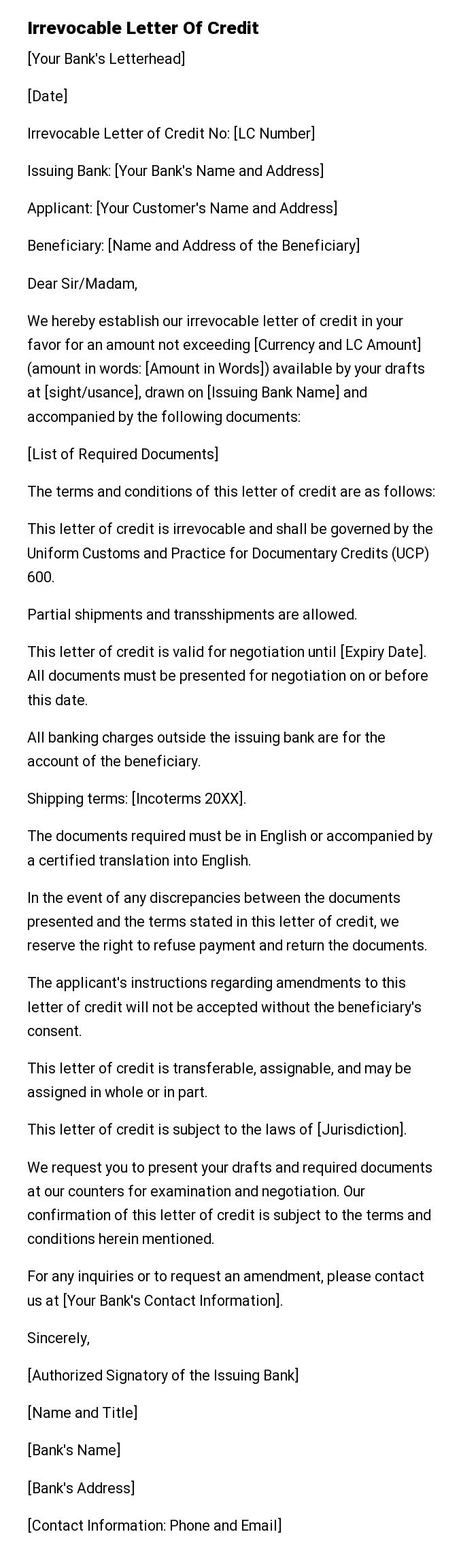

Irrevocable Letter Of Credit

[Your Bank's Letterhead]

[Date]

Irrevocable Letter of Credit No: [LC Number]

Issuing Bank: [Your Bank's Name and Address]

Applicant: [Your Customer's Name and Address]

Beneficiary: [Name and Address of the Beneficiary]

Dear Sir/Madam,

We hereby establish our irrevocable letter of credit in your favor for an amount not exceeding [Currency and LC Amount] (amount in words: [Amount in Words]) available by your drafts at [sight/usance], drawn on [Issuing Bank Name] and accompanied by the following documents:

[List of Required Documents]

The terms and conditions of this letter of credit are as follows:

This letter of credit is irrevocable and shall be governed by the Uniform Customs and Practice for Documentary Credits (UCP) 600.

Partial shipments and transshipments are allowed.

This letter of credit is valid for negotiation until [Expiry Date]. All documents must be presented for negotiation on or before this date.

All banking charges outside the issuing bank are for the account of the beneficiary.

Shipping terms: [Incoterms 20XX].

The documents required must be in English or accompanied by a certified translation into English.

In the event of any discrepancies between the documents presented and the terms stated in this letter of credit, we reserve the right to refuse payment and return the documents.

The applicant's instructions regarding amendments to this letter of credit will not be accepted without the beneficiary's consent.

This letter of credit is transferable, assignable, and may be assigned in whole or in part.

This letter of credit is subject to the laws of [Jurisdiction].

