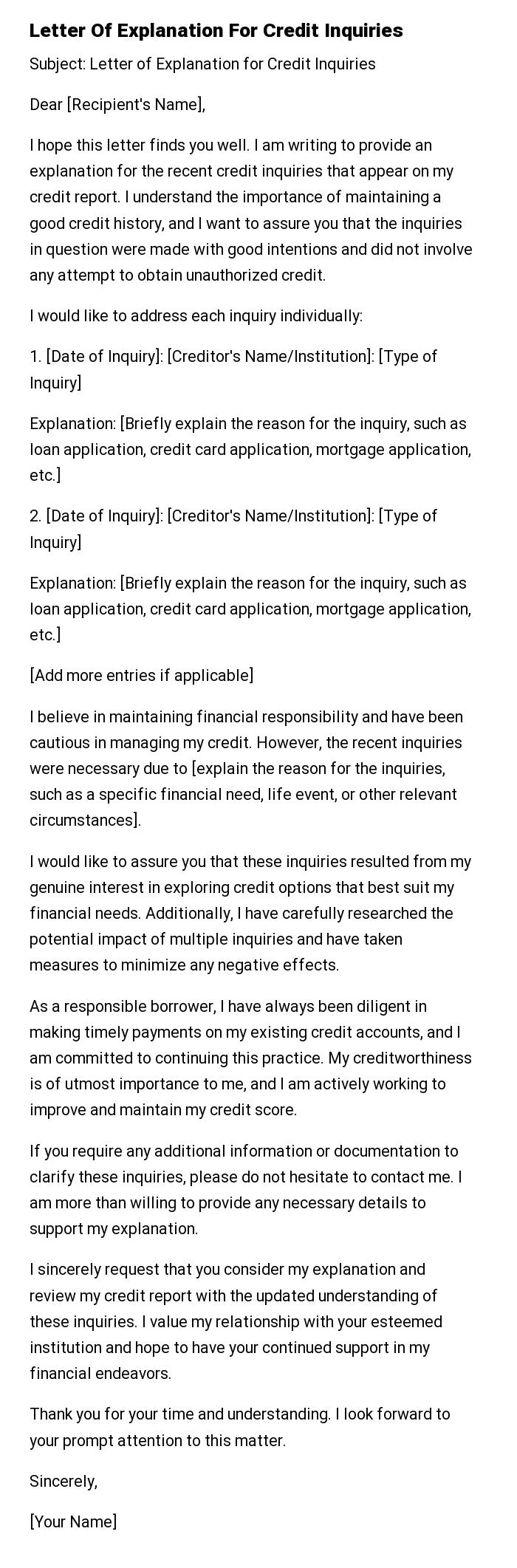

Letter Of Explanation For Credit Inquiries

Subject: Letter of Explanation for Credit Inquiries

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to provide an explanation for the recent credit inquiries that appear on my credit report. I understand the importance of maintaining a good credit history, and I want to assure you that the inquiries in question were made with good intentions and did not involve any attempt to obtain unauthorized credit.

I would like to address each inquiry individually:

1. [Date of Inquiry]: [Creditor's Name/Institution]: [Type of Inquiry]

Explanation: [Briefly explain the reason for the inquiry, such as loan application, credit card application, mortgage application, etc.]

2. [Date of Inquiry]: [Creditor's Name/Institution]: [Type of Inquiry]

Explanation: [Briefly explain the reason for the inquiry, such as loan application, credit card application, mortgage application, etc.]

[Add more entries if applicable]

I believe in maintaining financial responsibility and have been cautious in managing my credit. However, the recent inquiries were necessary due to [explain the reason for the inquiries, such as a specific financial need, life event, or other relevant circumstances].

I would like to assure you that these inquiries resulted from my genuine interest in exploring credit options that best suit my financial needs. Additionally, I have carefully researched the potential impact of multiple inquiries and have taken measures to minimize any negative effects.

