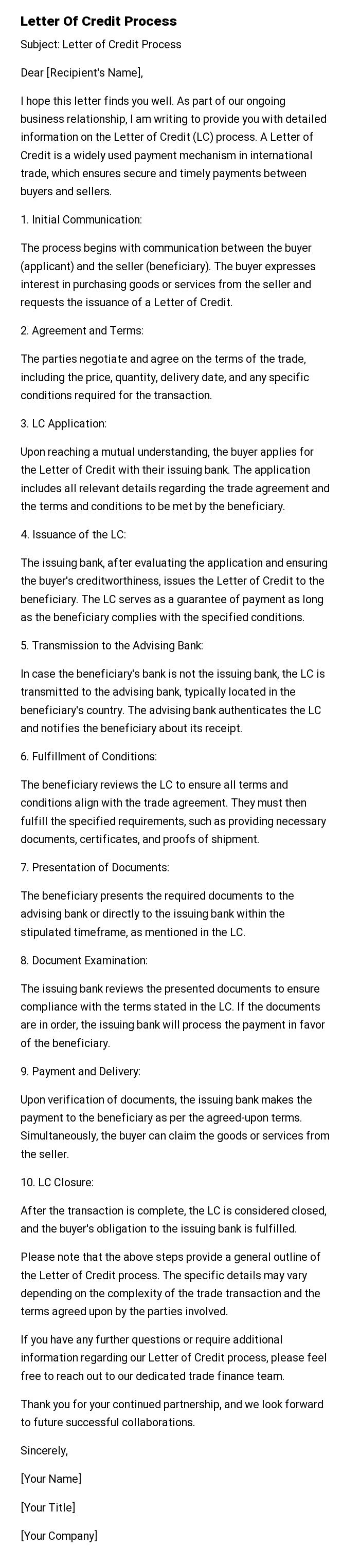

Letter Of Credit Process

Subject: Letter of Credit Process

Dear [Recipient's Name],

I hope this letter finds you well. As part of our ongoing business relationship, I am writing to provide you with detailed information on the Letter of Credit (LC) process. A Letter of Credit is a widely used payment mechanism in international trade, which ensures secure and timely payments between buyers and sellers.

1. Initial Communication:

The process begins with communication between the buyer (applicant) and the seller (beneficiary). The buyer expresses interest in purchasing goods or services from the seller and requests the issuance of a Letter of Credit.

2. Agreement and Terms:

The parties negotiate and agree on the terms of the trade, including the price, quantity, delivery date, and any specific conditions required for the transaction.

3. LC Application:

Upon reaching a mutual understanding, the buyer applies for the Letter of Credit with their issuing bank. The application includes all relevant details regarding the trade agreement and the terms and conditions to be met by the beneficiary.

4. Issuance of the LC:

The issuing bank, after evaluating the application and ensuring the buyer's creditworthiness, issues the Letter of Credit to the beneficiary. The LC serves as a guarantee of payment as long as the beneficiary complies with the specified conditions.

5. Transmission to the Advising Bank:

In case the beneficiary's bank is not the issuing bank, the LC is transmitted to the advising bank, typically located in the beneficiary's country. The advising bank authenticates the LC and notifies the beneficiary about its receipt.

6. Fulfillment of Conditions:

The beneficiary reviews the LC to ensure all terms and conditions align with the trade agreement. They must then fulfill the specified requirements, such as providing necessary documents, certificates, and proofs of shipment.

7. Presentation of Documents:

The beneficiary presents the required documents to the advising bank or directly to the issuing bank within the stipulated timeframe, as mentioned in the LC.

8. Document Examination:

The issuing bank reviews the presented documents to ensure compliance with the terms stated in the LC. If the documents are in order, the issuing bank will process the payment in favor of the beneficiary.

9. Payment and Delivery:

Upon verification of documents, the issuing bank makes the payment to the beneficiary as per the agreed-upon terms. Simultaneously, the buyer can claim the goods or services from the seller.