We request you to present your drafts and required documents at our counters for examination and negotiation. Our confirmation of this letter of credit is subject to the terms and conditions herein mentioned.

For any inquiries or to request an amendment, please contact us at [Your Bank's Contact Information].

Sincerely,

[Authorized Signatory of the Issuing Bank]

[Name and Title]

[Bank's Name]

[Bank's Address]

[Contact Information: Phone and Email]

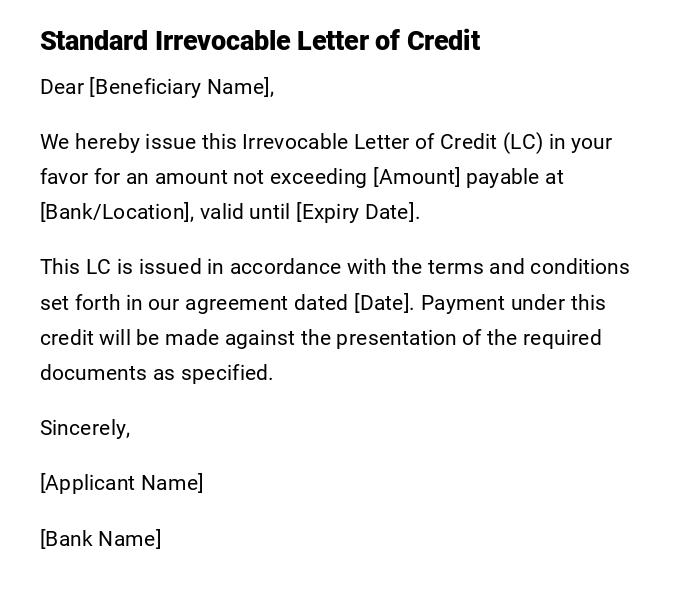

Standard Irrevocable Letter of Credit

Dear [Beneficiary Name],

We hereby issue this Irrevocable Letter of Credit (LC) in your favor for an amount not exceeding [Amount] payable at [Bank/Location], valid until [Expiry Date].

This LC is issued in accordance with the terms and conditions set forth in our agreement dated [Date]. Payment under this credit will be made against the presentation of the required documents as specified.

Sincerely,

[Applicant Name]

[Bank Name]

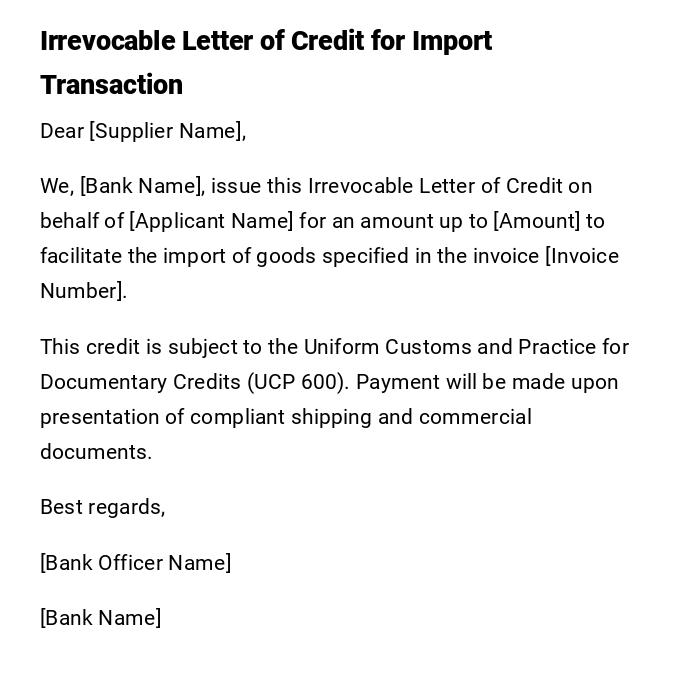

Irrevocable Letter of Credit for Import Transaction

Dear [Supplier Name],

We, [Bank Name], issue this Irrevocable Letter of Credit on behalf of [Applicant Name] for an amount up to [Amount] to facilitate the import of goods specified in the invoice [Invoice Number].