As a responsible borrower, I have always been diligent in making timely payments on my existing credit accounts, and I am committed to continuing this practice. My creditworthiness is of utmost importance to me, and I am actively working to improve and maintain my credit score.

If you require any additional information or documentation to clarify these inquiries, please do not hesitate to contact me. I am more than willing to provide any necessary details to support my explanation.

I sincerely request that you consider my explanation and review my credit report with the updated understanding of these inquiries. I value my relationship with your esteemed institution and hope to have your continued support in my financial endeavors.

Thank you for your time and understanding. I look forward to your prompt attention to this matter.

Sincerely,

[Your Name]

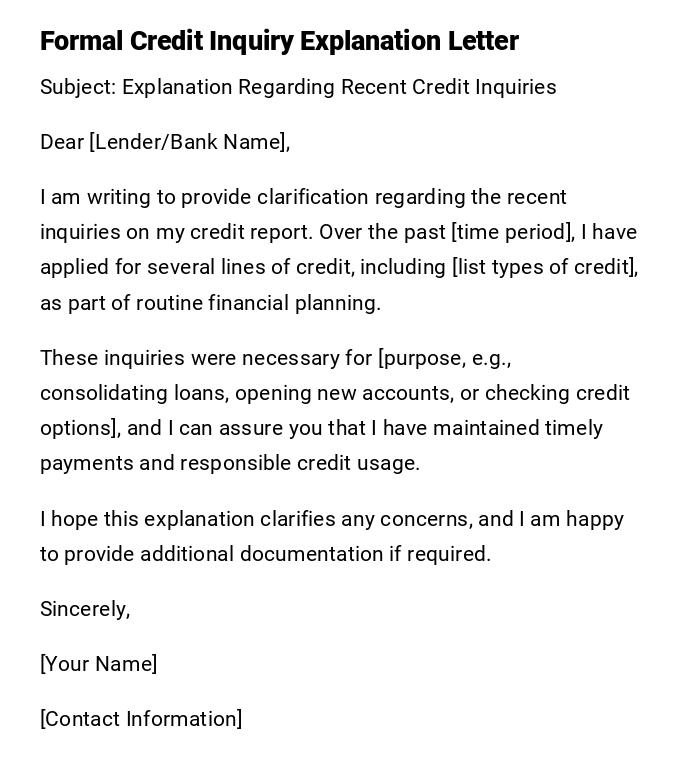

Formal Letter of Explanation for Credit Inquiries

Subject: Explanation Regarding Recent Credit Inquiries

Dear [Lender/Bank Name],

I am writing to provide clarification regarding the recent inquiries on my credit report. Over the past [time period], I have applied for several lines of credit, including [list types of credit], as part of routine financial planning.

These inquiries were necessary for [purpose, e.g., consolidating loans, opening new accounts, or checking credit options], and I can assure you that I have maintained timely payments and responsible credit usage.

I hope this explanation clarifies any concerns, and I am happy to provide additional documentation if required.

Sincerely,

[Your Name]

[Contact Information]