10. LC Closure:

After the transaction is complete, the LC is considered closed, and the buyer's obligation to the issuing bank is fulfilled.

Please note that the above steps provide a general outline of the Letter of Credit process. The specific details may vary depending on the complexity of the trade transaction and the terms agreed upon by the parties involved.

If you have any further questions or require additional information regarding our Letter of Credit process, please feel free to reach out to our dedicated trade finance team.

Thank you for your continued partnership, and we look forward to future successful collaborations.

Sincerely,

[Your Name]

[Your Title]

[Your Company]

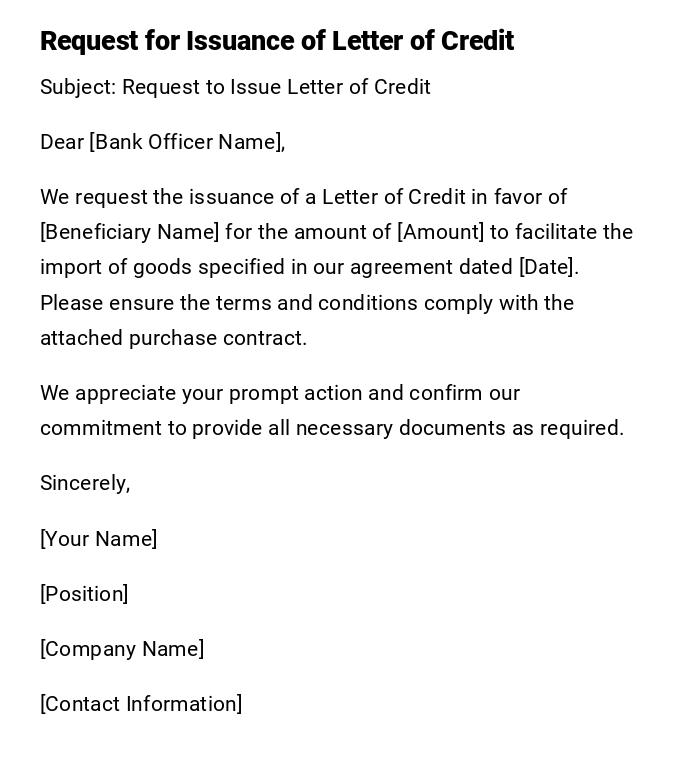

Request for Issuance of Letter of Credit

Subject: Request to Issue Letter of Credit

Dear [Bank Officer Name],

We request the issuance of a Letter of Credit in favor of [Beneficiary Name] for the amount of [Amount] to facilitate the import of goods specified in our agreement dated [Date]. Please ensure the terms and conditions comply with the attached purchase contract.

We appreciate your prompt action and confirm our commitment to provide all necessary documents as required.

Sincerely,

[Your Name]

[Position]

[Company Name]

[Contact Information]

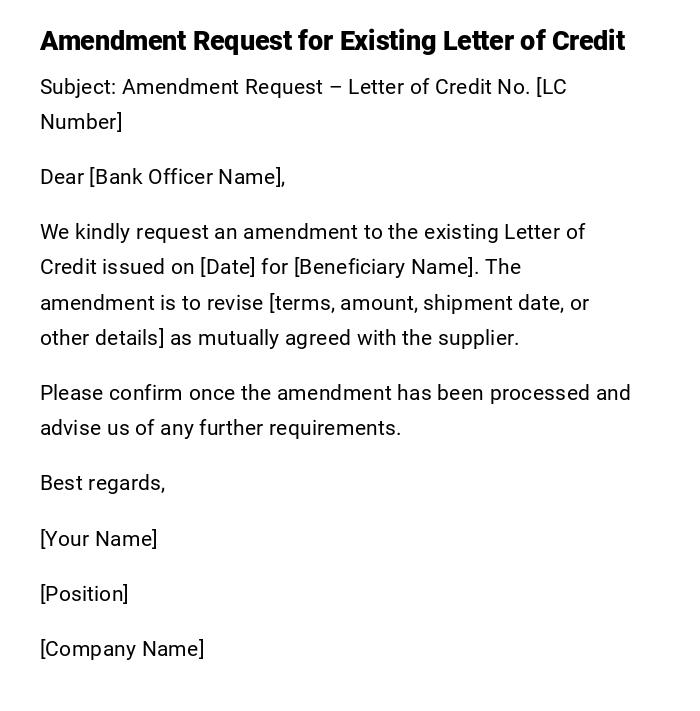

Amendment Request for Existing Letter of Credit

Subject: Amendment Request – Letter of Credit No. [LC Number]