This credit is subject to the Uniform Customs and Practice for Documentary Credits (UCP 600). Payment will be made upon presentation of compliant shipping and commercial documents.

Best regards,

[Bank Officer Name]

[Bank Name]

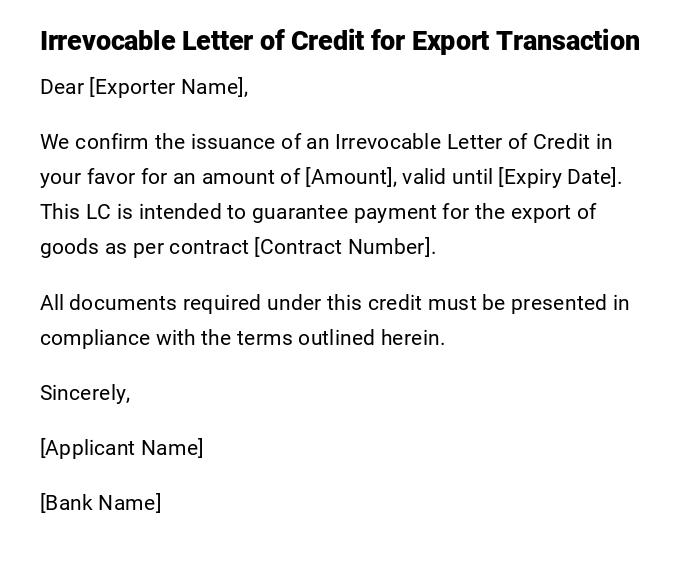

Irrevocable Letter of Credit for Export Transaction

Dear [Exporter Name],

We confirm the issuance of an Irrevocable Letter of Credit in your favor for an amount of [Amount], valid until [Expiry Date]. This LC is intended to guarantee payment for the export of goods as per contract [Contract Number].

All documents required under this credit must be presented in compliance with the terms outlined herein.

Sincerely,

[Applicant Name]

[Bank Name]

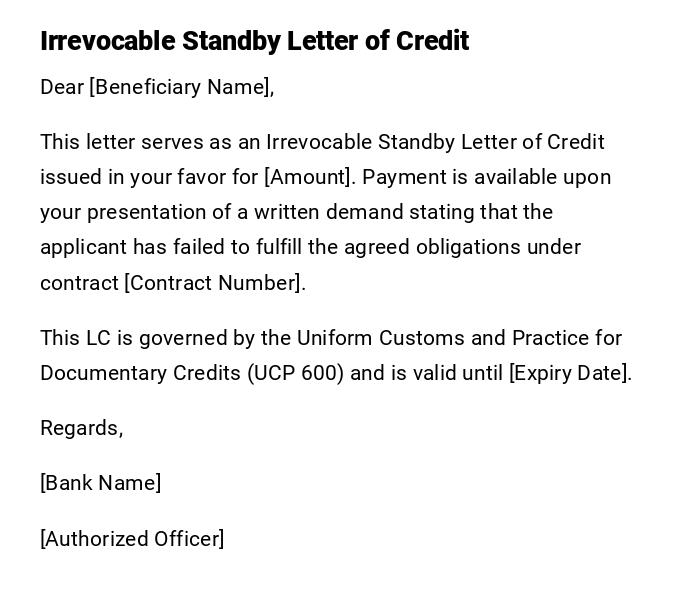

Irrevocable Standby Letter of Credit

Dear [Beneficiary Name],

This letter serves as an Irrevocable Standby Letter of Credit issued in your favor for [Amount]. Payment is available upon your presentation of a written demand stating that the applicant has failed to fulfill the agreed obligations under contract [Contract Number].

This LC is governed by the Uniform Customs and Practice for Documentary Credits (UCP 600) and is valid until [Expiry Date].