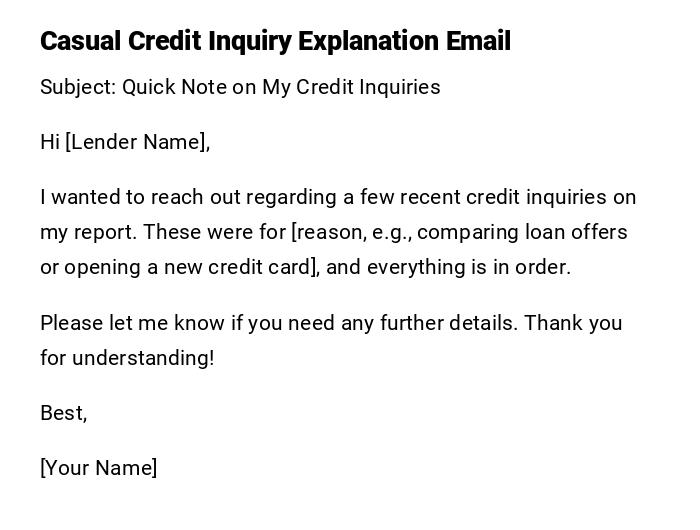

Casual Email Explanation for Credit Inquiries

Subject: Quick Note on My Credit Inquiries

Hi [Lender Name],

I wanted to reach out regarding a few recent credit inquiries on my report. These were for [reason, e.g., comparing loan offers or opening a new credit card], and everything is in order.

Please let me know if you need any further details. Thank you for understanding!

Best,

[Your Name]

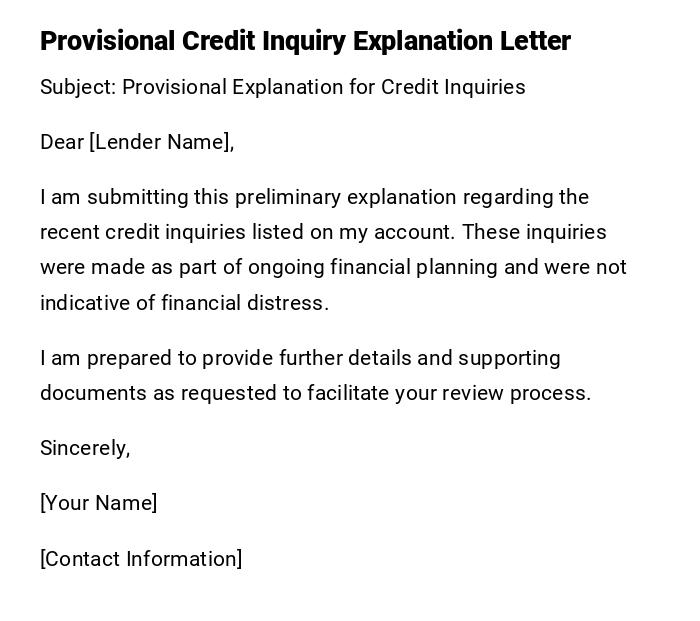

Provisional / Preliminary Letter of Explanation for Credit Inquiries

Subject: Provisional Explanation for Credit Inquiries

Dear [Lender Name],

I am submitting this preliminary explanation regarding the recent credit inquiries listed on my account. These inquiries were made as part of ongoing financial planning and were not indicative of financial distress.

I am prepared to provide further details and supporting documents as requested to facilitate your review process.

Sincerely,

[Your Name]

[Contact Information]

Heartfelt Letter Explaining Credit Inquiries

Subject: Clarification Regarding Credit Inquiries

Dear [Lender/Bank Name],

I understand that multiple credit inquiries can raise concerns, and I want to provide transparency. The recent inquiries were made in the process of responsibly managing my finances, including [specific reason, e.g., consolidating debts or planning for a major purchase].

I value my relationship with your institution and assure you that all financial obligations have been met promptly. Thank you for your patience and understanding.

Warm regards,

[Your Name]

Official Letter Explaining Multiple Credit Inquiries

Subject: Official Explanation of Credit Inquiries

To Whom It May Concern,

This letter serves to formally explain the recent credit inquiries appearing on my credit report. These inquiries were initiated for [reasons, e.g., new account openings, loan applications, or refinancing purposes] and reflect standard financial management.

I have consistently maintained timely payments and responsible credit usage. Should you require additional documentation, I am prepared to provide it promptly.

Sincerely,

[Your Name]

[Contact Information]

Funny / Lighthearted Email Explaining Credit Inquiries

Subject: About Those Curious Credit Inquiries

Hi [Lender Name],

I noticed a few credit inquiries popping up and wanted to reassure you that I’m not going on a spending spree! These were just me exploring options responsibly, like a cautious financial explorer.