Dear [Bank Officer Name],

We kindly request an amendment to the existing Letter of Credit issued on [Date] for [Beneficiary Name]. The amendment is to revise [terms, amount, shipment date, or other details] as mutually agreed with the supplier.

Please confirm once the amendment has been processed and advise us of any further requirements.

Best regards,

[Your Name]

[Position]

[Company Name]

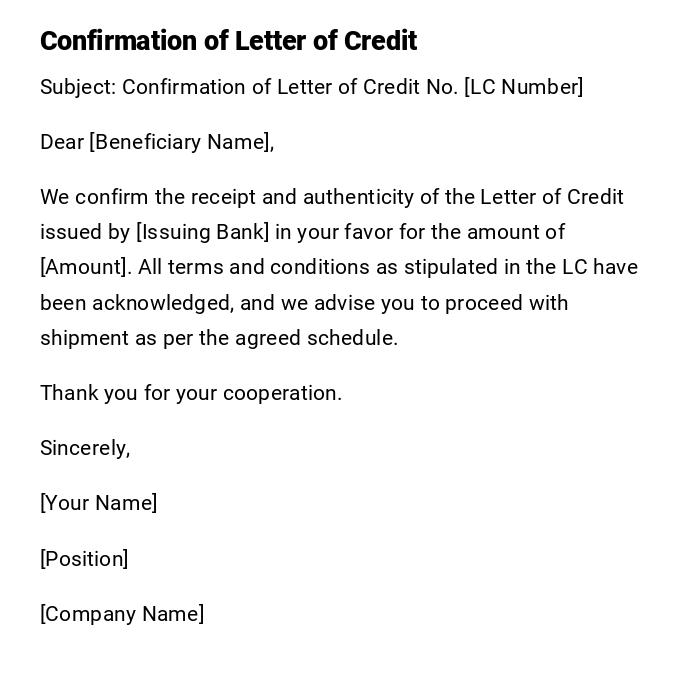

Confirmation of Letter of Credit

Subject: Confirmation of Letter of Credit No. [LC Number]

Dear [Beneficiary Name],

We confirm the receipt and authenticity of the Letter of Credit issued by [Issuing Bank] in your favor for the amount of [Amount]. All terms and conditions as stipulated in the LC have been acknowledged, and we advise you to proceed with shipment as per the agreed schedule.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Position]

[Company Name]

Advice of Letter of Credit

Subject: Advice of Letter of Credit

Dear [Beneficiary Name],

We are pleased to advise you that a Letter of Credit has been issued by [Issuing Bank] on behalf of [Applicant Name] for your benefit. The LC number is [LC Number], amounting to [Amount], effective [Date] and expiring [Date]. Please review the attached document carefully to ensure compliance with all terms.

Kind regards,

[Your Name]

[Position]

[Bank Name]

Letter of Credit Payment Notification

Subject: Notification of Payment under LC No. [LC Number]

Dear [Beneficiary Name],

We confirm that payment under Letter of Credit No. [LC Number] has been executed as per the terms of the credit. The funds have been transferred to your account [Account Details] on [Date]. Please acknowledge receipt of the payment.

Sincerely,

[Your Name]

[Position]

[Bank Name]

Provisional Letter of Credit Request

Subject: Provisional Letter of Credit Request

Dear [Bank Officer Name],

We request a provisional Letter of Credit for [Beneficiary Name] in the amount of [Amount], pending the final contract approval. This provisional LC is intended to facilitate preliminary arrangements for shipment and inspection of goods.