Regards,

[Bank Name]

[Authorized Officer]

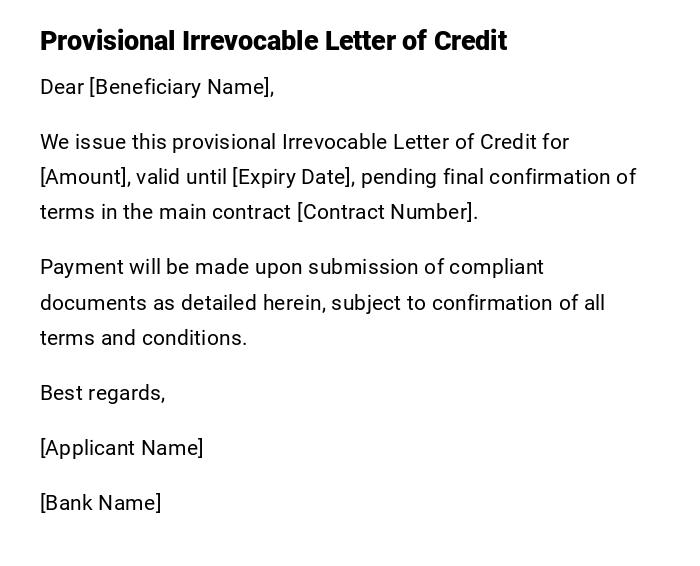

Provisional Irrevocable Letter of Credit

Dear [Beneficiary Name],

We issue this provisional Irrevocable Letter of Credit for [Amount], valid until [Expiry Date], pending final confirmation of terms in the main contract [Contract Number].

Payment will be made upon submission of compliant documents as detailed herein, subject to confirmation of all terms and conditions.

Best regards,

[Applicant Name]

[Bank Name]

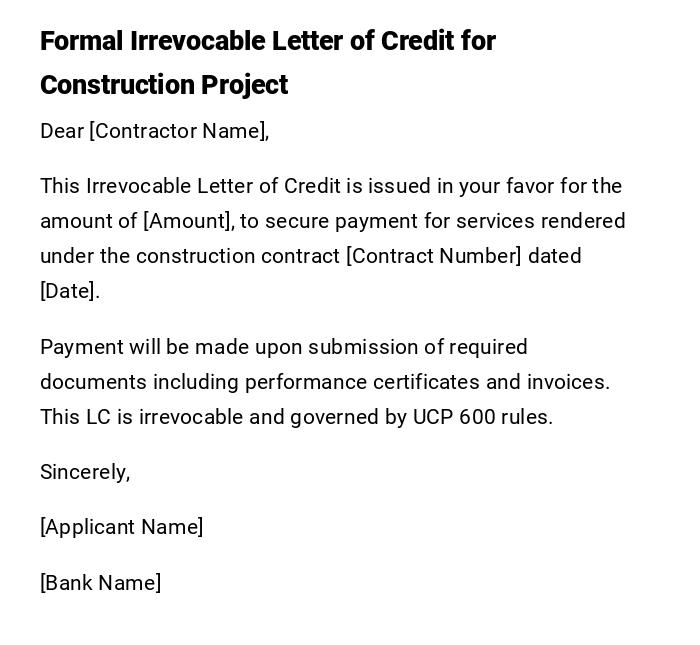

Formal Irrevocable Letter of Credit for Construction Project

Dear [Contractor Name],

This Irrevocable Letter of Credit is issued in your favor for the amount of [Amount], to secure payment for services rendered under the construction contract [Contract Number] dated [Date].

Payment will be made upon submission of required documents including performance certificates and invoices. This LC is irrevocable and governed by UCP 600 rules.

Sincerely,

[Applicant Name]

[Bank Name]

What / Why of an Irrevocable Letter of Credit

- An Irrevocable Letter of Credit (LC) is a financial instrument issued by a bank guaranteeing payment to a beneficiary.