All payments are up to date, and no dragons or hidden debts are involved. Feel free to reach out if you need any paperwork.

Cheers,

[Your Name]

What / Why is a Letter of Explanation for Credit Inquiries

A Letter of Explanation for Credit Inquiries is a formal or informal document written by a consumer to a lender or financial institution.

Its main purposes are:

- To clarify the reasons behind multiple credit checks.

- To reassure lenders that the inquiries were legitimate and not indicative of financial distress.

- To maintain trust and transparency with financial institutions.

- To potentially support applications for loans, mortgages, or credit cards.

Who Should Send a Letter of Explanation for Credit Inquiries

- Individuals with multiple recent credit inquiries on their report.

- Borrowers applying for significant credit, such as mortgages, car loans, or personal loans.

- Professionals or clients whose credit report may raise questions during underwriting.

- Anyone needing to proactively clarify unusual patterns in their credit history.

Whom Should a Letter of Explanation for Credit Inquiries Be Addressed To

- Banks, credit unions, or mortgage lenders reviewing a loan application.

- Credit reporting agencies when disputing or clarifying inquiries.

- Financial advisors or loan officers assisting with credit approval.

- Any institution requiring formal documentation of the inquiries.

When is a Letter of Explanation for Credit Inquiries Needed

- When applying for a mortgage, personal loan, or large credit facility.

- When multiple inquiries appear in a short period, potentially raising red flags.

- If a lender specifically requests an explanation as part of their underwriting process.

- When applying for credit after recent account openings or refinancing.

How to Write and Send a Letter of Explanation for Credit Inquiries

- Identify all credit inquiries on your report.

- Document the purpose of each inquiry and the associated date.

- Choose a tone: formal for banks, casual or email for informal inquiries.

- Draft the letter with acknowledgment, explanation, and assurance of responsible credit management.

- Send via the lender’s preferred method: email, mail, or online submission portal.

Formatting Guidelines for a Letter of Explanation for Credit Inquiries

- Length: 1–2 pages maximum; concise and clear.

- Tone: Professional, clear, and polite. Light humor may be acceptable in casual communications.

- Structure: Start with subject, greeting, explanation, assurance, and closing.

- Mode: Printed letter for official submissions, email for digital applications.

- Wording: Be honest, direct, and factual. Avoid over-explaining or providing unnecessary details.

Requirements and Prerequisites Before Writing the Letter

- Obtain a copy of your recent credit report.

- Identify and list all relevant credit inquiries.

- Understand the reason each inquiry was made.

- Prepare supporting documents if requested (loan applications, account openings).

- Ensure all financial obligations are up to date.

Common Mistakes to Avoid in Credit Inquiry Explanation Letters

- Being vague or omitting details about the inquiries.

- Using overly casual or unprofessional language in formal submissions.

- Providing incorrect dates or financial information.

- Overloading the letter with irrelevant personal details.

- Failing to proofread for clarity, grammar, or formatting.

Elements and Structure of a Letter of Explanation for Credit Inquiries

- Subject line or heading

- Greeting

- Clear statement of purpose for the letter

- Detailed explanation of each credit inquiry

- Assurance of responsible credit usage

- Optional supporting documents or references

- Closing and signature

- Contact information for follow-up

After Sending a Letter of Explanation for Credit Inquiries

- Confirm that the lender or institution has received your letter.

- Respond promptly to any follow-up questions or requests for additional documentation.

- Keep a copy for your records in case future inquiries arise.

- Monitor your credit report to ensure inquiries are correctly reflected.

Tricks and Tips for Writing a Clear Credit Inquiry Explanation Letter

- List inquiries chronologically for clarity.

- Stick to facts, avoid opinions or emotional statements.

- Use bullet points if explaining multiple inquiries.

- Include a brief summary at the start for quick understanding.

- Keep tone professional yet approachable.

Download Word Doc

Download Word Doc

Download PDF

Download PDF