We will provide finalized documents upon contract confirmation.

Thank you,

[Your Name]

[Position]

[Company Name]

What a Letter of Credit Process Entails and Its Purpose

- A Letter of Credit (LC) is a guarantee from a bank ensuring payment to a seller upon meeting specified conditions.

- Purpose: Protects both buyer and seller in international trade.

- Ensures sellers receive payment once contractual obligations are met.

- Provides assurance to buyers that payment will only be made if terms are fulfilled.

Who Should Initiate a Letter of Credit

- Importers or buyers typically request the LC from their bank.

- Exporters or sellers benefit from LC protection.

- Banks act as intermediaries ensuring compliance with trade terms.

Whom the Letter of Credit is Addressed To

- Primary recipient: Beneficiary (exporter/seller).

- Banks involved: Issuing Bank (importer’s bank), Advising/Confirming Bank (exporter’s bank).

- Sometimes, other financial institutions involved for payment guarantees.

When to Initiate a Letter of Credit

- Before international shipments are made.

- When large or high-value transactions require secure payment.

- When trading partners have limited trust or credit history.

How the Letter of Credit Process Works

- Buyer and seller agree on sales contract terms.

- Buyer requests LC from issuing bank.

- Bank issues LC and sends it to the advising/confirming bank.

- Seller ships goods and submits required documents to bank.

- Bank reviews documents for compliance with LC terms.

- Payment is made to the seller once all conditions are satisfied.

Requirements and Prerequisites for a Letter of Credit

- Signed sales contract specifying goods, amount, and shipment details.

- Bank account and credit arrangement with the issuing bank.

- Knowledge of LC terms: type (irrevocable, confirmed), expiry date, documents required.

- Awareness of international trade regulations and shipping documentation.

Elements and Structure of a Letter of Credit

- Applicant (buyer) and beneficiary (seller) details.

- Issuing bank information and LC number.

- Amount, currency, and expiry date.

- Terms of payment and documents required (invoice, bill of lading, insurance).

- Instructions for advising or confirming bank.

Formatting and Best Practices

- Letters must be clear, concise, and comply with international standards (UCP 600).

- Tone: Formal and professional.

- Use standard banking terminology to prevent disputes.

- Avoid ambiguity in shipment dates, documents, or conditions.

Common Mistakes in Letter of Credit Process

- Incorrect or missing document requirements.

- Discrepancies between LC and sales contract.

- Late issuance or amendment of LC.

- Miscommunication between buyer, seller, and banks.

After Issuing a Letter of Credit

- Ensure the beneficiary acknowledges receipt.

- Monitor shipment and document submission.

- Track payment processing and address any discrepancies.

- Maintain records for auditing and compliance.

Pros and Cons of Using Letters of Credit

Pros:

- Secure payment for sellers.

- Reduces risk for buyers.

- Facilitates international trade.

Cons:

- Can be costly due to bank fees.

- Complex process requiring strict compliance.

- Document discrepancies can delay payment.

Tricks and Tips for Smooth Letter of Credit Transactions

- Double-check document compliance before submission.

- Use standardized templates to avoid errors.

- Communicate clearly with banks and trade partners.

- Consider confirmed LC for added security.

- Keep copies of all documentation.

Frequently Asked Questions About Letter of Credit

-

Q: What types of LCs exist?

A: Irrevocable, confirmed, transferable, standby, revolving. -

Q: Who bears the bank charges?

A: Usually, the applicant (buyer), unless otherwise agreed. -

Q: Can LC terms be amended?

A: Yes, via an agreed amendment process involving all parties. -

Q: Does LC guarantee product quality?

A: No, it ensures payment only if terms and documents are compliant.

Does a Letter of Credit Require Attestation or Authorization

- LCs must be issued and authenticated by authorized banking institutions.

- Confirmed LCs may require additional authorization from advising banks.

- All parties must comply with international banking standards (UCP 600).

Download Word Doc

Download Word Doc

Download PDF

Download PDF