- It cannot be amended or canceled without the consent of all parties involved.

- Purpose: ensures payment security in international trade, import/export transactions, and large contractual obligations.

- Provides confidence to exporters and service providers that they will receive payment if terms are met.

Who Should Issue an Irrevocable Letter of Credit

- Banks on behalf of their clients (applicants) involved in trade or large transactions.

- Financial institutions for corporate clients in import/export or construction projects.

- Any entity requiring formal payment guarantees for contractual obligations.

Whom Should an Irrevocable Letter of Credit Be Addressed To

- Beneficiaries such as suppliers, exporters, contractors, or service providers.

- Entities or individuals receiving guaranteed payment under the terms of the contract.

- Correspondent banks involved in international trade settlements.

When to Use an Irrevocable Letter of Credit

- International trade transactions to guarantee payment for shipped goods.

- Large domestic contracts like construction projects or high-value services.

- Standby purposes, ensuring obligations are met under agreements.

- Situations requiring a secure, non-revocable financial commitment.

Requirements and Prerequisites for Issuing an Irrevocable Letter of Credit

- Signed contract or purchase agreement between applicant and beneficiary.

- Credit approval and verification by issuing bank.

- Specific details including amount, expiry date, and required documents.

- Clear identification of governing rules (e.g., UCP 600) and bank details.

How to Prepare and Send an Irrevocable Letter of Credit

- Applicant requests the LC from their bank with full transaction details.

- Bank reviews creditworthiness and confirms compliance with rules.

- Draft the LC specifying amount, beneficiary, expiry, documents, and terms.

- Send LC via bank channels (SWIFT or physical letter) to the beneficiary or advising bank.

- Confirm receipt and compliance from the beneficiary.

Formatting and Structure of an Irrevocable Letter of Credit

- Length: Usually 1–2 pages, depending on complexity.

- Tone: Formal and professional.

- Mode of Sending: Bank-issued letter, SWIFT message, or printed official document.

- Wording: Precise, unambiguous terms with reference to governing rules.

- Structure: Opening, credit details, beneficiary, terms & conditions, required documents, closing, and bank authorization.

FAQ About Irrevocable Letters of Credit

- Q: Can the LC be modified by the applicant?

A: No, not without the consent of the beneficiary and all parties. - Q: What happens if the beneficiary presents incomplete documents?

A: Payment may be refused until documents comply with the LC terms. - Q: How long is an LC typically valid?

A: Until the expiry date stated in the LC; often months or tied to shipment deadlines. - Q: Is this LC legally binding?

A: Yes, it is a formal bank obligation under banking rules like UCP 600.

After Sending / Follow-up Actions for Irrevocable Letters of Credit

- Confirm receipt of the LC with the beneficiary or advising bank.

- Track compliance of presented documents for payment.

- Respond promptly to any discrepancies or requests for amendments.

- Ensure all records are filed for accounting and auditing purposes.

Tricks and Tips for Handling Irrevocable Letters of Credit

- Double-check all details: beneficiary name, amount, and expiry date.

- Clarify document requirements clearly to avoid payment delays.

- Use standard banking practices (UCP 600) for international transactions.

- Keep communication professional and retain copies of all correspondence.

Pros and Cons of Using an Irrevocable Letter of Credit

Pros:

- Provides guaranteed payment to beneficiary.

- Reduces risk in international trade.

- Strengthens trust between parties.

Cons:

- May involve bank fees and administrative costs.

- Strict document compliance can delay payment.

- Amendments require consent of all parties, reducing flexibility.

Common Mistakes to Avoid in Irrevocable Letters of Credit

- Incorrect beneficiary details.

- Ambiguous terms or document requirements.

- Ignoring expiry dates or shipment deadlines.

- Failure to coordinate with the bank or beneficiary before issuance.

Download Word Doc

Download Word Doc

Download PDF

Download PDF